Also in the letter:

■ WeWork to sell 27% stake in India unit

■ Europe is a hotspot for Indian IT M&As

■ Peak XV MD to leave VC fund

Centre, SBI Card, telcos come together to tackle OTP frauds

The government has teamed up with SBI Card, the credit card business of State Bank of India and telecom operators to track and flag frauds being conducted with the help of one time passwords, commonly know as OTPs, which are used widely for facilitating digital payments, two people in the know told us.

How will this work? According to people in the know, banks will track SIM card (used in mobile phones) location of a customer through telecom service providers. They also have the customer’s registered address in their database. In case the OTP is going to a third location unrelated to the customer, a pop up can be flashed on the customer’s screen alerting a possible phishing attack. In worst cases the complete OTP can be blocked.

Big picture: Cyber attacks have become a huge problem. According to data released by the Indian Cyber Crime Coordination Centre (i4C), Rs 10,319 crore were siphoned off by cyber criminals between April 2021 and December 2023.

Action by authorities: The Reserve Bank of India enforced additional factor of authentication many years back to prevent fraudulent attacks on digital payments. But currently, fraudsters have started using sophisticated means to reroute OTP or in some cases get gullible customers to give up their OTPs. The central government has set up a cyber crime reporting portal to get citizens to report instances of cybercrime.

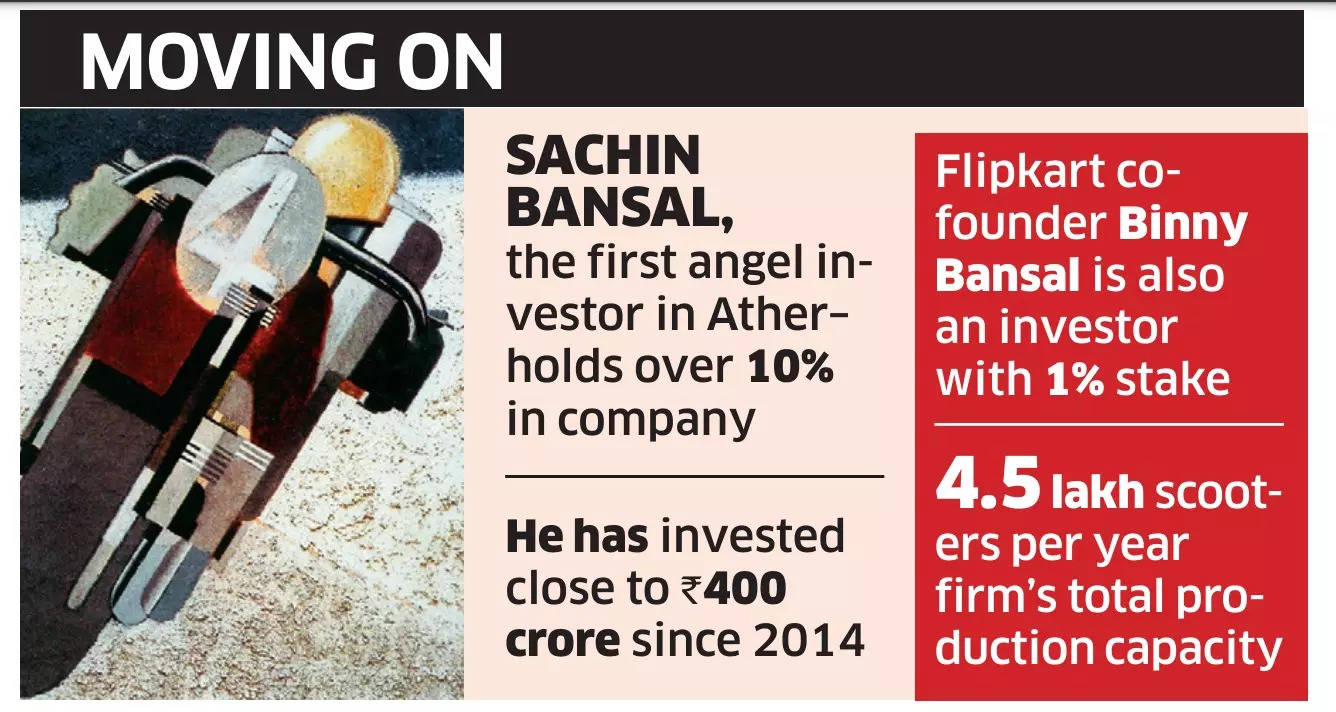

Ather eyes new funding round, Nikhil Kamath buys big part of Sachin Bansal’s stake

Zerodha cofounder Nikhil Kamath (left) and Flipkart cofounder Sachin Bansal

Electric scooter maker Ather Energy is in talks to raise a large round of funding in a mix of primary and secondary share sale, sources told ET.

Driving the news: Flipkart cofounder Sachin Bansal, who was the first angel investor in Ather, might sell his remaining stake in the firm to Zerodha cofounder Nikhil Kamath, as part of the secondary sale share. Bansal has already sold a significant part of his holding in Ather to Kamath, but still owns over 10% of the firm.

Tell me more: Ather is also in discussions to raise $75-90 million in primary funding from existing investors at a valuation of between $850 million to $1 billion, helping it join a small club of unicorns minted in India over the last year. Unicorns are privately held startups valued at $1 billion or more.

Zoom out: The investment comes as Ather is planning to ramp up its production after the launch of its Rizta range of scooters that will target the family segment. The company, which has a total production capacity of 4.5 lakh scooters per year, said it would expand production from the current 1.5 lakh vehicles it makes per year after the Rizta hits the market.

Brighter market outlook: Mobility firms like Ather across the board are seeing increasing investor interest as demand grows. Bengaluru-based Rapido is looking to raise around $100 million in new funding. Ather’s rival Ola Electric filed its draft IPO papers in December for a public offering and is awaiting approval from the public markets regulator–Sebi.

Also read | New ride-hailing apps racing Uber, Ola for mobility business

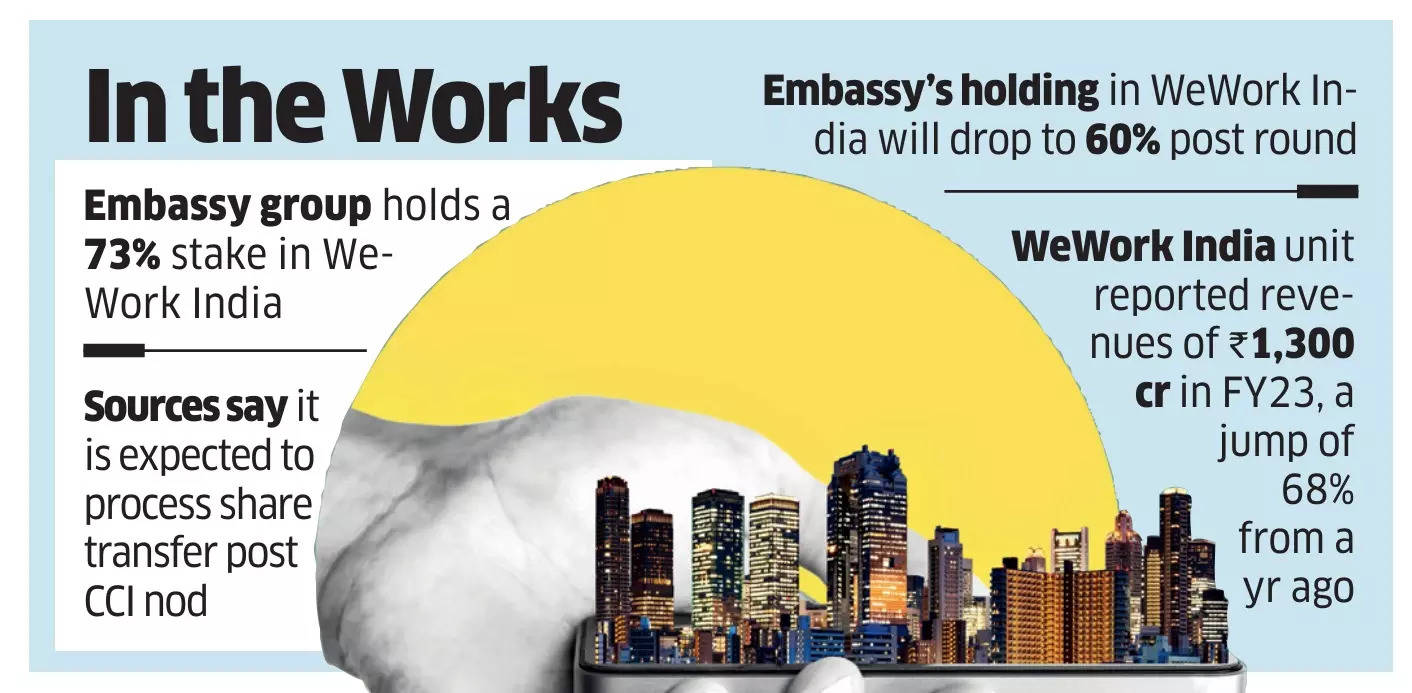

Exclusive: WeWork Inc to sell 27% stake held in India unit via secondary deal

Karan Virwani, CEO, WeWork India

Nearly seven years after coworking major WeWork US entered India through a joint venture with the Embassy group, it is now exiting the market. Here are all the details.

Driving the news: WeWork India, promoted by Bangalore-based Embassy group, is in the midst of offloading the stake held by its US parent through a Rs 1,200 crore secondary transaction. Embassy group owns 73% in WeWork India and the rest is with WeWork US. The India entity retains the branding rights for WeWork in India.

New investors check-in: Enam group’s family office led by Akash Bhanshali, investment fund A91 Partners, and CaratLane founder’s Mithun Sacheti are investing in WeWork India. This capital will be used to buyout WeWork Inc’s stake in the India unit. The joint venture unit was set up in 2017.

Deal details: Along with the 27% that is being sold by WeWork Inc, the deal also involves another 13% being offloaded by the Embassy group, said a person familiar with the details.

Also read | ETtech Explained: WeWork’s downfall from $47 billion valuation to bankruptcy

Background: Adam Nuemann and Miguel McKelvey founded WeWork in 2010 and raised several billion dollars from top investors including SoftBank. In November, however, it filed for chapter 11 bankruptcy. Neumann, according to reports, is planning to buy back the company.

India business thriving: Unlike its collapsed US operations, WeWork India reported a 68% jump in FY23 revenue at Rs 1,300 crore while losses reduced by 80% at Rs 146 crore. For the first six months of FY24, it clocked a revenue Rs 831 crore revenue, up 40% on-year. It is yet to file its audited FY24 financials with the RoC (Registrar of Companies).

Also read | WeWork India says business not affected by US bankruptcy

Other Top Stories By Our Reporters

Europe emerges as hotspot for Indian IT M&As, tops buy chart: Indian outsourcing leaders are increasingly acquiring companies in Europe, where the pace of revenue expansion has lately dwarfed growth rates the other side Atlantic seaboard to justify about a dozen M&As in the continent since the pandemic.

Peak XV MD Piyush Gupta to leave VC fund: Piyush Gupta, a managing director at Peak XV Partners, is exiting the venture capital firm to launch his own fund that will focus on secondary transactions, people aware of the matter said. Gupta, who is based in Singapore, leads strategic development for Peak XV and is not involved with making investments.

Need time to study impact of proposed digital competition law, say tech policy advocacy groups: A group of 21 organisations, including Broadband India Forum, Deepstrat, the Internet Freedom Foundation, and the Dialogue, as well as some individuals, have written to the government asking for a five-month extension to the May 15 deadline to provide inputs to the draft of the Digital Competition Bill.

Global Picks We Are Reading

■ The AI race is generating a dual reality (FT)

■ Why African tech companies are ditching Google for a small Indian competitor (Rest of World)

■ Why America’s system for investigating child exploitation online isn’t working (WSJ)