The auto claims process has entered a new era—one marked by growing complexity, specialized repairs and rising costs.

While inflation plays a role in increased claims severity, it’s only part of the story. Today’s vehicles are fundamentally more complex, and three converging trends are reshaping the claims landscape: the rise of alternative powertrains, the mainstream adoption of advanced driver-assistance systems (ADAS) and the increasing size and specifications of vehicles on the road.

The Cost of Complexity

The average total cost of repair (TCOR) has increased by 96.4% since 2009—from $2,405 to over $4,720 in 2024. Nearly half of that increase occurred in just the past five years. By comparison, overall inflation rose 46.2% between 2009 and 2024 (CPI annual average), and just 22.7% from 2019 to 2024 (CPI annual average). Meanwhile, the Consumer Price Index for motor vehicle insurance jumped 136.2% over the same 15-year span (CPI annual average 2009 – 2024), including a 47.6% increase since 2019.

These cost trends underscore the deeper shifts taking place across vehicle technology and consumer preferences.

Powertrains Are Changing

Electric vehicles (EVs), hybrids, and alternative fuel systems are becoming a larger share of the national fleet, introducing new challenges for repair shops and insurers. These vehicles often feature unfamiliar systems and high-voltage components that require specialized tools, repair protocols and trained technicians.

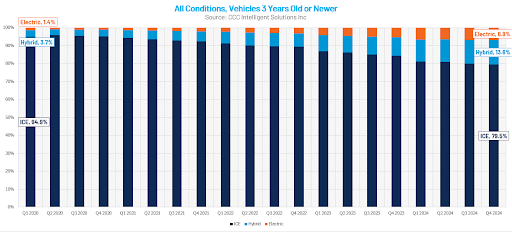

EVs accounted for just 0.5% of claims in Q1 2020 but rose to 2.5% by Q4 2024, while hybrids increased from 3.2% to 6.5% in the same period. Among vehicles three years old or newer, EVs now represent 6.9% of claims and hybrids make up 13.6% Notably, in 2024, internal combustion engine (ICE) vehicles represented less than 80% of new vehicle sales for the first time.

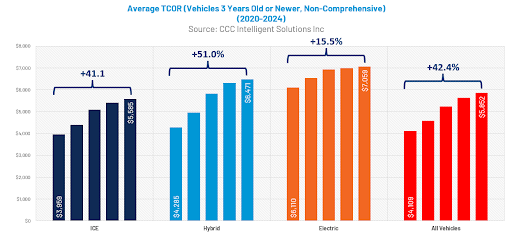

Repair costs vary by powertrain. For vehicles three years old or newer, TCOR increased since 2020 by:

- 15% for EVs

- 50% for hybrids

- 40% for ICE

The cost gap between EVs and hybrids has narrowed from more than $1,800 in 2020 to under $600 in 2024, reflecting market maturity and evolving repair approaches.

While the industry is adapting, the need for continued investment in training and tools remains critical, particularly for repairers managing new materials and systems.

ADAS is Now Standard

ADAS features—designed to enhance safety—have become standard across many makes and models. But even minor repairs now require recalibration of cameras, sensors, and radar systems, adding both time and cost to the claims process.

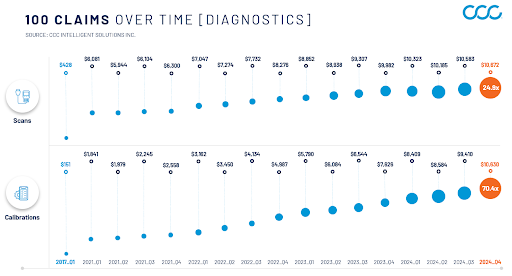

In Q1 2017, only 3.3% of repairable claims included a scan, and 0.9% involved calibration. By Q4 2024, those numbers rose to 70.6% and 21.8%, respectively. Average scan fees rose from $129.80 in 2017 to $151.12 in 2024, while calibration fees increased from $168.00 to $488.48. That means for every 100 claims, diagnostic-related costs went from around $580 to over $21,300.

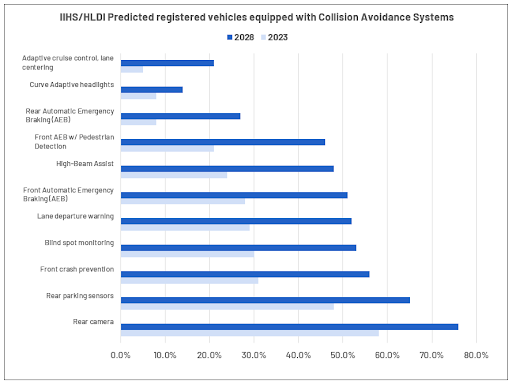

This trend is accelerating. The Highway Loss Data Institute (HLDI) projects that by 2028, six ADAS systems will be present in at least half of all registered vehicles.

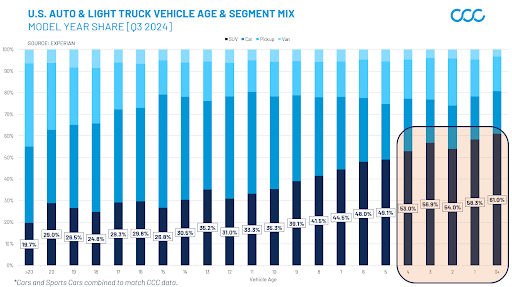

Vehicles Are Bigger–And More Equipped

Modern vehicles are larger, heavier and more customized than ever before. SUVs and crossover utility vehicles now dominate new car sales, often requiring larger replacement panels and increasing collision severity. Not to mention the performance capabilities of modern vehicles.

EV batteries add significant weight—anywhere from 800 to 2,900 pounds—which can contribute to more extensive damage in a crash. Meanwhile, the growing list of factory options and trim packages has elevated both vehicle value and repair cost. According to Edmunds, the price gap between base models and upgraded versions has grown from 24.6% in 2002 to 38.1% in 2022.

Looking Ahead

Claims professionals are now operating in a landscape where the “standard” repair is anything but. As vehicle technology evolves, so must the tools, training, and expectations of everyone involved in the claims process.

The path forward requires collaboration between insurers, repairers, OEMs and analytics providers to help the industry keep pace with an increasingly complex fleet – and deliver the accurate, timely and safe repairs drivers expect.

Krumlauf is director of industry analytics for CCC Intelligent Solutions.

Want to stay up to date?

Get the latest insurance news

sent straight to your inbox.