State of Alaska Department of Revenue trimmed its stake in shares of Hewlett Packard Enterprise (NYSE:HPE – Free Report) by 3.4% during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 408,754 shares of the technology company’s stock after selling 14,260 shares during the period. State of Alaska Department of Revenue’s holdings in Hewlett Packard Enterprise were worth $6,940,000 at the end of the most recent reporting period.

State of Alaska Department of Revenue trimmed its stake in shares of Hewlett Packard Enterprise (NYSE:HPE – Free Report) by 3.4% during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 408,754 shares of the technology company’s stock after selling 14,260 shares during the period. State of Alaska Department of Revenue’s holdings in Hewlett Packard Enterprise were worth $6,940,000 at the end of the most recent reporting period.

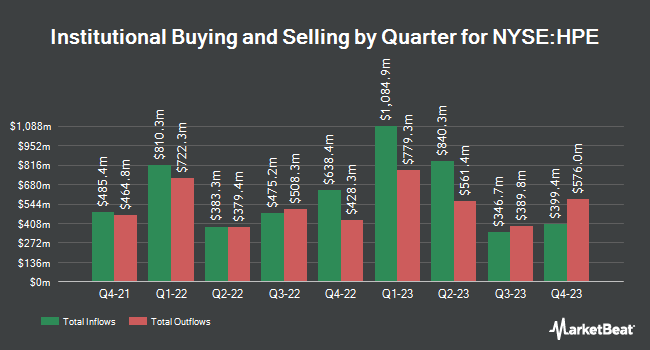

Other large investors also recently modified their holdings of the company. Aspire Private Capital LLC lifted its position in shares of Hewlett Packard Enterprise by 169.2% during the fourth quarter. Aspire Private Capital LLC now owns 1,217 shares of the technology company’s stock worth $19,423,320,000 after purchasing an additional 765 shares in the last quarter. Authentikos Wealth Advisory LLC acquired a new position in shares of Hewlett Packard Enterprise during the third quarter worth approximately $31,000. Ritter Daniher Financial Advisory LLC DE acquired a new position in shares of Hewlett Packard Enterprise during the third quarter worth approximately $33,000. Salem Investment Counselors Inc. lifted its position in shares of Hewlett Packard Enterprise by 180.1% during the fourth quarter. Salem Investment Counselors Inc. now owns 1,961 shares of the technology company’s stock worth $33,000 after purchasing an additional 1,261 shares in the last quarter. Finally, First Manhattan Co. lifted its position in shares of Hewlett Packard Enterprise by 89.4% during the first quarter. First Manhattan Co. now owns 2,413 shares of the technology company’s stock worth $40,000 after purchasing an additional 1,139 shares in the last quarter. 80.78% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

HPE has been the subject of a number of recent research reports. Wells Fargo & Company reissued an “equal weight” rating and set a $17.00 price target (down from $21.00) on shares of Hewlett Packard Enterprise in a research note on Friday, March 1st. Evercore ISI dropped their price target on shares of Hewlett Packard Enterprise from $19.00 to $18.00 and set an “in-line” rating for the company in a research note on Friday, March 1st. Barclays dropped their price target on shares of Hewlett Packard Enterprise from $15.00 to $14.00 and set an “equal weight” rating for the company in a research note on Friday, March 1st. StockNews.com downgraded shares of Hewlett Packard Enterprise from a “buy” rating to a “hold” rating in a research note on Monday, March 4th. Finally, Stifel Nicolaus lowered their target price on shares of Hewlett Packard Enterprise from $20.00 to $18.00 and set a “buy” rating for the company in a research note on Friday, March 1st. Eight equities research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company’s stock. According to data from MarketBeat.com, the company has a consensus rating of “Hold” and an average target price of $17.45.

Get Our Latest Analysis on Hewlett Packard Enterprise

Hewlett Packard Enterprise Stock Performance

Shares of HPE opened at $17.73 on Monday. The stock has a market capitalization of $23.05 billion, a price-to-earnings ratio of 12.23, a PEG ratio of 3.28 and a beta of 1.19. The company has a current ratio of 0.89, a quick ratio of 0.63 and a debt-to-equity ratio of 0.37. The firm has a fifty day simple moving average of $16.24 and a 200 day simple moving average of $16.35. Hewlett Packard Enterprise has a 12 month low of $13.65 and a 12 month high of $20.07.

Hewlett Packard Enterprise (NYSE:HPE – Get Free Report) last announced its quarterly earnings results on Thursday, February 29th. The technology company reported $0.48 EPS for the quarter, beating analysts’ consensus estimates of $0.45 by $0.03. The firm had revenue of $6.76 billion during the quarter, compared to analysts’ expectations of $7.09 billion. Hewlett Packard Enterprise had a net margin of 6.81% and a return on equity of 9.12%. The company’s revenue for the quarter was down 13.5% compared to the same quarter last year. During the same quarter last year, the company posted $0.38 earnings per share. Research analysts forecast that Hewlett Packard Enterprise will post 1.4 EPS for the current fiscal year.

Hewlett Packard Enterprise Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, April 12th. Stockholders of record on Friday, March 15th will be given a $0.13 dividend. This represents a $0.52 annualized dividend and a dividend yield of 2.93%. The ex-dividend date of this dividend is Thursday, March 14th. Hewlett Packard Enterprise’s payout ratio is presently 35.86%.

About Hewlett Packard Enterprise

Hewlett Packard Enterprise Company provides solutions that allow customers to capture, analyze, and act upon data seamlessly in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan. It operates in six segments: Compute, HPC & AI, Storage, Intelligent Edge, Financial Services, and Corporate Investments and Other.

Further Reading

Receive News & Ratings for Hewlett Packard Enterprise Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Hewlett Packard Enterprise and related companies with MarketBeat.com’s FREE daily email newsletter.