A Rutgers study reveals that new policies to enable lower-income buyers to afford used electric vehicles (EVs) are needed to drive the adoption of EVs.

Hailed as a sustainable and eco-friendly alternative to traditional vehicles, which are powered by petrol and diesel, EVs are a technological revolution that continues to see advancement. With the advent of solid-state batteries, EVs are now looking at faster charging times, enhanced safety, and longevity. Another approach to EVs that is being studied is hydrogen fuel cells, which also aim to improve durability and lifespan.

This is not to say EVs are not struggling. In fact, EV adoption has hit a snag due to lagging infrastructure, expensive repair costs, and poor resale values. Therefore, EV manufacturers like Fisker are struggling to stay afloat.

However, it can’t be denied that EVs have emerged as one of the primary solutions for reducing greenhouse gas (GHG) emissions. As a result, the US announced subsidies through tax credits on the purchase of new EVs up to $7,500. This means that as more EVs enter the vehicle fleet, so will the market for used EVs.

Additionally, the market of used EVs has started to mature in the US as early EV adopters trade up for the latest models.

With new EV sales increasing from about 22,000 to more than 2 million between 2011 and 2021, the latest study expects to see a similar uptrend in the used EV market. Data shows that the used vehicle market actually makes up the majority of all sales and leases, accounting for 71% in 2019. Used EVs are also eligible for a subsidy of up to $4k.

However, potential buyers, especially those belonging to the low-income group, aren’t convinced of the conveniences of these vehicles and are discouraged by the price, according to the study conducted at Rutgers University-New Brunswick and published in the journal Transportation Research Part D: Transport and Environment.

“While the transition to electric vehicles is an important piece of reducing greenhouse-gas emissions, the market for used electric vehicles in the US remains dominated by wealthy households.”

– Wei San Loh, Senior Statistician at the University of Michigan

He further added:

“Our findings offer clues as to why that might be.”

So, against this backdrop of the EV market being dominated by wealthier households and a rapidly increasing market for used EVs, the study aims to understand the motivation and concerns of buyers from different demographic, income, and socio-economic groups to purchase second-hand EVs.

Also, if we want to make a full transition, all income strata have to replace their vehicles that use fossil fuels. As such, the study seeks to find whether there are any major barriers to expanding this market and achieving a full transition.

To this end, Loh, along with Robert B. Noland, director of the Rutgers Alan M. Voorhees Transportation Center, ran a survey of electric vehicle owners in the US. They recruited 1,167 participants from more than a dozen states via EV discussion groups on Facebook and Reddit.

The survey, conducted between September and October 2022, included questions related to pre-purchase concerns, including the availability of used EVs, price, battery performance, charging availability, driving range, and the cost of installing a home charger.

Most individuals in the survey’s dataset were male, white, middle-aged, and well-educated. The survey respondents further had a higher annual household income, with 25.5% having $150k or more, than the US population. This suggests many lower-income families may not yet be able to afford used EVs or may have other concerns about them. Over 73% of survey participants lived in single-family housing, slightly higher than that of the US population at 70%.

Furthermore, more than half of the participants started buying used EVs in 2019, and about 20% of them bought used EVs in 2021 alone, suggesting a more rapid growth in used EV purchases in recent years.

The survey focused on owners of used Nissan Leaf (12.8%), Chevrolet Bolt (8.2%), BMW i3 (5.6%), Hyundai Kona (5.5%), and Tesla Model 3 (5.3%). The top choices were chosen because they are the most frequently discussed models on the r/electricvehicle subreddit discussion forum.

The Results

Previous studies have shown that the higher price of an EV is one of the biggest factors influencing a consumer’s decision. Improved availability of electric charging stations, on the other hand, has been shown to increase consumer demand for EVs by reducing range anxiety, which is the fear of being stranded with a dead battery. These concerns apply to used EVs as well.

The latest survey used age, employment status, type of residence, and the number of charging stations near home as control variables due to prior research findings related to concerns about an EV before purchasing one.

So, when isolated for household income, price, charging availability, and battery performance have been found to be the biggest concerns for buyers when considering purchasing a used EV. These concerns, however, weren’t shared universally.

The study findings revealed that used EV owners earning below the national median of $75K were more concerned about price (at over 86%) than those with the highest annual household income group of $150K.

The survey findings further reveal that most respondents (about 95%) have public chargers near their residences. This availability may influence their decision to purchase an EV. The study notes that the price of used EVs may still be prohibitive for lower-income households, making price a critical factor in their decision to adopt an EV.

Moreover, those earning below $50,000 were more likely to be concerned about the availability of charging stations (at 48%) than those with over $150K in annual income (at 37%). In contrast, those at the lowest end of the income spectrum were 32% less likely to worry about battery performance than those at the highest due to them having shorter commutes, which could be the reason for this disparity.

Individuals with lower household incomes are more concerned about pricing and charging availability, possibly because they have fewer financial resources to cover the overall cost of purchasing an EV. Moreover, low-income households can’t install a home charging station and may also have less access to charging infrastructure, which makes owning an EV a costly affair for them.

Based on this, the odds of having concern about charging availability decrease if there is at least one charging station near one’s residence.

When it comes to housing type, holding other variables constant, multi-family dwellers had about 39% lower odds of being concerned about used EV pricing than those living in single-family homes.

As for employment types, full-time workers, except for self-employed business owners, are more likely to have concerns about charging availability prior to purchasing a used EV. According to Loh, a former graduate student of Edward J. Bloustein School of Planning and Public Policy at Rutgers:

“Buyers will always compare EVs to combustion engines. That’s why we need to think creatively about making it more attractive for people from different income brackets to consider the used EV option.”

Loh said that in addition to expanding subsidies for used EV purchases and increasing charging stations’ availability, which are often discussed, a change in policy could help advance used EV adoption across income groups. Moreover, with EV subsidies not broadly available for used vehicles, subsidizing charging infrastructure may enhance the ability of lower-income households to purchase used EVs. According to Noland:

“Taken together, these findings suggest that EV demand may still not be widespread for lower-income households in the US. Encouraging nationwide EV adoption will require broader uptake of new and used EVs from all income levels.”

When noting the limitation of the study, it stated that non-random samples of Facebook and Reddit users are not representative of the entire population in the US, and the study may have only reached a biased subset of used EV owners who are comfortable with technology.

A Look at Leading EV Manufacturers

Now, let’s look at two prominent names in the EV manufacturing world that are making a lot of noise and big moves.

#1. Tesla Inc. (TSLA)

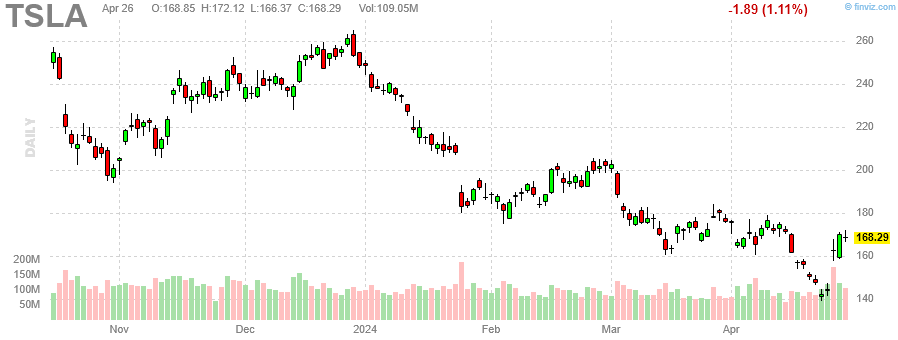

One of the most popular EV manufacturers, Elon Musk’s Tesla, produces electric vehicles, energy storage systems, and solar products. With a market cap of $541.98 bln, the company shares (TSLA: NASDAQ) are trading at 170.18, down 31.51% year-to-date (YTD). Tesla has an EPS (TTM) of 3.91 and a P/E (TTM) of 43.52.

Recently, in its financial results for the first quarter of 2024, the company reported $21 billion in revenue, a drop of 55% from the year-ago quarter, and $1.1 billion in net income.

During Tesla’s earnings call, Musk noted the global EV adoption rate being “under pressure.” As a result, auto manufacturers are pulling back on EVs to pursue plug-in hybrids, but Tesla believes “this is not the right strategy. And electric vehicles will ultimately dominate the market.”

Musk said it’s rather time to “reorganize” Tesla as the company laid off over 10% of its global workforce this month, a move he called necessary for the “next phase of growth.” These job cuts are expected to save the company over $1 billion annually in costs.

Tesla, the billionaire said, would focus on leveraging its existing manufacturing factories to introduce more affordable products, and they have already “updated future vehicle line-up.” The company has been working on expanding its core AI infrastructure and will be showcasing its “cyber cab,” the purpose-built robotaxi, early in August.

With this robotaxi, Musk aims to have “some combination” of Airbnb and Uber by operating its own fleet as well as cars owned by the end user. Owners will be able to rent their self-driving vehicles to robotaxi users and earn money, while Tesla will charge a commission. In the future, these robotaxis will also be able to run AI workloads when they are not in use, Musk said.

As for regulatory concerns around autonomous driving tech, Musk doesn’t see “significant regulatory barriers” because data shows that autonomous cars are safer than those driven by humans.

This follows Tesla’s recall of all 3,878 Cybertrucks due to a fault that caused the accelerator pedal to get stuck. The issue was attributed to an “unapproved change” that introduced “lubricant” during the assembly of accelerator pedals, reducing their retention. Previously, Tesla had to recall 2 million Tesla vehicles because the font on the warning light was too small to meet safety standards, and the problem was resolved with a software update.

#2. BYD Company Limited (BYDDF)

The China-based automobile company is engaged in the manufacturing and sale of transportation equipment, electronic devices, rechargeable batteries, photovoltaic products, and more. “BYD’s greater ambition is to be an energy ecosystem company,” FT quoted Bridget McCarthy, the head of China operations at Shenzhen-based hedge fund invested in BYD, Snow Bull Capital, as saying in its piece on the company.

With a market cap of 84.3 bln, the company shares (1211: Hong Kong Stock Exchange) are trading at 213, down 0.75% YTD. BYD has an EPS (TTM) of 11.36 and P/E (TTM) of 18.74. It pays a dividend yield of 0.59%.

Founded by Wang Chuanfu, the Tesla rival’s low-cost pure battery and plug-in hybrids account for about one-third of all new EVs sold in China. The company’s Denza SUVs, N7 and N8, along with D9 vehicles, have been the biggest contributor to BYD’s EV domination.

Recently, at the 2024 Beijing auto show, the company unveiled its first sedan Denza Z9GT. Denza has been a joint venture with Mercedes-Benz AG. “In the past, traditional luxury brands were defined by their logos. Today, luxury for new energy brands is defined by technology,” is how Denza general manager Zhao Changjiang talked about the luxury vehicle, which features BYD’s innovative Blade battery and packs three electric motors producing up to 952 hp.

BYD also showcased its Ocean-M hatchback, which is the first rear-wheel-drive performance hatchback. Built on BYD’s new all-electric platform, the Ocean-M will be powered by a new generation of C2B batteries.

The C2B, or “cell-to-body” tech, was cracked in 2022, and it fuses together the battery cell with the body of the vehicle. The tech that can help reduce costs further and increase crash safety can be applied to cars, buses, trucks, and other commercial vehicles. To be launched in Q3 of this year, the car will be sold in the price range of RMB 150,000 ($20,700) to RMB 200,000 ($27,600), the company said.

BYD’s biggest strength is its cost control. However, the company is facing a saturated domestic market amid a price war, while governments overseas are blaming Chinese EVs for flooding markets. BYD’s plans are far bigger. It aims to go global and expand its manufacturing operations in Southeast Asia, South America, the Middle East, and Europe.

Concluding Thoughts

Although the EV manufacturing industry is facing challenges, the adoption of electric vehicles is growing at a steady pace. The global EV market size is expected to increase to nearly $952 bln by the end of this decade. As EV adoption grows, so too will the market for used EVs. This requires governments to implement measures such as policy changes and improved infrastructure to promote EV adoption across all income levels, ensuring the full realization of its full environmental benefits.

Click here for the list of the top ten EV stocks to invest in.