SG Americas Securities LLC boosted its position in Enterprise Bancorp, Inc. (NASDAQ:EBTC – Free Report) by 18.9% during the 4th quarter, HoldingsChannel reports. The firm owned 5,256 shares of the savings and loans company’s stock after buying an additional 835 shares during the quarter. SG Americas Securities LLC’s holdings in Enterprise Bancorp were worth $170,000 as of its most recent filing with the Securities & Exchange Commission.

SG Americas Securities LLC boosted its position in Enterprise Bancorp, Inc. (NASDAQ:EBTC – Free Report) by 18.9% during the 4th quarter, HoldingsChannel reports. The firm owned 5,256 shares of the savings and loans company’s stock after buying an additional 835 shares during the quarter. SG Americas Securities LLC’s holdings in Enterprise Bancorp were worth $170,000 as of its most recent filing with the Securities & Exchange Commission.

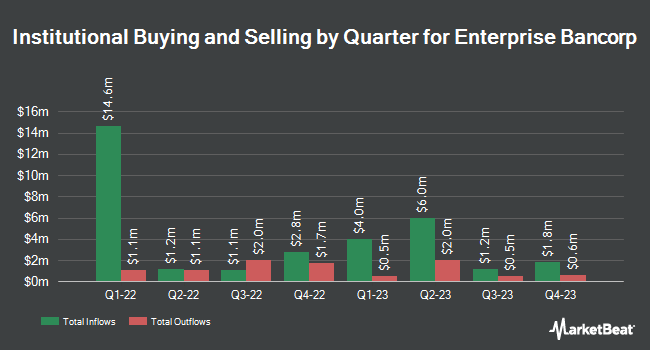

Other hedge funds have also recently bought and sold shares of the company. Tower Research Capital LLC TRC lifted its position in Enterprise Bancorp by 202.1% in the 3rd quarter. Tower Research Capital LLC TRC now owns 870 shares of the savings and loans company’s stock valued at $26,000 after purchasing an additional 582 shares during the last quarter. Acadian Asset Management LLC bought a new stake in Enterprise Bancorp in the 1st quarter valued at about $76,000. BNP Paribas Arbitrage SA lifted its position in Enterprise Bancorp by 25.4% in the 2nd quarter. BNP Paribas Arbitrage SA now owns 2,610 shares of the savings and loans company’s stock valued at $84,000 after purchasing an additional 529 shares during the last quarter. UBS Group AG raised its position in shares of Enterprise Bancorp by 1,306.5% during the 4th quarter. UBS Group AG now owns 2,813 shares of the savings and loans company’s stock worth $99,000 after buying an additional 2,613 shares in the last quarter. Finally, Citigroup Inc. raised its position in shares of Enterprise Bancorp by 285,900.0% during the 2nd quarter. Citigroup Inc. now owns 2,860 shares of the savings and loans company’s stock worth $83,000 after buying an additional 2,859 shares in the last quarter. 38.93% of the stock is currently owned by institutional investors.

Enterprise Bancorp Stock Down 1.8 %

EBTC stock opened at $23.39 on Monday. Enterprise Bancorp, Inc. has a 52 week low of $23.12 and a 52 week high of $34.10. The company has a market capitalization of $287.21 million, a price-to-earnings ratio of 7.55 and a beta of 0.61. The firm’s 50-day moving average is $26.09 and its two-hundred day moving average is $27.69. The company has a current ratio of 0.89, a quick ratio of 0.89 and a debt-to-equity ratio of 0.26.

Enterprise Bancorp (NASDAQ:EBTC – Get Free Report) last released its quarterly earnings results on Thursday, January 25th. The savings and loans company reported $0.64 EPS for the quarter. Enterprise Bancorp had a net margin of 17.41% and a return on equity of 12.20%. The company had revenue of $42.07 million for the quarter.

Enterprise Bancorp Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Friday, March 1st. Shareholders of record on Friday, February 9th were given a dividend of $0.24 per share. This represents a $0.96 dividend on an annualized basis and a dividend yield of 4.10%. This is an increase from Enterprise Bancorp’s previous quarterly dividend of $0.23. The ex-dividend date was Thursday, February 8th. Enterprise Bancorp’s payout ratio is 30.97%.

Insiders Place Their Bets

In related news, Director Michael T. Putziger purchased 1,755 shares of the company’s stock in a transaction on Friday, March 1st. The shares were bought at an average cost of $27.46 per share, for a total transaction of $48,192.30. Following the transaction, the director now owns 206,075 shares of the company’s stock, valued at $5,658,819.50. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. 15.69% of the stock is owned by insiders.

Enterprise Bancorp Company Profile

Enterprise Bancorp, Inc operates as the holding company for Enterprise Bank and Trust Company that engages in the provision of commercial banking products and services. It offers commercial and retail deposit products, including checking accounts, limited-transactional savings and money market accounts, commercial sweep products, and term certificates of deposit.

Further Reading

Want to see what other hedge funds are holding EBTC? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Enterprise Bancorp, Inc. (NASDAQ:EBTC – Free Report).

Receive News & Ratings for Enterprise Bancorp Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Enterprise Bancorp and related companies with MarketBeat.com’s FREE daily email newsletter.