Welcome back,

Hello from Helsinki—I’m in Finland for Arctic15, one of Europe’s top startup shows. But this week’s newsletter remains very much focused on Asia.

From a Southeast Asian rival to ChatGPT backed by $55 million in funding, to Nvidia’s staggering $44B quarter despite export blocks, there’s no shortage of big moves across the region. Shein’s IPO ambitions, Tencent’s K-pop bet, and fresh momentum in India’s startup and listing scene round it all out.

Let’s get into it.

All the best,

Jon

Follow the Asia Tech Review LinkedIn page for updates on posts published here and interesting things that come our way. If you’re a news junkie, the ATR Telegram news feed has you covered with news as-it-happens or join the community chat here.

The seeds of a $55 million Singapore government project to build a local alternative to global AI are bearing fruit.

Sea-Lion, a large language model (LLM) focused on Southeast Asia, is approaching 250,000 downloads and has attracted major corporations including ride-hailing giant GoTo. Sea-Lion recently acquired ‘reasoning’ capabilities, which significantly boosted adoption, according to a Straits Times article—and there’s more to come. Voice recognition is scheduled to be added this year, with visual recognition slated as the next milestone feature.

The LLM supports 11 languages, including Javanese, Sudanese, Malay, Tamil, Thai and Vietnamese—giving it the edge on globally-focused rivals like ChatGPT, DeepSeek and more.

The first version of Sea-Lion was launched in December 2023, and its latest (3.5) version runs on Meta’s Llama. Beyond language support, it claims to be developed for cost-efficient, low-latency applications that are common across the region.

The project was created by AI Singapore, a group that includes Singapore-based research institutions alongside startups and companies that are developing AI. The National Research Foundation funded Sea-Lion to the tune of SG$70 million (nearly US$55 million), but regional government organizations and companies have helped finetune languages that are supported.

GoTo has emerged as one of the biggest adopters of Sea-Lion. The firm is using it to train its own AI system. Details aren’t terribly clear right now, but GoTo said that a more localised LLM will help it to be “locally relevant, inclusive, and impactful.” That certainly makes sense given the uniqueness of Southeast Asian languages and cultures, which wouldn’t appear to be a major focus for global AI giants, yet.

Shein’s IPO won’t happen in London after all, according to new developments.

The fast fashion company saw that path blocked by Chinese regulators, according to Reuters, leaving Hong Kong as the likely alternative. Shein is said to be planning to file a prospectus as soon as this month, with the ultimate plan to be listed by the end of the year.

K-pop has been effectively banned in China, but the mainland is alive to the potential of Korean culture after Tencent Music invested $177M to become the second largest investor in SM Entertainment. Kakao is the largest shareholder but the deal will see Tencent Music take a near 10% stake in the business.

K-pop has been unofficially banned in China since 2016, but there are signs that the situation may change.

We know that Nvidia is in a tough spot in China, but the business is thriving despite the situation.

Nvidia posted record quarterly revenue of $44B, despite being shut out of China. The business remains strong thanks to growth of deals in the Middle East. But, the company expects to lose billions in revenue due to new licensing requirements for its H20 chips.

It’s a reminder that while China may be key, it’s not everything.

Huawei is backing Zhuhai Cornerstone Technologies in a bid to build a chip chemical supplier that rivals global leaders, aiming to support China’s push for a self-sufficient semiconductor supply chain link

China’s race for self-sufficiency got a boost with chipmaker Hygon merging with server maker Sugon in a share swap—Hygon is valued at $43.9B, Sugon at $12.6B link

DeepSeek says its upgraded AI model outperforms the previous version in math, programming, and logic, with fewer hallucinations link

A new front in the US-China AI race has emerged: YouWare, a six-month-old Chinese startup offering coding assistants for amateurs, just raised $20M for its business which has tens of thousands of daily users, mostly in the US, Japan, and South Korea link

After years of US companies like Boston Dynamics leading in humanoid robotics, Chinese startups such as X-Humanoid, Unitree Robotics and EngineAI are now driving the next wave, deploying robots in healthcare, public safety and potentially military roles link

The Trump administration has ordered US semiconductor design software firms to halt sales to Chinese companies—sources say firms including Cadence, Synopsys, and Siemens EDA have been contacted link

The President is aiming to close a loophole around tech by requiring licenses for transactions with subsidiaries of already-sanctioned firms—that’s a workaround commonly used by Huawei and others to sidestep US curbs. link

But US venture capitalists are racing to invest in China’s biotech sector as it shifts to global innovation—deals like Pfizer’s $6B cancer treatment pact with 3Sbio show Chinese biotechs moving beyond copying to creating new therapies, now making up 30% of licensed drugs link

Just a week after pledging to stop sharing sensitive tech with China, self-driving truck firm TuSimple transferred US test data to a Beijing-owned company, according to a Wall Street Journal report link

Alibaba is exploring ways to reduce its minority stake in ZTO Express, including a possible sale of exchangeable bonds, according to sources link

Honor, spun off from Huawei, is developing humanoid robots as part of its $10B push into AI and new industries in China’s competitive market link

Jumia, Africa’s top online retailer, is adding more China-based sellers to compete with rising pressure from Temu and Shein link

Meituan reported an 18.1% year-on-year revenue growth to $12B link

Xiaomi posted record earnings as it dives into EVs and developing chip tech and other R&D link

PDD, which owns Temu, saw its share price drop over 10% link

Builder.ai, the AI startup facing bankruptcy after falsifying its numbers, reportedly faked transactions with India-based social media company VerSe Innovation—the companies are said to have ‘round tripped’ by billing each other similar amounts without actually delivering products or services link

Surveillance gear makers are clashing with India’s regulators over new rules that require CCTV manufacturers to submit hardware, software, and source code for government lab testing, Reuters reports—the move is said to be driven by concerns over China’s surveillance capabilities link

Unicorn tracking is passe these days, but still noteworthy as a sign of investor and market optimism: on that note, online trading platform Dhan is set to become India’s next billion-dollar startup with a round of $190M-$200M incoming—the deal is said to be led by ChrysCapital with Alpha Wave, MUFG among the other backers link

Rival investment platform Groww, meanwhile, is heading to an IPO after it filed papers for a listing that could reportedly raise $700M-$1B link

Speaking of listings, Oyo is meeting bankers as it aims for third IPO attempt—the goal is a $5B-$7B valuation link

From one comeback to another—Byju Raveendran, founder of India’s edtech giant Byju’s, is attempting a comeback from Dubai as he faces allegations of a $533M fraud which has destroyed the business once valued at $22B link

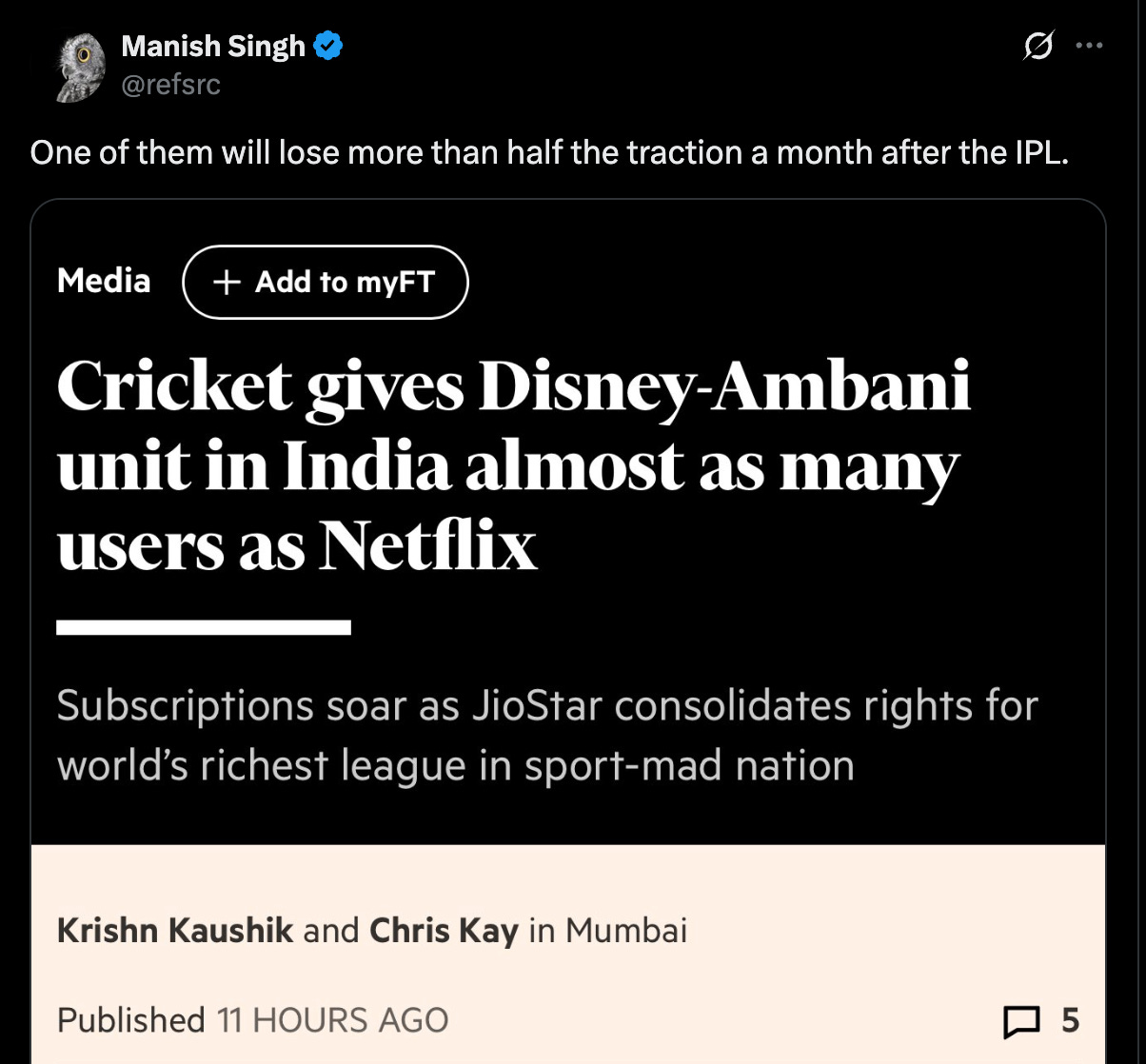

JioHotstar reached 280M subscribers, up from 50M in March—for comparison Netflix has 300M subscribers worldwide link

But the apples-to-apples comparison may be wide of the mark, as the IPL drives JioHotstar’s numbers and significant churn is expected as the season draws to a close—plus the price points are hugely different

India’s crypto industry is pushing for tax cuts that have stifled domestic trading link

The founders of once-hot edtech startup Unacademy are leaving their operational roles to reset the business and spin out their language learning business AirLearn link

Cred is reportedly in talks to raise $75M at a valuation of $3.5B in a round led by Singapore’s GIC—that’s huge but actually a down round on its previous $6.4B valuation link

The government has ordered e-commerce platforms and retailers to remove ‘dark patterns’ that trick customers into unintended purchases link

On-demand laundry and cleaning startup Snabbit raised $19M at a valuation of $80M through a round led by Lightspeed link

Executives from major semiconductor companies like Intel and AMD are leaving to launch AI chip startups in India, fuelled by government incentives and a growing demand for semiconductors link

FPT Corp, Vietnam’s largest tech company with a $6.8B valuation and a partial stake owned by the government, is expanding into AI, data centres and semiconductor through a partnership with Nvidia that’s aimed at modernising the local economy link

Thailand is blocking overseas crypto exchanges which don’t have a license to operate domestically, the list includes Bybit and OKX link

ByteDance’s TikTok Shop is cutting several hundred jobs in Indonesia as it trims costs after acquiring Tokopedia—logistics, operations, marketing, and warehousing are the areas of focus and the total number of staff is down from 5,000 last year to 2,500 link

OpenAI has set up a legal entity in South Korea and plans to open a Seoul office soon to support local partnerships—the company says Korea is its largest market for paid ChatGPT users outside the US link

Samsung is reportedly planning to join a $100M investment round for California-based medical imaging startup Exo link

Japan is investing $415M in climate tech startups through a government-backed fund to drive innovations from aquaculture to flood defenses link

AI chip startup EdgeCortix won a US Defense contract and secured $21M in government subsidies to develop energy-efficient AI chiplets for 2027 commercialization link

Pakistan is said to be setting up a ‘government-lead’ strategic Bitcoin reserve link

TSMC plans to open a chip design centre in Munich, which could later be used to support AI development link

The firm is also said to be considering an advanced chip plant that would be in the UAE link

The US government has sanctioned Philippines-based Funnull Technology, linking it to most virtual currency scam sites reported to the FBI. According to the Treasury’s OFAC, Funnull supports “hundreds of thousands” of sites tied to pig butchering scams. U.S. victims have reported over $200 million in losses, averaging $150,000 each—figures likely below the true total due to underreporting. link

Google warns of Vietnam-based hackers using bogus AI video generators to spread malware link

‘Rich and naive’: Singapore’s digitally savvy, rule-following residents are fueling a surge in scams, from phishing and fake job offers to crypto fraud. link

A US-based “laptop farm” helped North Korean IT workers pose as American employees, stealing $17.1 million from more than 300 U.S. companies. link

A China-based hacking group, APT41, exploited Google Calendar in a cyber-espionage campaign targeting governments, Google researchers revealed this week. Also known as Brass Typhoon, Wicked Panda, and RedGolf, the state-backed group focuses on foreign governments and sectors like logistics, media, auto, and tech. link