The electric vehicle (EV) sector has been running in low gear over the past few years, despite the best efforts of government policymakers to promote sales. A series of headwinds have been putting pressure on EV makers, including disrupted supply chains, the limitations of existing battery technology, and lower-than-expected consumer demand. That last has been hit hard by high interest rates, which make it more difficult to finance big-ticket purchases.

But the supply chains are smoothing out, and expectations are that central banks will start bringing rates down toward the end of this year – and governments are still supporting EV makers through policy mandates. This paints a better picture for EV stocks heading forward.

The key here, for EV investors, will be to find the electric car makers with solid financials – the companies that have weathered the current storm will show the best upside as the EV segment recovers.

Tim Hsiao, sector expert at Morgan Stanley knows this, and he’s recommending 2 top EV stocks for investors to buy ahead of upcoming earnings releases. Specifically, he’s pointing at Nio (NYSE:NIO) and Li Auto (NASDAQ:LI), two of China’s top EV companies. We’ve used the TipRanks database to find out what the rest of the Street has to say about these two picks. Let’s take a closer look.

Nio, Inc.

Nio got its start in 2014, and after several years of design and development work, launched its first regular production EV models in 2019. Nio currently has eight cars on the market, including 5 electric SUV models and three sedans. The company unveiled a fourth sedan, the ET9, and plans to start deliveries during 1Q25.

While Nio’s cars include a suite of features to attract buyers, from stylish design to high-end battery technology, some of the company’s best selling points are not even on the cars at all. Nio backs up its vehicles with its Battery-as-a-Service model, offered to paying subscribers and simplifying the process of ‘recharging’ the car. BaaS subscribers can pull into any of Nio’s 2,300 battery swapping stations, where drained battery packs can be switched for fully charged units. Nio was the first EV automaker to introduce the BaaS model and plans to install up to 1,000 more swapping stations this year.

In addition to Battery-as-a-Service, Nio is also developing automated systems for its vehicles, introducing the technology that will bring both smart driver assistance and intelligent autonomous driving systems into the real world. Neither feature is currently ready for introduction on regular-production consumer vehicle models, but Nio is working to develop them as subscription services. Between the battery swapping service and the development of intelligent vehicles, Nio aims to capitalize on the potential of selling automotive high tech as a customer service.

Nio’s combination of quality vehicles and solid customer service has provided a firm foundation for its vehicle sales. In the last delivery update, covering April 2024, the company stated that it had delivered 15,620 vehicles in the month. This was up more than 134% from April 2023 and made up approximately one-third of the 45,673 total vehicle deliveries in the first four months of this year.

As of April 30 this year, Nio has delivered an aggregate total of 495,267 vehicles since it started regular production of consumer models. In an interesting note, Nio stated that of the April 2024 deliveries, 8,817 were premium smart electric SUV models, and 6,803 were from the premium smart electric sedan category.

Nio’s current line-up of vehicles caters to a well-heeled customer base – but the company is looking to expand, and later this month is set to release its new, lower-priced brand, called Onvo. These vehicles, of which the first will be the L60, will be priced significantly below the 300,000 renminbi average sticker of the current line-up. At an expected 250,000 renminbi, the new vehicle line will retail for the equivalent of US$34,600.

Also this month, Nio is expected to release earnings results for 1Q24. The Street is expecting to see $1.44 billion at the top line, a figure that would represent a 7.7% year-over-year decline.

Checking in with Morgan Stanley’s Hsiao, we find that the analyst sees this stock near the start of an upward trajectory. In his words, “We estimate 1Q deliveries dropped 40% QoQ, to 30k units, in line with the company’s reduced guidance. Hence, we expect 1Q revenue of around Rmb10bn, slightly below its original guidance of Rmb10.5-11bn, assuming a relatively steady ASP… For 2Q24, we expect the company’s deliveries to increase 60-70% QoQ, to 49-51k, on the back of improving order intake since April amid renewed promotions.”

Hsiao goes on to explain why investors should buy into this EV maker, adding, “With the steady recovery of the NIO core brand and the recent share price rally, investors are now willing to give attention to the launch of Onvo (Alps), which should be a volume driver and potentially a make-or-break product. We look for Onvo to make its debut in May with the initial price likely coming in at around Rmb250k with battery (lower if choosing BaaS). Deliveries should start in June…”

To this end, Hsiao gives NIO stock an Overweight (i.e. Buy) rating, and he sets a $10 price target that implies a one-year upside of ~88% for the shares. (To watch Hsiao’s track record, click here)

Overall, the stock holds a Moderate Buy consensus rating from the Street’s analysts, based on 16 recent reviews with a breakdown of 7 Buys, 7 Holds, and 2 Sells. The shares are priced at $5.33, and the $6.92 average target price suggests that NIO will gain ~30% going forward. (See Nio stock forecast)

Li Auto

Next up is Li Auto, a Chinese EV company that has attracted investor interest. The company has made successful moves to make itself a leader in top-end electric vehicle drivetrains, a specialized technology that is essential to the EV market. It’s an important point, as it helps to differentiate Li from its competitors in China’s large – and growing – EV sector. Li also has a wide-ranging network of dealerships and vehicle service centers available to market cars and provide support for customers.

Li’s current model lineup includes the L6, L7, L8, and L9, a family of electric SUVs that feature ‘extended range;’ that is, they are equipped with four-cylinder gasoline engines that will kick in and charge the battery when the charge runs too low. Li’s cars are not true gas/electric hybrids – the combustion motors do not actually drive the car, but only provide power to recharge the battery while driving.

The company’s most recent model, however, is a true pure-play EV. Dubbed the MEGA, the vehicle is a purely battery-powered minivan, introduced in November of last year. The MEGA, which is a family-oriented vehicle, features a roomy interior, more than 8 square meters of windows, three rows of seating, powered sliding doors, and even a built-in refrigerator. Deliveries began in March of this year.

Li’s delivery numbers for April 2024 hit 25,787, and the cumulative total reached 739,551. These are solid numbers and are backed up by a service network that includes 481 retail stores in 144 cities across China; 361 service centers and company-authorized body and paint shops, located in 210 cities; and 386 supercharging stations in operation across China, boasting a total of 1,678 charging stalls.

Looking ahead to the 1Q24 earnings report, due out on May 20, Morgan Stanley’s Hsiao expects a decline in Li’s financial results – but not one that will derail investor interest.

“We expect 1Q24 deliveries of 80.4k units, down 39% QoQ, topping the upper end of reduced company guidance of 76-78k. We expect revenue of Rmb25-26bn for the quarter, assuming largely stable ASP… Looking to 2Q24, we expect Li Auto’s volume guidance to roughly fall in a range of 105-115k units (up ~40% QoQ), reflecting solid order intake for the recently-launched L6… Investors are likely to focus on the sustainability of order momentum for L6 after it scored 41k orders since launch, as well as the potential impact on blended margins. Following the solid performance of L6, the market will also increasingly pay attention to the recovery pace of L7/8/9 post recent price adjustments,” Hsiao noted.

Hsiao translates his view of Li’s forward prospects into numbers with a $65 price target – which implies an upside of a solid 138%. It’s not surprising, then, why he rates the stock an Overweight (i.e. Buy).

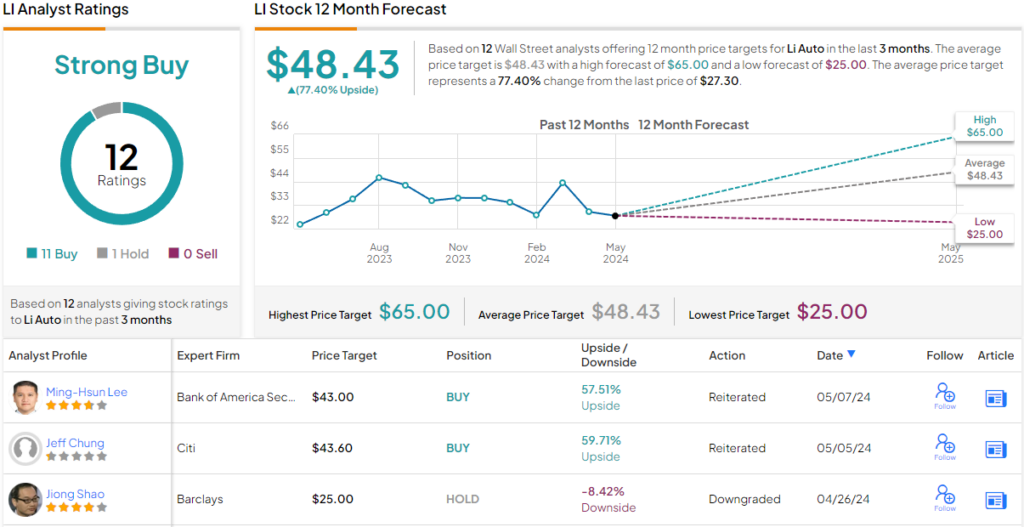

That’s in line with the Strong Buy consensus rating here, a rating based on 12 recent analyst reviews with a breakdown of 11 Buys to 1 Hold. The shares are priced at $27.30 and the $48.43 average price target indicates room for 77% share appreciation this year. (See LI stock forecast)

To find good ideas for EV stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.