Americans need lower car prices. But not Hertz. “The residual decline … was relative to both ICE vehicles and EVs”: Hertz

By Wolf Richter for WOLF STREET.

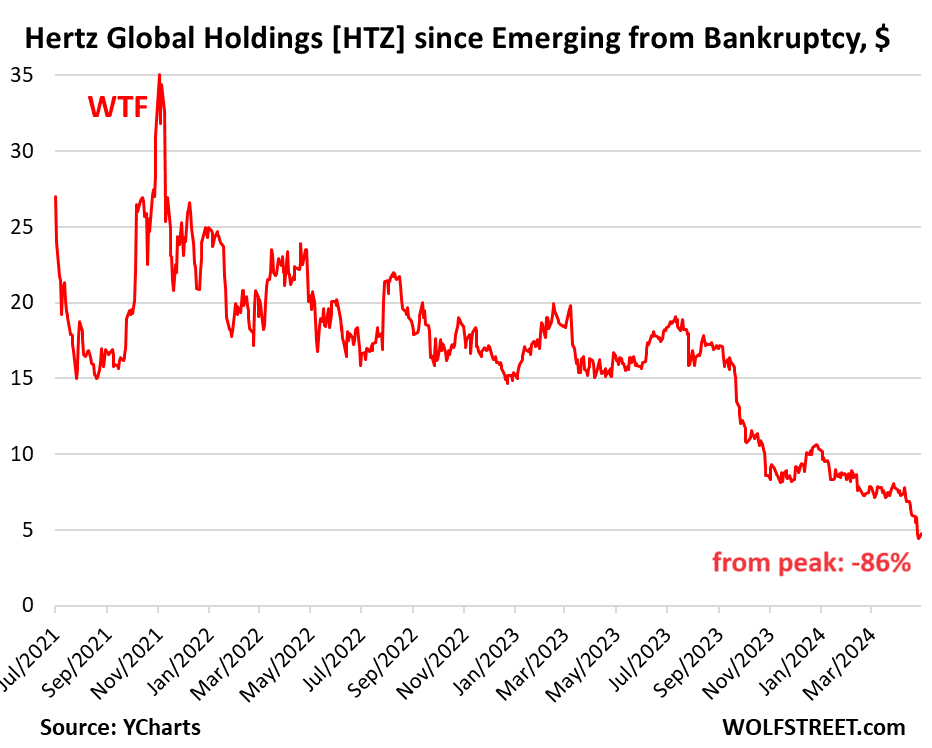

Rental car operator Hertz Global Holdings has had a nasty time in the stock market since it emerged from bankruptcy (filed Chapter 11 in May 2020, emerged on June 30, 2021). The new stock closed on the first day of trading at $26.99, then wobbled lower until the meme-stock crowd briefly fancied it again, and it spiked to $35 by November 2021. And then everything came apart.

Shares collapsed further last week, after the company booked a quarterly loss of $561 million before taxes, on soaring maintenance costs, soaring collision-damage repair costs, and plunging prices of used vehicles that crushed residual values of ICE vehicles and EVs in its fleet, leading to a mark-to-market write-down and much faster depreciation.

Vehicle depreciation and lease charges spiked by 154%, or by $578 million, to $969 million. The spike accounted for more than the entire pre-tax loss. Of that $969 million depreciation expense, $195 million was a mark-to-market write-down of the residual values of EVs held-for-sale.

“But the residual decline we saw during the quarter on forward residual values was relative to both ICE vehicles and EVs. So, it’s not a problem solely related to EVs,” explained CFO Alexandra Brooks during the earnings call (transcript via Seeking Alpha).

The biggest problem was that it had purchased ICE vehicles in 2021 and 2022 at used-vehicle auctions and as new vehicles at crazy peak prices. And values of those vehicles in its fleet have been plunging since then. The entire math of rental fleets was turned upside down by the massive gyrations of vehicle prices.

Shares have collapsed by 86% from the peak and are solidly seated in our pantheon of Imploded Stocks. That 7.9% bounce today to $4.77 is barely visible (data via YCharts):

Buy high, sell low.

During the pandemic, automakers ran into semiconductor shortages, causing production cuts globally, and the vehicles they did build were largely higher-end models and trim packages to get maximum dollars, and they were sold largely to retail customers. Incentives, including for fleet sales vanished. Deliveries to rental fleets plunged, and those vehicles that fleets could get were high-priced. Rental fleets then covered the shortages by buying used vehicles at auctions to help meet demand amid the “revenge” travel boom.

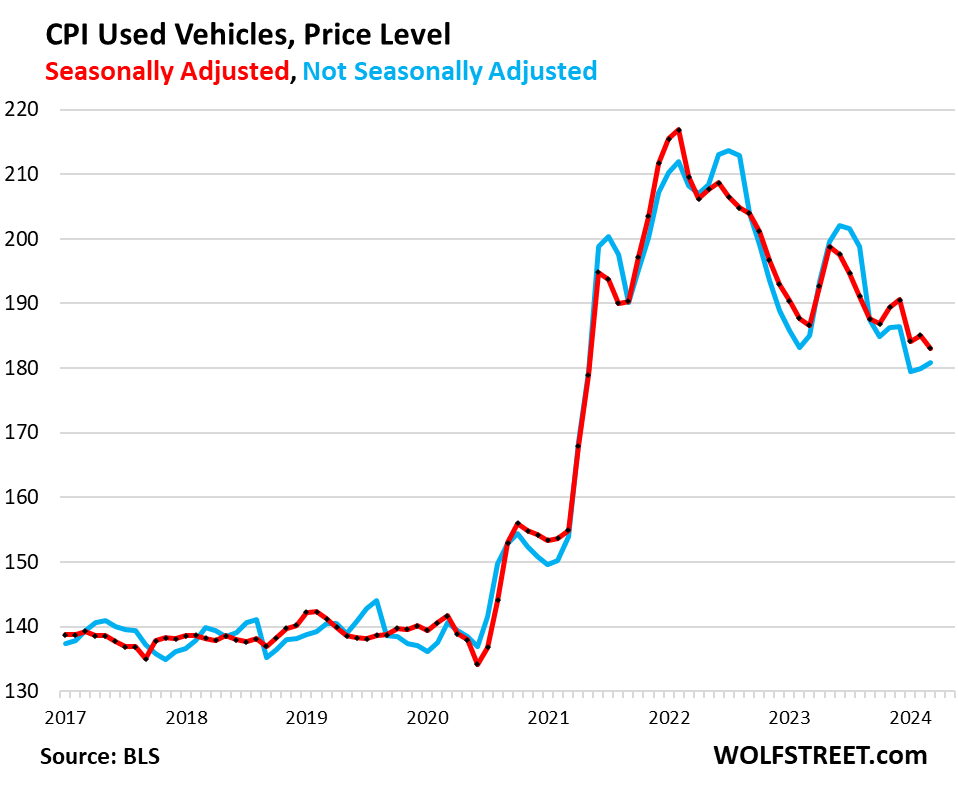

During that time, new vehicle prices soared; and used vehicle prices, including wholesale prices at auction where rental fleets were suddenly buying instead of selling, spiked in a historic manner.

That craziness peaked in late 2021 and early 2022, and then used vehicle wholesale prices and retail prices swooned in a historic manner, unwinding part of the spike.

From the peak, prices of used vehicle sold at auction have plunged by 17% not seasonally adjusted, and by 21% seasonally adjusted, according to the Manheim Used Vehicle Value Index. Or by nearly $4,000 per vehicle.

For Hertz, it means the value of vehicles in its fleet has plunged far faster than the normal rental-fleet depreciation that occurs as vehicles age and rack up miles.

These used-vehicle wholesale prices are what Hertz is facing when it sells its vehicles at wholesale auctions or to big used-vehicle dealers. In essence, its fleet is deeply underwater, leading to massive mark-to-market write-downs and much higher depreciation rates, which fueled the loss in Q1:

Used vehicle retail prices, which had spiked by 53% in 2020 through 2021, have now unwound nearly one-third of that spike. So this is what Hertz is facing when it’s retailing vehicles at its own dealerships:

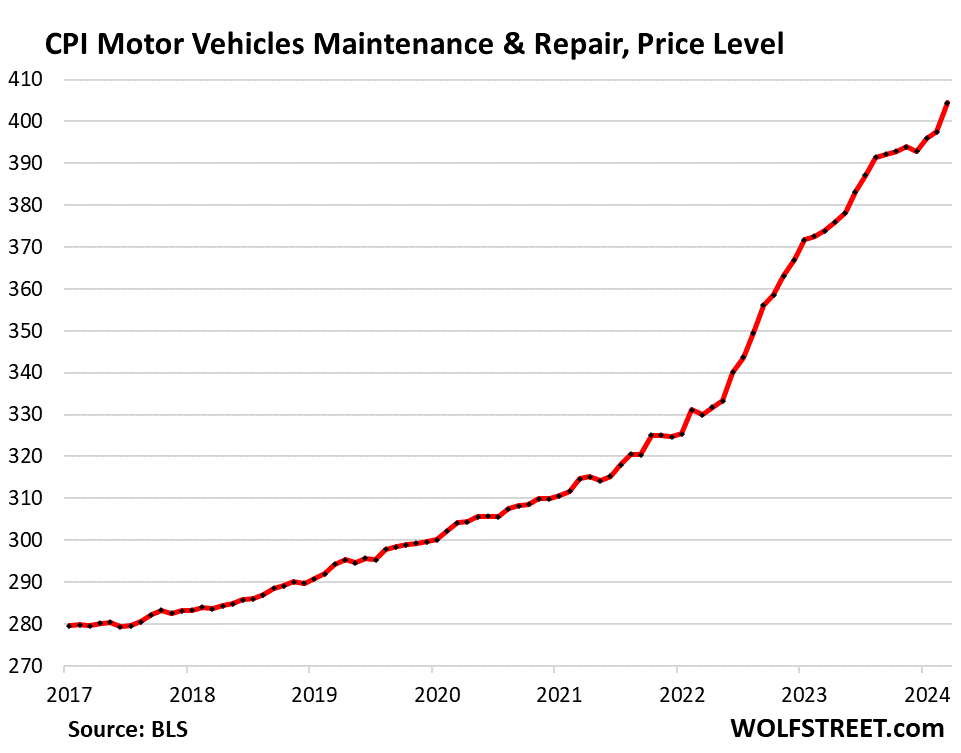

And then there are the ballooning maintenance and repair costs.

The Consumer Price Index for motor vehicle maintenance and repair leaped in March and was up by 8.2% from a year ago, and by 37% from four years ago. CPI reflects cost increases that consumers face. For fleets, cost increases, including for collision damage repairs, were similar.

Piling into EVs to create hype caused a “collision with renters that are not familiar with the operations of driving a new EV.”

Hertz made the announcement in September 2021, months after emerging from bankruptcy, that it would massively pile into Teslas.

The meme-stock crowd picked up on it, and Hertz shares doubled in two months – the WTF spike in the top chart above.

And it caused Tesla shares to spike to their all-time high in November 2021 (despite the 15% jump today, Tesla shares are down 53% from the November 2021 high).

We here pooh-poohed this deal at the time as a “propaganda coup,” for Hertz and for Tesla, and for the “selling shareholders” of Hertz, namely some hedge funds and PE firms that had gotten the shares during the bankruptcy proceeding in exchange for its debt they’d bought for cents on the dollar before the bankruptcy, and that had filed to sell their shares.

Turns out, there’s an EV learning curve. The average rental-car customer has never driven an EV, isn’t familiar with EVs, has no clue about the charging systems, and doesn’t know how to use the Tesla app and Tesla’s route planning system to find charging stations, etc. When people step off a plane, they don’t want to spend hours figuring out how all this stuff works.

So not enough customers reserved EVs, given the size of the EV fleet, because they didn’t want to mess with the learning curve. In addition, Hertz had trouble upgrading customers for free to EVs when ICE vehicles were not available. When rental car companies don’t have the vehicle type a customer reserved (for example, “economy car”), they offer the customer a free upgrade to a vehicle the they do have, and normally that’s welcome. But not when the upgrade is an EV that people don’t know how to use.

Hertz said in its earnings call that there was demand for EVs, but not to the extent that they had EVs in the fleet. So Hertz decided to drastically reduce the number of EVs in its fleet.

Reducing the EV fleet “is going to eliminate a portion of collision with renters that are not familiar with the operations of driving a new EV who otherwise would have chosen to take an ICE vehicle. But unfortunately, what they’re needing to take is an EV based on the fleet mix,” Hertz Chief Operating Officer Justin Keppy explained.

And Tesla then did what Americans need the most: It cut prices on new vehicles, over and over again. Other automakers followed and also cut EV prices. And each time a new-vehicle price gets cut, all used vehicles of that model experience a similar drop in value, determined largely by the spread between new and used models. And these price cuts by Tesla – great for consumers wanting to buy vehicles – are toxic for fleets that already own EVs. The price cuts caused the residual values of Hertz’s EV fleet to sag even faster than the residuals of its ICE vehicles.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()