It’s like an immutable law of physics.

The Federal Highway Trust Fund, which helps pay for the cost of road repairs across the country, is running out of money. Its expenditures are increasing while revenues have not kept up.

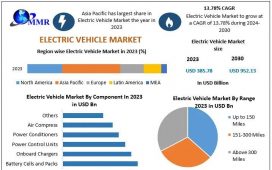

A big part of the reason is the increase in electric, hybrid and more fuel-efficient vehicles that pay no federal gas tax, or decreasing amounts. The federal tax is 18.4 cents a gallon, which has remained unchanged since 1993.

That’s separate from state gas taxes, which tend to be higher — California’s is the highest — but do not go into the federal fund.

The trust fund is projected to become insolvent by 2028, unless Congress does something. Another way to look at it is the fund faces a potential $280 billion shortfall by 2034, according to the Congressional Budget Office.

House Republicans are moving to plug at least part of that deepening hole with new fees. The bottom line is it will be more costly to drive an electric or hybrid vehicle if their plan is adopted.

An initial proposal caused something of an internal Republican firestorm and was quickly dashed. That plan called for annual fees of $200 on electric vehicles, $100 on hybrids and $20 for other vehicles, mostly gas-powered.

It was the $20 fee that was the cause for consternation, with critics contending it puts a greater burden on gas-car drivers, who already pay more gas taxes than owners of alternative-powered vehicles. The author of the measure, Rep. Sam Graves, R-Mo., chair of the House Transportation and Infrastructure Committee, quickly retooled his proposal.

The proposal passed out of his committee after Graves dropped the $20 fee, and boosted the EV levy to $250 but kept the hybrid charge at $100.

Its future remains uncertain, however. The plan is part of President Donald Trump’s “big, beautiful bill” on taxes, immigration, energy and defense. Even some Republicans are reluctant to back the bill in its current form.

For now, congressional Republicans are keeping their distance from potential road-use charges, or mileage fees, to pick up the slack for declining gas-tax revenue. Such charges are being studied in pilot programs in many states, including California, as recently reported by Rob Nikolewski of The San Diego Union-Tribune.

Like the federal trust fund, state highway and road funds are facing declining revenues for the same reason.

Numerous Republican states are looking into road charges as well. Utah has a program that gives electric vehicle owners the option of paying a mileage fee or a flat annual charge.

A main concern about broad mileage fees is that, while intended to eventually replace state gas taxes, drivers will be charged both, at least during a transition, resulting in double taxation.

The mileage fee concept is regularly called a “tax” by critics, a term that could be applied to the vehicle fees proposed by House Republicans. Regardless, the mileage fee so far has been more controversial.

Republican proponents of the EV and hybrid fees argue the proposal is a matter of fairness.

“For far too long, EVs have operated on our nation’s roads without paying into this system,” said Graves, according to The Washington Post. “Plain and simple, this is a fairness issue, and it’s time these roadway users pay their share for the use of the road.”

In other words, it’s a user fee and not a universal tax — the same as a gas tax or, for that matter, a mileage fee, unless those funds are syphoned off for other spending.

It’s also a progressive tax. Surveys show that EV owners tend to have high incomes, likely a partial result of the sizable initial outlay to buy one. New fees aside, the cars will become more costly if Congress backs Trump’s plan to revoke the EV $7,500 federal tax credit. Critics contend that credit is a taxpayer subsidy for the wealthy.

EV owners also are mostly middle-aged, college-educated White men — and more likely to identify as Democrats.

A federal EV fee would come on top of those charged by many states. In California, owners of zero-emission vehicles from 2020 models and later are charged an annual $118 road improvement fee in addition to other registration fees, according to the Department of Motor Vehicles.

Opponents of the federal fees have their own fairness argument.

According to Consumer Reports, the average EV owner would pay more than three times as much in annual federal vehicle taxes as the average owner of a new gasoline-powered vehicle and more than twice as much as drivers of some of the least-efficient vehicles on the market.

Seniors, who typically drive far fewer miles than average, would be disproportionately affected. With this new fee, a senior driving an EV would be expected to pay almost six times as much than if they drove the average new vehicle getting 28 miles per gallon of gas.

“It’s easy to pick on a small minority,” said Chris Harto, senior policy analyst at Consumer Reports, noting that EV drivers represent just 2 percent of drivers on the road, according to the Post. “But this is a much bigger problem and needs a much bigger solution.”

Graves’ initial fee proposal was projected to raise $50 billion over the next decade. The one moving forward is expected to bring in $38 billion, about 14 percent of the 2034 highway fund shortfall.

Call them what you like — fees, taxes, revenue enhancements — but even more may be on the way, whichever party controls Congress.

What they said

Tucker Carlson, when asked if the notion of being president ever crossed his mind.

“Literally, not for one second. I couldn’t get elected to an empty congressional seat in an uncontested election in North Dakota. I’m not qualified to be president… I wasn’t qualified to host a show on Fox News, it turns out… If I’m president, move.”