The House reconciliation bill includes a fee on electric vehicles to help contribute to the Highway Trust Fund (HTF).

The HTF runs billion-dollar deficits and the problem is only projected to get worse in coming years as electric vehicle (EV) purchases continue to grow. The House proposal will raise revenue and it will reduce the funding gap. However, it will not be nearly enough, and the legislation does not address the fact that all vehicles, not just EVs, have been underpaying for road maintenance.

Background

At a basic level, highway users should be paying for highway operations and maintenance. There are two issues within that umbrella: revenue levels and cost-fee alignment. Fees and taxes on highway users should cover highway spending, and highway users should be charged different taxes and fees based on the different amounts of wear and tear they impose. People that drive more, or drive heavier vehicles, impose more maintenance costs and should pay more taxes and fees.

The Situation

Revenue-wise, the HTF is failing. The gas taxA gas tax is commonly used to describe the variety of taxes levied on gasoline at both the federal and state levels, to provide funds for highway repair and maintenance, as well as for other government infrastructure projects. These taxes are levied in a few ways, including per-gallon excise taxes, excise taxes imposed on wholesalers, and general sales taxes that apply to the purchase of gasoline.

(the primary source of fund revenue) has not increased since 1993 and has declined by over 50 percent in real terms. Increased fuel efficiency and EV introduction have shrunk the gas tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates.

, and increased EV adoption will have a larger impact on gas taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

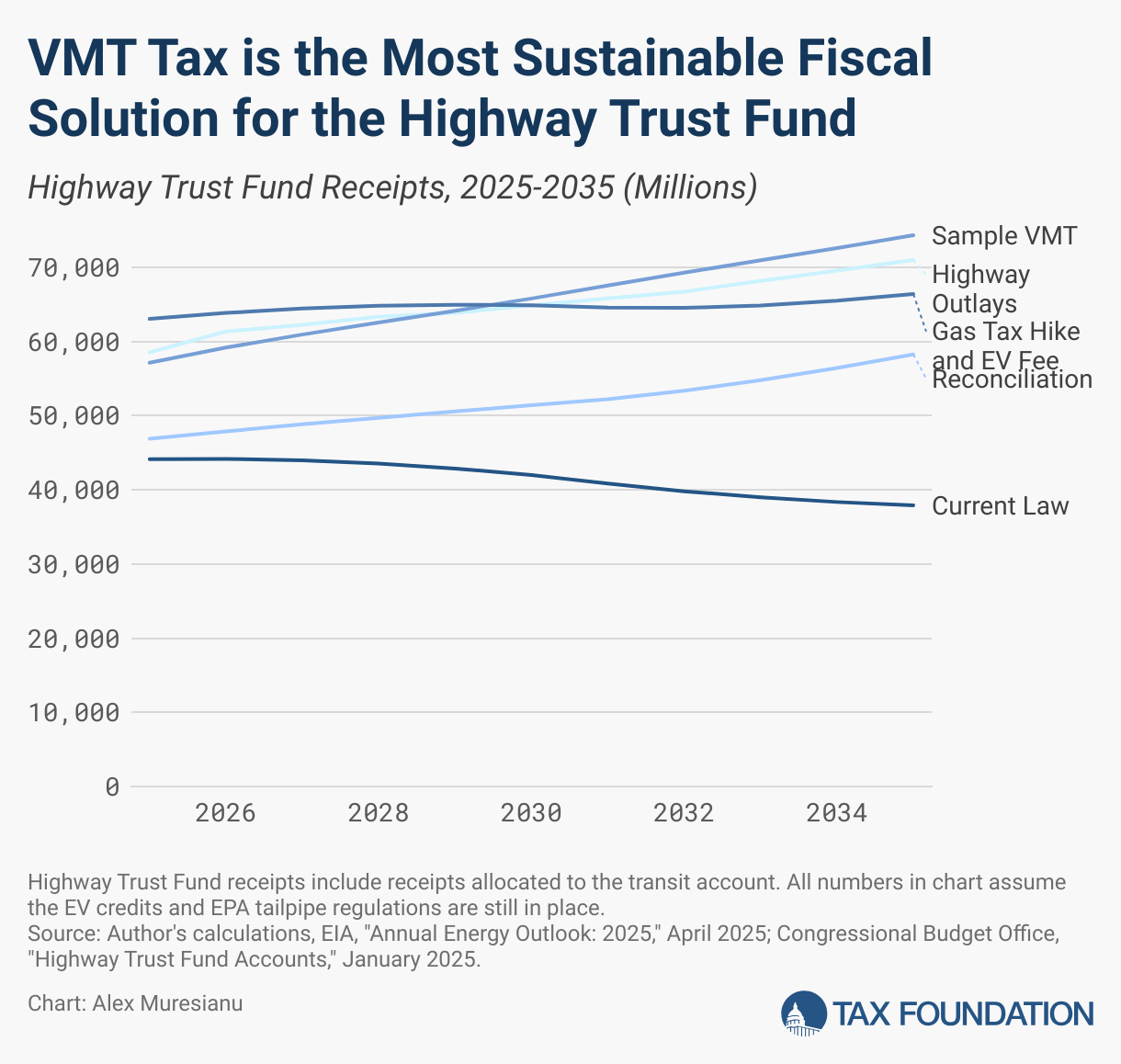

revenue in the future. From 2026 to 2035, the HTF’s highway account alone is projected to run a cumulative deficit of almost $287 billion.

Regarding aligning revenues and costs, the HTF does okay, but it’s gotten less effective. With the gas tax, people pay more the more they drive, and given heavier cars typically get worse gas mileage, those drivers pay more in gas tax too. However, road damage increases disproportionately with weight—a car that’s twice as heavy will impose more than twice the road maintenance cost. That’s why even with a higher diesel tax rate, annual fees, and excise taxes on tires, heavy commercial traffic is substantially undertaxed relative to the maintenance costs it imposes.

The Ideal Solution

A tax based on vehicle miles traveled (VMT) that adjusts for vehicle weight per axle is the ideal solution to both revenue adequacy and revenue misalignment.

We put together an example VMT with different average rates by vehicle class at rates necessary to fund the HTF going forward. Under this proposal, rates could scale up or down within categories, with vehicles weighing higher than the category average subject to above-average rates and vice versa with lower rates. Ideally the rate would scale continuously based on weight per axle regardless of category, but the category approach lends itself better to revenue estimation.

Hypothetical Differentiated Federal VMT Regime

Proposals on the Table

In the first version of the reconciliation package, the Transportation and Infrastructure Committee (T&I) included a $200 annual fee for EVs, $100 annual fee for hybrids, and a $20 annual fee for all other personal vehicles. After the Committee markup, the $20 registration fee for non-EV or hybrid vehicles was removed and the annual EV fee was raised to $250.

The Committee-passed proposal will certainly raise revenue. We estimate the policy on its own would raise $111 billion in gross revenue from 2026-2035, translating to $81.9 billion in net revenue, after accounting for the income and payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue.

offset.

However, the overall reconciliation bill that passed the House includes the Ways and Means package, which nixes the EV credit as well as other text which eliminates EPA tailpipe regulations. Both policy changes would reduce EV adoption and accordingly reduce the revenue this hypothetical policy would raise. Using the Energy Information Administration’s (EIA) alternate scenario that assumes the EPA tailpipe regs and EV credits are both repealed, we estimate the EV and hybrid fees would raise $78.5 billion over a decade gross and $57.8 billion net.

Reconciliation EV Fees Would Raise $78 Billion for Highway Trust Fund, Almost $58 Billion in Net Revenue

10-Year Conventional Revenue Estimates, Billions, 2026-2035

Note: JCT excise tax offset used does not consider how overall reconciliation package would change average tax rates.

Source: Author’s calculations; Congressional Budget Office, “Modeling the Demand for Electric Vehicles and the Supply of Charging Stations in the United States,” September 2023, https://www.cbo.gov/system/files/2023-09/58964-EV.pdf; EIA, “Annual Energy Outlook: 2025,” April 2025, https://www.eia.gov/outlooks/aeo/.

This idea would not fix the apportionmentApportionment is the determination of the percentage of a business’ profits subject to a given jurisdiction’s corporate income or other business taxes. U.S. states apportion business profits based on some combination of the percentage of company property, payroll, and sales located within their borders.

problem of HTF revenue. According to recent Congressional Budget Office (CBO) estimates, the average light-duty vehicle driver pays around $100 per year in federal gas taxes. Introducing a $250 annual fee for electric vehicles (and not adjusting the gas tax) would mean a disproportionate burden on electric vehicles.

Given that it’s a flat fee, it would not adjust for miles traveled. An EV driver that drives 5,000 miles a year (lower than average) would pay an exorbitant 5 cents per mile, while an internal combustion engine vehicle (ICEV) driver getting 25 miles per gallon would pay less than a cent per mile. If the reconciliation bill retained the $20 fee for non-electric cars, the gap would be marginally smaller. EVs are a hole in the tax base, but the EV fee proposal would be a dramatic overcorrection.

Intermediate Options

The best alternative to a full VMT tax is an incremental one. A VMT tax for heavy commercial traffic, for instance, could rely on tracking technology already installed on freight trucks. A VMT tax for passenger vehicles could start with just EVs that avoid the gas tax, allowing the gas tax to still serve as a user feeA user fee is a charge imposed by the government for the primary purpose of covering the cost of providing a service, directly raising funds from the people who benefit from the particular public good or service being provided. A user fee is not a tax, though some taxes may be labeled as user fees or closely resemble them.

for ICEV drivers. Partial VMT taxes have already been introduced at the state level and are certainly achievable.

If a VMT tax is off the table, doing a lower annual EV fee of $175 paired with 50 percent higher gas and diesel taxes would be a better halfway fix. This idea would come closer to parity between EVs and ICEV for road funding in the aggregate. Still, relying on a flat (rather than a per-mile) fee would overcharge EVs that drive less and undercharge those that drive more, all while under-taxing heavy commercial traffic.

Four Paths: Revenue Results

The revenue potential for each of these options illustrates how the VMT tax would be a more durable revenue source. The current T&I proposal would increase revenue more substantially later in the budget window as electric vehicles are projected to grow as a share of the vehicle stock, but it would still be seriously inadequate. Raising gas and diesel taxes while also introducing an EV fee would raise significantly more revenue than just an EV fee, but it would not address long-run funding problems, as this option does not include increases or inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power.

adjustments for the freight traffic-focused excise taxes.

What They Mean for Different Vehicles

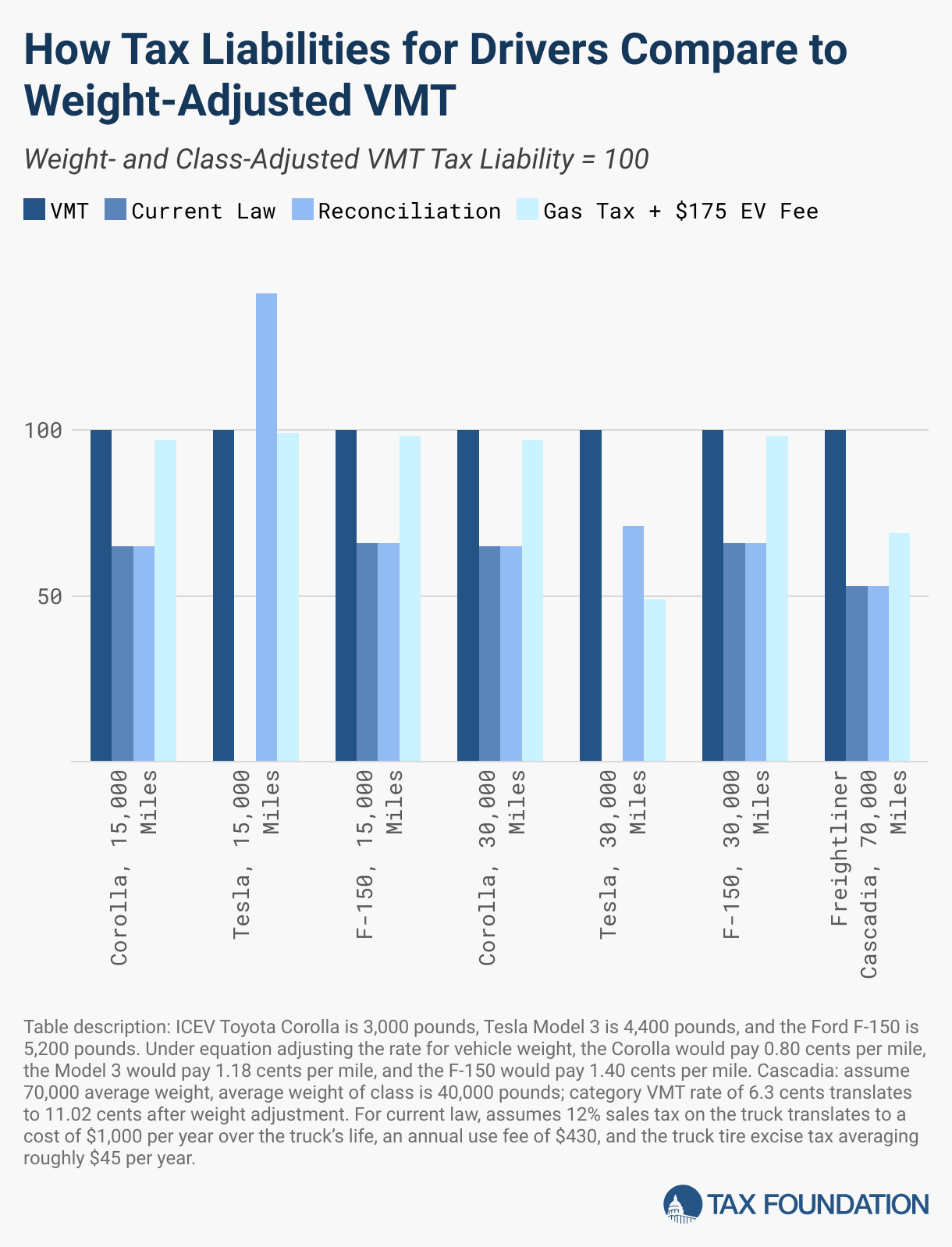

To illustrate how these options would tax individual drivers differently, we ran some example drivers through each package. We calculated driver tax liability per year under a VMT tax based on class and vehicle weight. Then, we calculated the tax liability for each driver under three scenarios: current law, the reconciliation proposal, and the halfway proposal. Last, we converted those payments to the percentage of the “correct” tax liability drivers would pay under the VMT tax.

Under the reconciliation package, an electric vehicle that drives 15,000 miles a year, an approximately standard amount, would pay over 40 percent more in taxes and fees than they would under a weight-based VMT calibrated to raise sufficient revenue for the HTF. Meanwhile, an EV that drives 30,000 miles would still be undercharged, but given that EVs drive less than average, most EV drivers would be overcharged. Meanwhile, ICEVs and particularly commercial traffic would still be undertaxed.

Contrarily, the mixed solution would ensure light-duty ICEVs would pay their “proper” tax liability. The EV driving an average number of miles would also match their “proper” tax liability, although EVs that drive less would still be overtaxed and EVs that drive more would still be undertaxed. While freight traffic would still be undertaxed, raising the diesel tax would help ameliorate the problem.

Conclusion

A VMT tax is the ideal fix for both the Highway Trust Fund’s fiscal problems and the imbalances in road taxes owed between different vehicle types. The EV fee in the reconciliation package would help the fiscal situation but would overcorrect the hole in the gas tax base EVs create. There are intermediate options, such as VMT taxes for EVs and commercial traffic or pairing flat EV fees with gas and diesel tax increases, that would be incrementally better than the reconciliation package’s approach.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share this article