A second analyst house has warned about a slowdown in smartphone shipments, citing the impact of US President Donald Trump’s tariffs.

Counterpoint Research in its latest ‘Market Outlook Smartphone Shipment Forecast Report’ announced it has revised down its 2025 global smartphone shipment growth forecast to 1.9 percent year-on-year (YoY) from 4.2 percent YoY, “in light of renewed uncertainties surrounding US tariffs.”

Counterpoint is now the second analyst house to cite Trump’s tariffs as a reason for a lowering of smartphone shipments around the world.

Growth halves

Last month IDC Research had warned that worldwide smartphone shipments were forecast to grow just 0.6 percent year-over-year (YoY) in 2025, dramatically reduced from previous shipment forecast of 2.3 percent.

IDC last month had cited “high uncertainty, tariff volatility and macro-economic challenges such as inflation and unemployment across many regions leading to a slowdown in consumer spending.”

And now Counterpoint has warned that smartphone shipment growth in 2025 has been halved from previous forecasts, but says most regions are expected to grow – except for North America and China.

Indeed, North America is expected to decline due to expected price increases from tariffs.

Meanwhile China has been revised down to near-flat YoY growth on weaker-than-expected market reaction to the government’s subsidy program.

Price increases from cost pass-throughs remain a key focal point, although the tariff situation remains fluid and unpredictable, said Counterpoint.

“All eyes are on Apple and Samsung because of their exposure to the US market,” said Counterpoint’s Associate Director Liz Lee. “Although tariffs have played a role in our forecast revisions, we are also factoring in weakened demand not just in North America but across Europe and parts of Asia.”

“We still expect positive 2025 shipment growth for Apple driven by the iPhone 16 series’ strong performance in Q1 2025,” Lee added. “Moreover, premiumisation trends remain supportive across emerging markets like India, Southeast Asia and GCC – these are long-term tailwinds for iPhones.”

Counterpoint Research said it’s current forecasts assume a relatively stable tariff environment through 2025, “although the escalating rhetoric and uncertainty around trade policy could significantly impact OEM pricing strategies, supply chain planning, and, ultimately, consumer demand.”

Huawei shines?

It should be remembered that the smartphone shipments are still expected to grow, albeit at a lesser rate.

Counterpoint noted that Apple and Samsung’s growth projections have been revised down as cost increases are expected to be passed on to consumers, hurting demand – this despite some easing of the tariff burden compared to earlier worst-case scenarios.

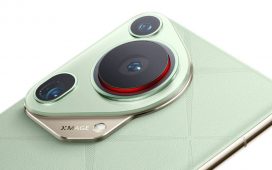

Meanwhile Huawei’s growth outlook has been upgraded due to easing supply chain bottlenecks and sustained momentum from its self-developed chips.

“The bright spot this year – again – will likely be Huawei,” noted Counterpoint Associate Director Ethan Qi, citing projections for global smartphone shipment growth in 2025. “We are seeing an easing around sourcing bottlenecks for key components at least through the rest of the year, which should help Huawei grab substantial share in the mid-to-lower-end segments at home.”

“Is 2025 the breakout year for Huawei globally?” Qi asked. “It might be a bit soon for that but increasing supply chain strength will definitely help the brand establish a better foothold overseas in the medium term.”

Donald Trump

The trade war had entered a new phase on 2 April, when Trump announced his so called “liberation day” tariffs against nearly all countries.

In late May Trump then re-ignited his trade threats, by threatening a 50 percent tax on all imports from the European Union, as well a 25 percent tariff on Apple products unless iPhones are made in America.

Trump’s first round of tariffs had raised prices for American consumers, and failed to produce the trade deals he had been seeking, or the widespread return of manufacturing to the US.

Indeed, after China refused to back down to the US tariff threats, Apple was forced to reconsider where it sourced its iPhones for the US.

In response to Trump’s ‘liberation day’ levies, Tim Cook sought to shift production of iPhones destined for the US market to India, saying in April that the majority of iPhones shipped to the US in the April to June quarter would be produced in India –a move that greatly irked Trump.

Apple had also chartered cargo flights to ferry 600 tons of iPhones, or as many as 1.5 million devices, to the United States from India in an effort to circumvent the worst of Trump’s tariffs.

Cook has also previously stated that Apple expects Trump’s tariff policies to lead to $900 million (£683m) in additional costs this quarter, with costs continuing to rise.

Meanwhile Apple is reportedly considering price increases for its autumn iPhone range, but is determined to avoid any appearance of relating the increases to US tariffs on Chinese imports, instead potentially attributing them to new features and design changes.

After many weeks of global turmoil and rising consumer prices in America, Donald Trump in May had made the decision to suspend the punitive tariffs against China and other countries for 90 days.