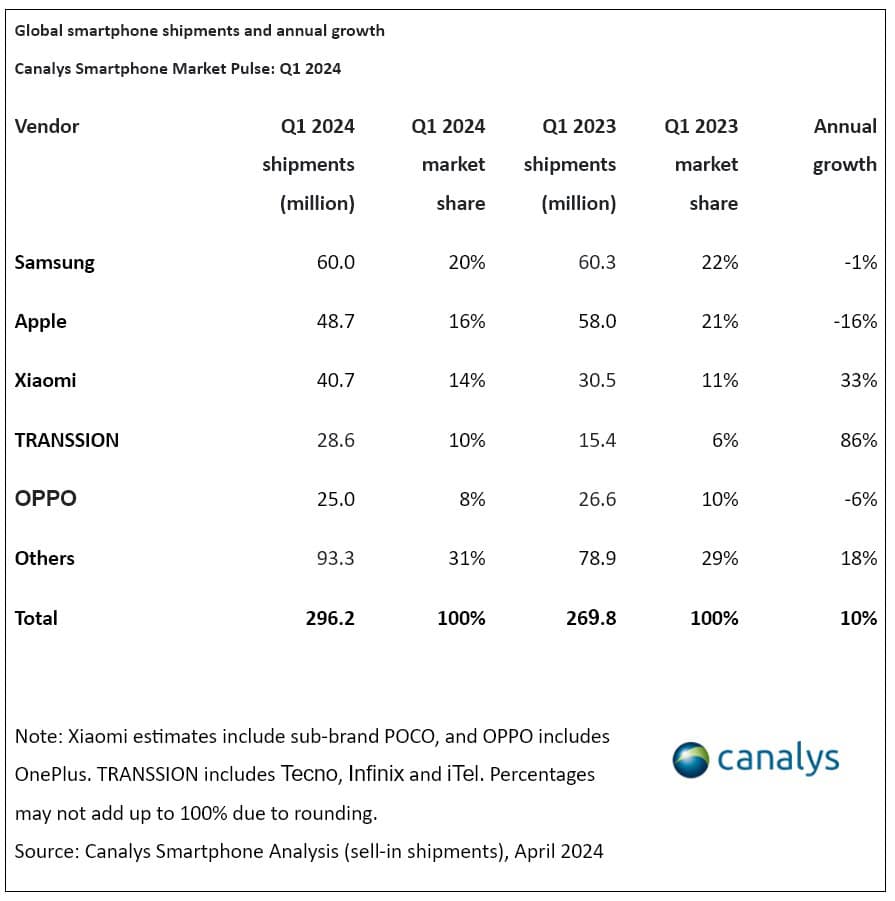

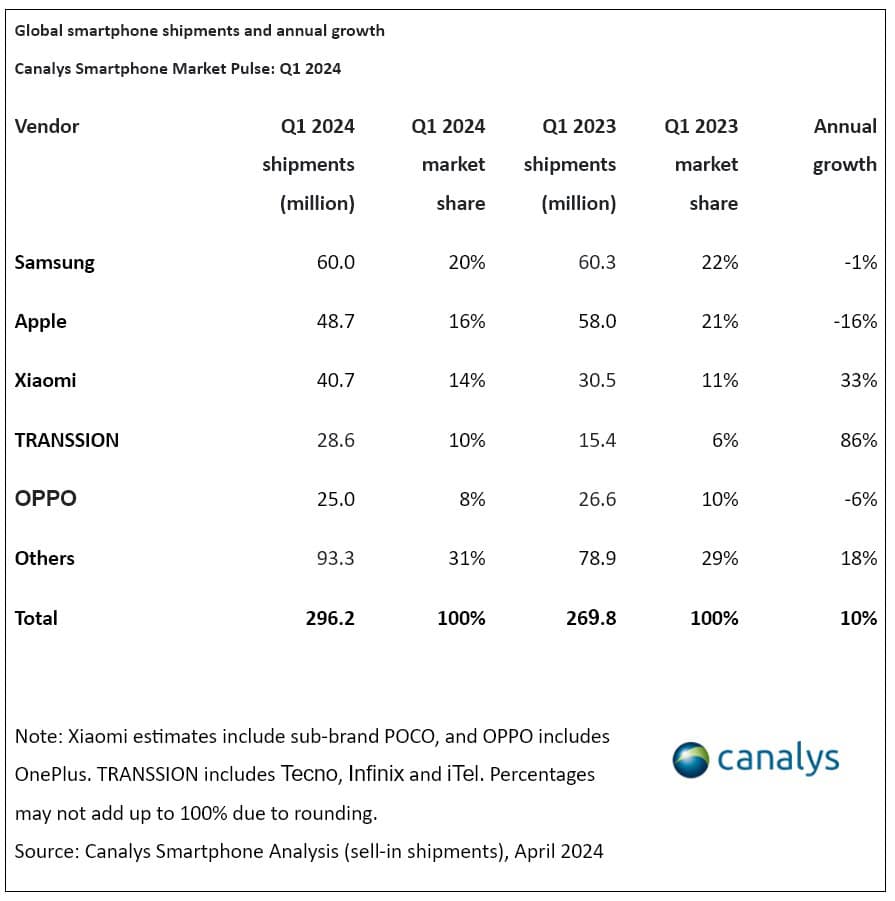

The global smartphone market registered a double-digit shipment growth for the first time in almost three years, Canalys reports. The research firm estimates that a total of 296.2 million smartphones were shipped globally in Q1 2024, up 10% year-over-year (YoY) from Q1 2023. This is the biggest YoY growth since an 11% jump in Q2 2021. The top two vendors—Samsung and Apple—suffered declines, though.

The smartphone market saw double-digit shipment growth in Q1 2024

The smartphone industry didn’t enjoy great success in 2022 and 2023. The market showed signs of recovery towards the end of last year and, as expected, 2024 began with a bang. Several research firms have already published their estimates and all of them have hinted at big shipment growth. Canalys is saying the same, estimating 10% growth to mark the first double-digit growth after ten difficult quarters.

According to Canalys, this surge was “primarily fueled by vendors introducing refreshed portfolios and macroeconomic stabilization in emerging market economies.” Samsung remained at the top with 60.0 million shipments and a 20% market share. The company saw strong demand for the Galaxy S24 flagships, selling 13.5 million units in just over two months. Its A series phones also did well in the mid-range segment.

However, Samsung didn’t benefit much from the global shipment growth. In fact, its smartphone shipments declined 1% YoY in Q1 2024. Apple at the second spot had an even worse start to the year. Its shipments dropped 16% to 48.7 million units. This means the company only accounted for 16% of all sales this past quarter, down from 21% in the same period last year when it shipped 58 million iPhones globally.

Xiaomi and Transsion, meanwhile, had an altogether different first quarter of 2024. The two firms (the latter is the maker of Tecno, Itel, and Infinix phones) registered a 33% and 86% shipment growth, respectively. Transsion leapfrogged Oppo into the fourth spot. Oppo dropped to fifth after a 6% decline in shipments. The combined market share of the remaining firms (Vivo, Google, Motorola, Nokia, and others) remained almost flat at 31%.

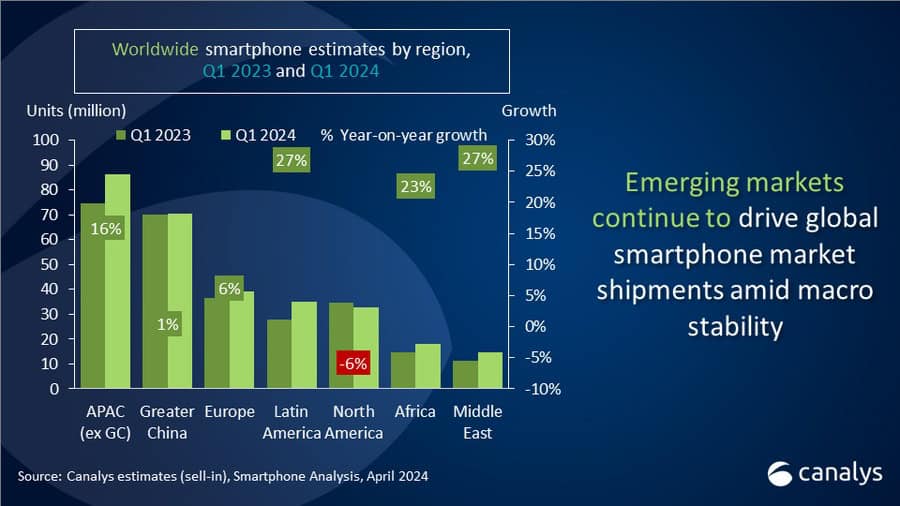

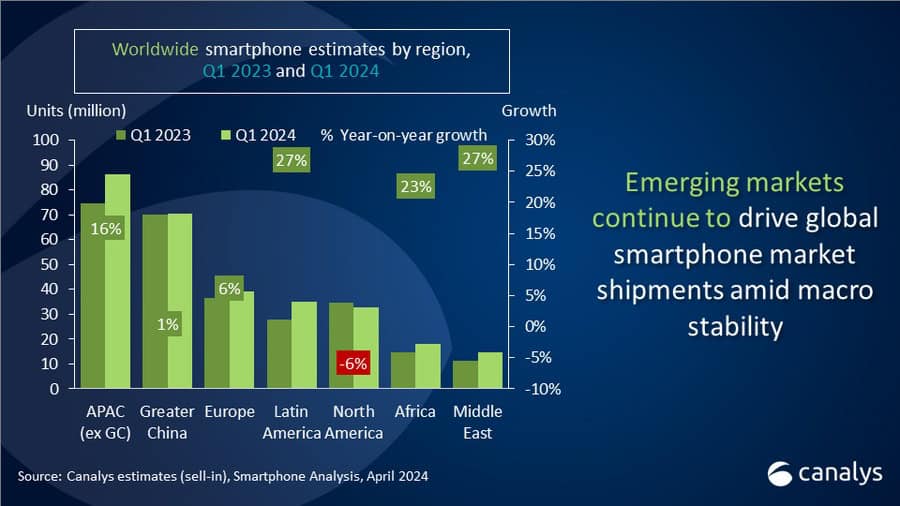

North American smartphone market declined this past quarter

The Canalys report says smartphone shipments declined 6% YoY in Q1 2024 in North America. This is perhaps why Samsung and Apple saw a shipment decline. These two firms capture the majority of the market in the region. Shipments were up throughout the rest of the world. The growth rate was higher in emerging markets such as Africa, the Middle East, Latin America, and Asia Pacific excluding China.

The research firm expects to move forward cautiously this year. “In 2024, vendors will maintain a cautious stance, focusing on wallet share, inventory management, and supply chain optimization. Meanwhile, exploring avenues to commercialize the generative AI wave remains critical for all players within the device ecosystem,” said Sanyam Chaurasia, a senior analyst at Canalys. Chaurasia sees companies bringing AI features to affordable devices to add more value to their products.