Samsung smartphones. Photo: Unsplash

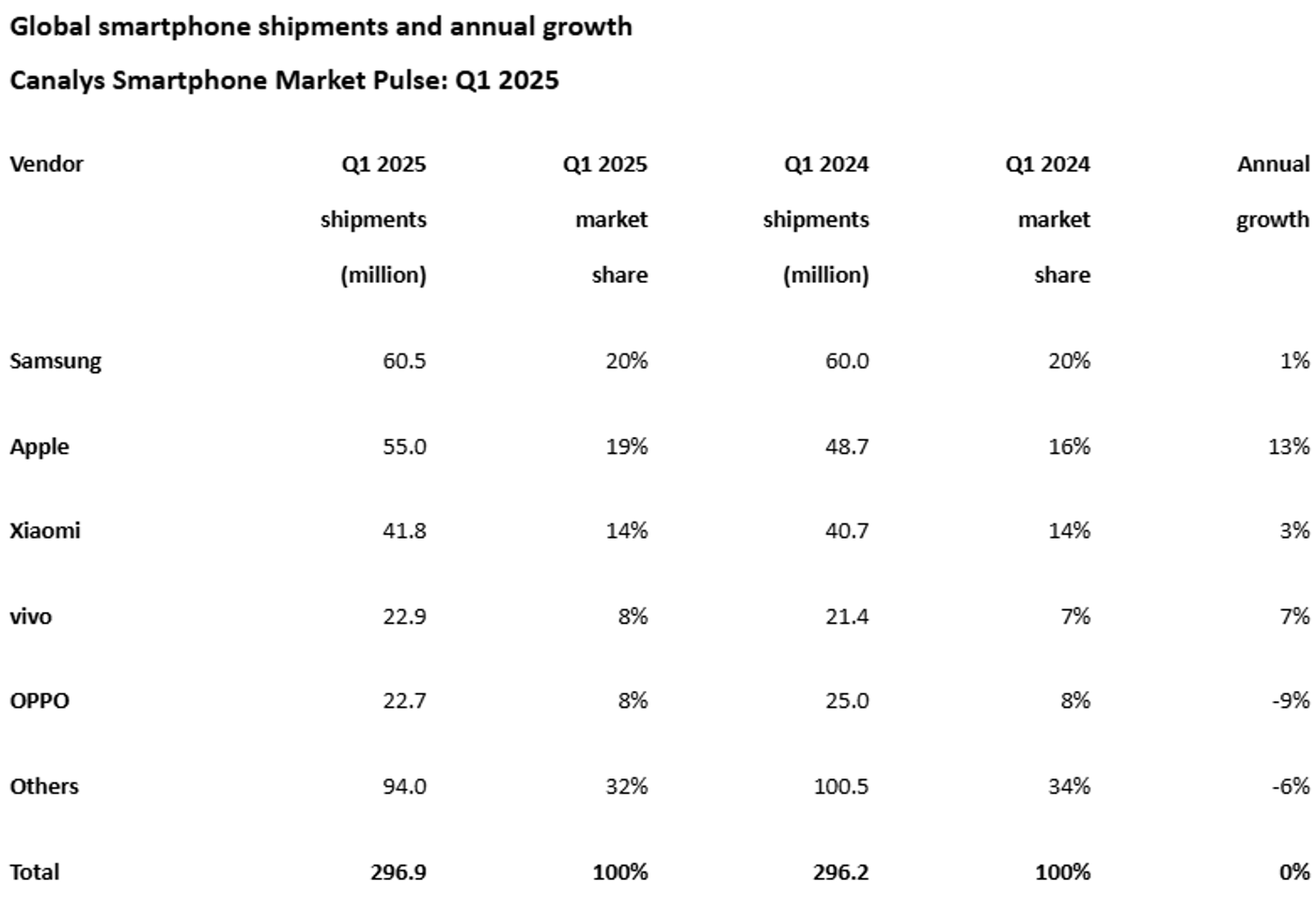

Global smartphone shipments reached 296.9 million units, and the rate of recovery slowed again: this is the third quarter in a row when growth was almost imperceptible. Manufacturers have completed the peak of the device replacement cycle and are focusing on healthier inventory management, which has affected the final figures.

It is stated in the report of the analytical company Canalys.

Advertisement

Who became the leader among smartphone manufacturers?

Samsung remained the leader with 60.5 million smartphones (20% of the market), successfully combining the launch of premium flagships and affordable A-series models. Apple shipped 55 million devices and took second place with a 19% share, increasing sales in developing countries. Xiaomi retained its third place (41.8 million and 14%), strengthening its brand in mainland China and new overseas markets. The next positions were taken by vivo (22.9 million and 8%) and OPPO (22.7 million and 8%). The total “other” segment declined to 94 million devices, down 6% year-on-year.

The Canalys analyst notes that the markets that showed strong demand last year (India, Latin America, the Middle East) are now facing a downturn. In Europe, supplies have also dipped: on the one hand, there is still a large stock of last year’s flagships, but on the other hand, there is uncertainty at the mid-market and budget level due to the upcoming eco-design directive.

In contrast, the Chinese market, where government subsidies have supported demand, and Africa, which continues to grow thanks to active retail expansion by manufacturers, have seen strong growth. In some places, double-digit growth rates were achieved: vivo and HONOR both significantly increased their overseas sales, with HONOR setting its own record.

In the United States, shipments jumped by 12% at once, driven by Apple. The company accumulated stocks in advance in preparation for possible tariff changes and accelerated production in India.

Despite the sluggish start to the year, key vendors have not revised their annual supply plans and are expecting a rebound in Q2 and H2. The first signs of recovery are already evident in Southeast Asia and Latin America, with declining inventories and upcoming new product releases adding to the optimism. However, there are also challenges: restrained hardware upgrades within the sub-USD 200 sectors, fierce competition in the mid-range USD 200-400 price range, and likely increased protectionism, which will force brands to invest in localisation.

As a reminder, new details about the iPhone 17 Air, which is expected to be released in September 2025, are actively leaked online. All the details that are now known indicate that Apple may introduce the smartphone that will become the bestseller.

We also wrote that Samsung has postponed the Galaxy S25 Edge presentation date from mid-April to mid-May. The official announcement is expected on May 13, where the company’s thinnest mobile device will be presented.

Advertisement

Read Novyny.LIVE!