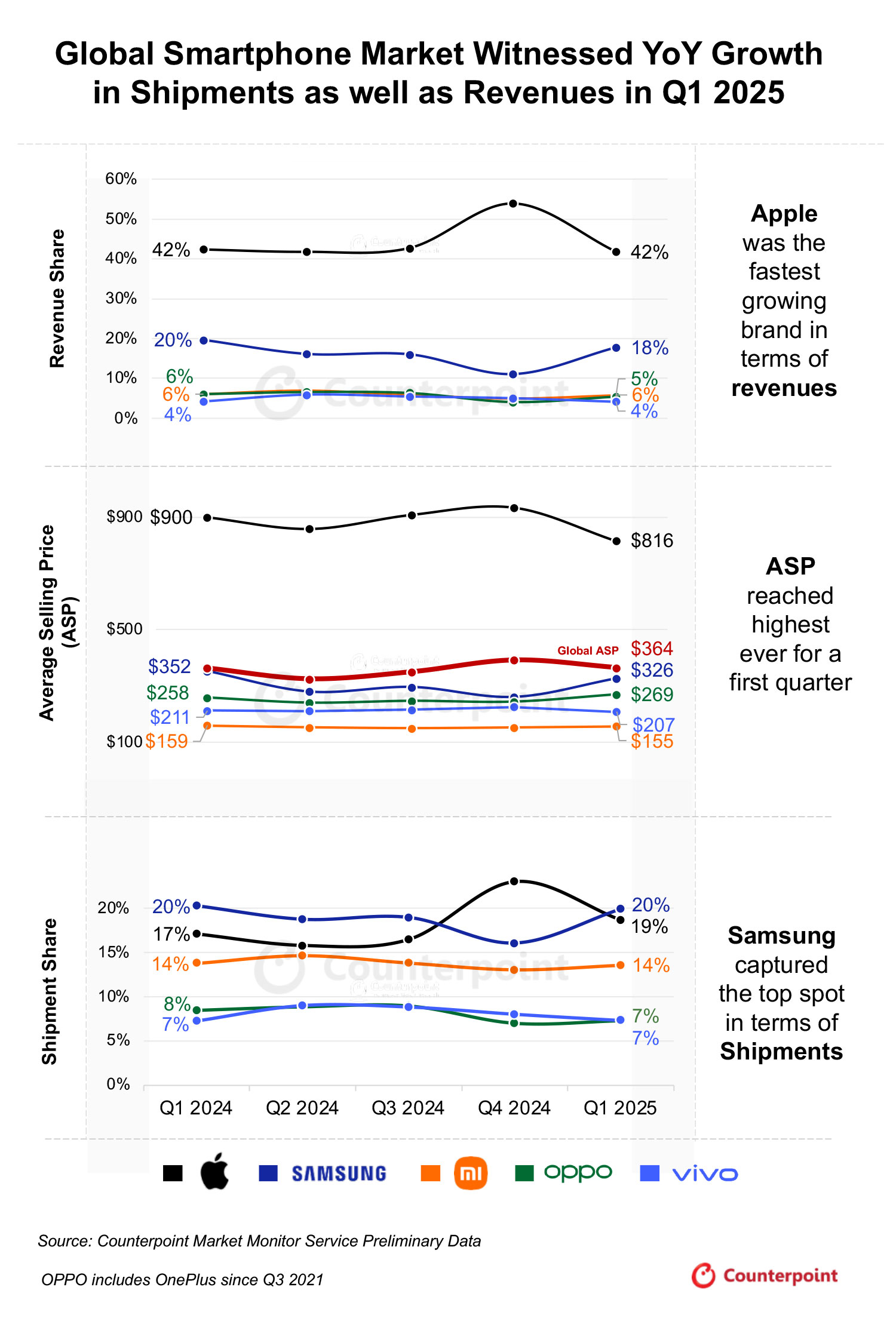

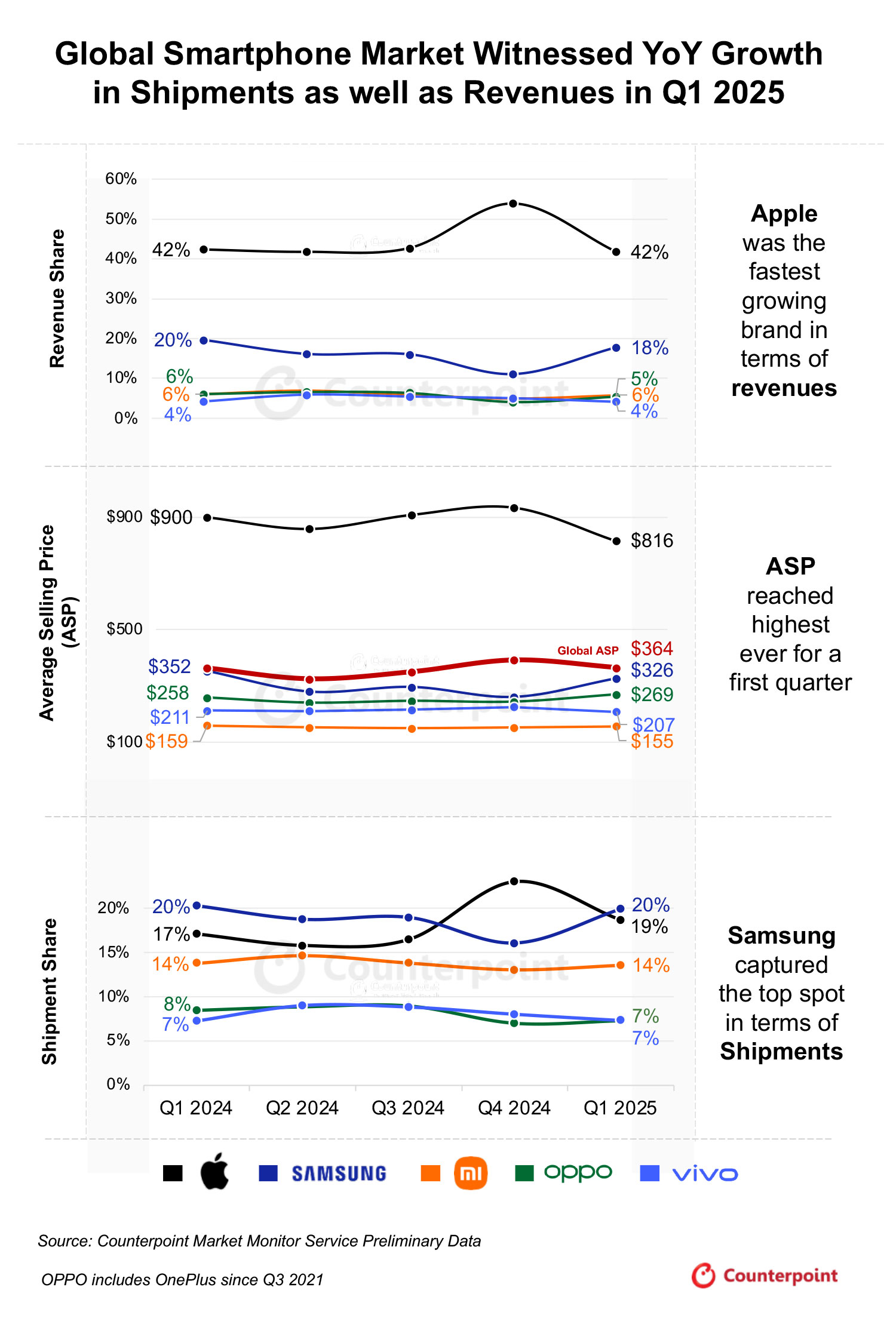

In the first quarter of 2025, the global smartphone market recorded a 3% year-over-year (YoY) increase in revenue, signalling modest recovery despite ongoing macroeconomic uncertainties. According to Counterpoint Research, this growth was largely driven by premiumisation trends and the performance of two major players: Apple and vivo. These were the only brands among the global top five to report YoY revenue growth during the period.

The global average selling price (ASP) for smartphones climbed 1% YoY to $364, marking the highest-ever ASP for a first quarter. This continues a broader trend toward premium and mid-premium device adoption, especially in mature and recovering markets. Consumers appear to be prioritising quality and innovation over price, contributing to greater revenue per unit.

Apple led the revenue gains thanks to the introduction of the iPhone 16e, which contributed to a 12% YoY increase in its shipments. Although Apple’s ASP fell 9% YoY due to strong sales of the lower-priced iPhone 16e, the volume of units sold offset this decline, keeping overall revenue in positive territory. Apple continues to leverage its loyal customer base and ecosystem lock-in to maintain strong market influence.

Vivo also recorded positive revenue growth during the quarter. The company’s performance was bolstered by strong demand in its home market of China and in India. In China, vivo benefited from government subsidy programmes that supported consumer upgrades, while in India, its focus on well-priced mid-range devices with appealing specifications attracted growing demand. Vivo’s localised product strategies and brand positioning have helped it remain resilient amid stiff competition.

Other major brands, however, struggled. Samsung, while retaining the top spot in global shipments, saw a 7% YoY decline in ASP. This decrease led to an overall dip in revenue. The drop was attributed to a lower mix of flagship models and increased competition in the mid-tier segment. Xiaomi and OPPO also reported revenue declines, with Xiaomi facing pressure in Latin America and OPPO affected by reduced momentum in Southeast Asia. Interestingly, OPPO was the only one among the three to see an ASP rise, driven by a greater mix of premium models.

Outside the top five, several other brands experienced notable growth. Huawei, now focusing on the Chinese market with its HarmonyOS ecosystem and in-house chipsets, saw strong consumer interest in its high-end models. Motorola also posted double-digit revenue growth, supported by increased brand visibility and product launches in North and South America.

Despite inflation concerns and the possibility of increased trade tariffs in some markets, OEMs continued to build up inventory levels to stay ahead of potential disruptions. This proactive approach helped sustain shipment volumes and supported revenue consistency.

Overall, Q1 2025 highlights a market steadily recovering with a clear shift towards premiumisation. Brands that successfully positioned themselves with compelling devices in either the premium or mid-tier categories, like Apple and vivo, reaped the benefits. As competition intensifies, especially from emerging brands outside the top five, adaptability and innovation will remain key to growth.