In 2024, Chinese automaker BYD dethroned Tesla (NASDAQ:) for the first time to become the world’s leading manufacturer of electric cars. BYD is now conquering Europe and Switzerland.

Introduction

While Tesla saw its profits fall by 71% year-over-year, BYD was moving in the opposite direction. The Chinese electric vehicle giant posted a stunning 126% surge in net profit, reaching 9.15 billion yuan, approximately $1.26 billion. Backed by strong domestic sales and rising global demand, BYD is thriving where many of its rivals are tightening belts. Its formula?

A blend of vertical integration, competitive pricing, and aggressive expansion. As Tesla and legacy automakers grapple with cost pressures and geopolitical tensions, BYD’s momentum has become impossible to ignore.

The Chinese automaker officially entered the Swiss market with its first showroom in Zurich. By the end of the year, fifteen sales outlets are scheduled to open across the country.

BYD: A Success Story

BYD, short for Build Your Dreams, is currently the world’s third best-selling car brand and the largest electric vehicle (EV) maker. The company began its journey in 1995 in China’s megacity of Shenzhen, as a small manufacturer of rechargeable batteries. In 2003, BYD made its first move into the car industry by acquiring a struggling state-owned car manufacturer, Qinchuan Auto. Not long after, it launched its first car, the BYD F3, which became a huge success in China and helped the company gain a foothold in the automotive market. In 2008, BYD took a strategic leap into the electric vehicle space by launching the F3DM, one of the world’s first plug-in hybrid cars to be mass produced. Over time, it used its battery know-how to expand into other green technologies, including solar power and energy storage. That same year, Berkshire Hathaway (NYSE:) invested $232 million for a 10% stake in BYD, signalling strong international confidence in its vision.

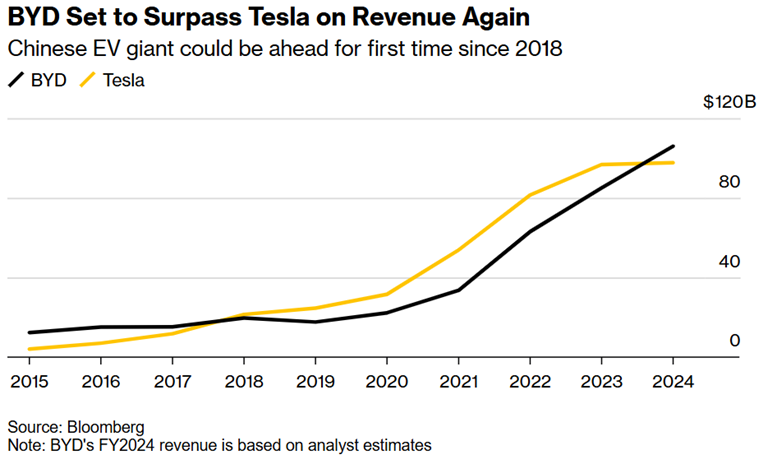

Between 2013 and 2024, BYD’s financial trajectory has been nothing short of impressive. Its revenue grew at an average rate of 29% per year, and its net profit rose by 49% per year on average. Today, BYD operates in two main areas: automobiles and related products—including electric cars, batteries, energy solutions, and mobile handset components—and assembly services.

Through all these product areas, EVs remain the main driver of its global rise—contributing around 80% to the company’s total revenue.

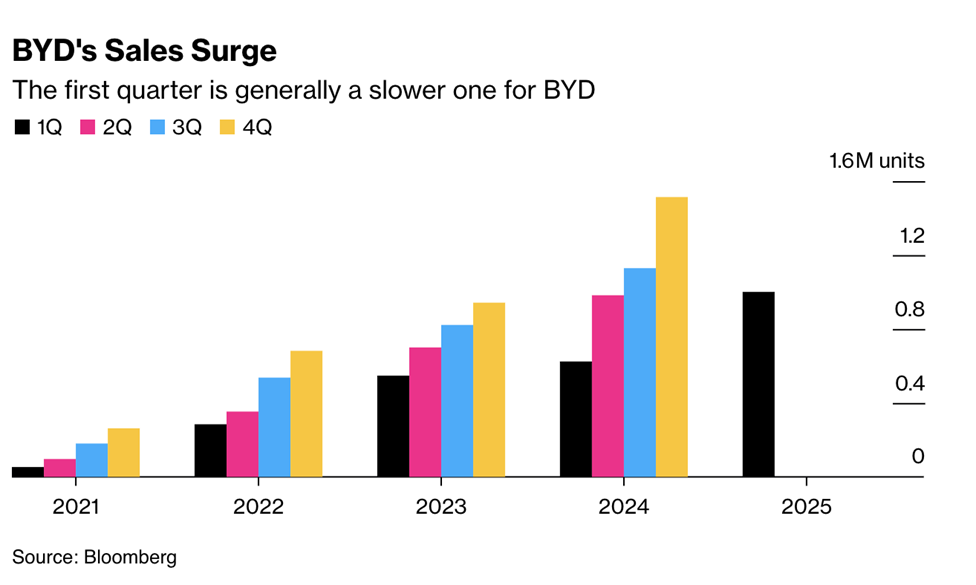

Source: Bloomberg

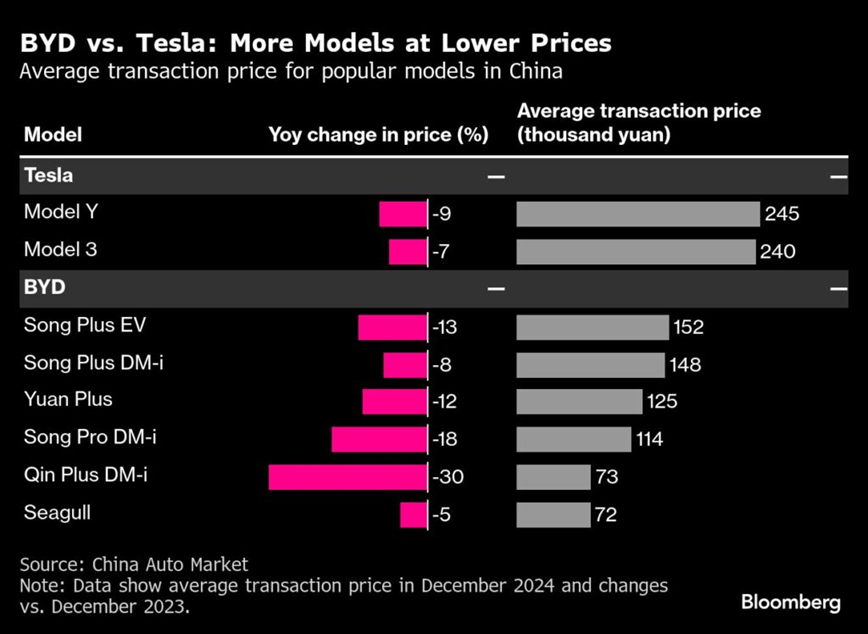

Unlike Tesla, which has focused on a limited number of premium models, BYD covers more market segments than almost any competitor in the EV space. The company follows a mass-market strategy by offering a wide range of vehicles that cater to various price points and consumer needs:

BYD’s entry-level offerings focus on compact, affordable electric vehicles catered to younger, urban consumers. Models like the Dolphin, Destroyer 05, and Seal 07—all part of the Ocean Series—provide budget-conscious buyers with practical, stylish, and tech-friendly EVs. Prices range from RMB 116,800 to 289,800 (approximately $16,300 to $40,600) and they directly compete with rivals such as the Tesla Model Y, Ora Good Cat, and MG 4 EV.

- Mid-range family and business vehicles

This segment includes well-known models such as the Han, Tang, Song, Qin, Yuan, and Frigate 07, drawn from the Dynasty and Ocean Series. These vehicles come in both battery electric (BEV) and plug-in hybrid (PHEV) formats, the latter is powered by BYD’s efficient DM-i system, which combines an electric motor with a combustion engine for extended range and flexibility. With prices ranging from RMB 76,800 to 350,000 (around $10,750 to $49,000), these models compete with the Tesla Model 3, NIO ET5, and Toyota (NYSE:) hybrids.

- Premium MPVs and executive models

BYD offers a line of high-end MPVs, Multi-Purpose Vehicles, through its Denza Series. Originally launched over a decade ago as a joint venture with Mercedes-Benz, Denza is now fully owned by BYD and has evolved into a premium sub-brand. Models like the Denza D9 DM-i, Denza N7, and upcoming Denza N8 cater to executives, large families, and the premium ride-hailing segment. These vehicles prioritise interior comfort, technology, and high-performance hybrid systems. Priced between RMB 280,000 and 450,000 (approximately $39,200 to $63,000), they go up against competitors such as the Buick GL8, Voyah Dream EV, and Roewe iMAX 8 in the luxury minivan space.

Catering to off-road enthusiasts, BYD’s Fang Cheng Bao Series brings rugged capability and bold design to the table. Priced between RMB 280,000 and 350,000 (roughly $39,200 to $49,000), it offers an alternative to high-end lifestyle vehicles like the Mercedes G-Class, and Land Rover Defender.

At the top of BYD’s range sits the Yangwang Series, dedicated to ultra-luxury and high-performance electric mobility. The Yangwang U8, a powerful PHEV off-road SUV, and the U9, a fully electric supercar, represent BYD’s boldest ambitions. These models are equipped with cutting-edge technology, including advanced autonomous systems and performance-focused engineering. With starting prices above RMB 800,000 (roughly $112,000), they target elite buyers and directly challenge established luxury brands like Mercedes-Benz (OTC:), Porsche, and other premium EV supercar makers.

In addition, BYD is now entering the sportscar segment. Just two weeks ago, the company unveiled the Denza Z, a flashy new deep blue sports car signaling its growing ambition to rival high-end Western brands.

Source: Bloomberg

Competitive Positioning

BYD’s competitive strategy is built on three pillars: volume and affordability, vertical integration, and geographic expansion.

One of the main reasons behind BYD’s rapid growth is the strong support received from the Chinese government. According to Germany’s Kiel Institute for the World Economy, BYD received at least $3.7 billion in subsidies between 2020 and 2022. These subsidies helped the company invest in research, scale up production, and expand its EV infrastructure. On top of direct subsidies, BYD also benefits from favourable industrial policies, cheaper land, tax breaks, and consumer incentives that boost demand for electric vehicles.

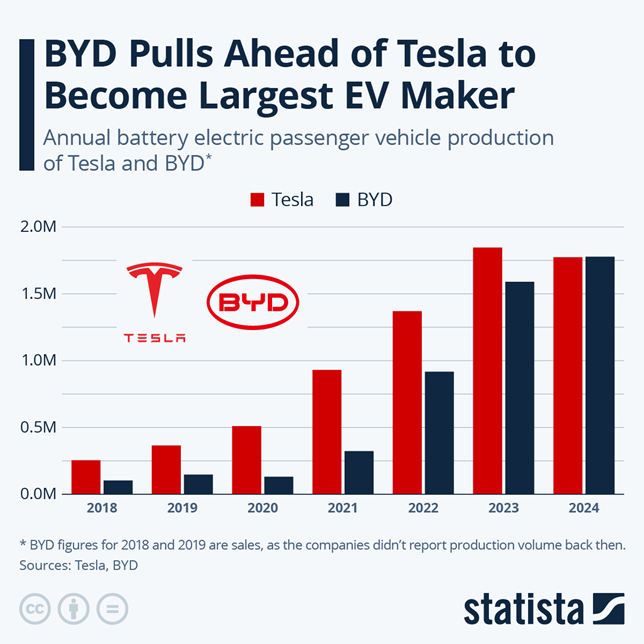

Thanks to this support, BYD’s production capacity surged by 259% between 2021 and 2024, allowing it to build vehicles at a pace few rivals can match. The company now operates several gigafactories across China and is expanding globally, with new manufacturing hubs in Thailand, Brazil, Hungary, and Türkiye.

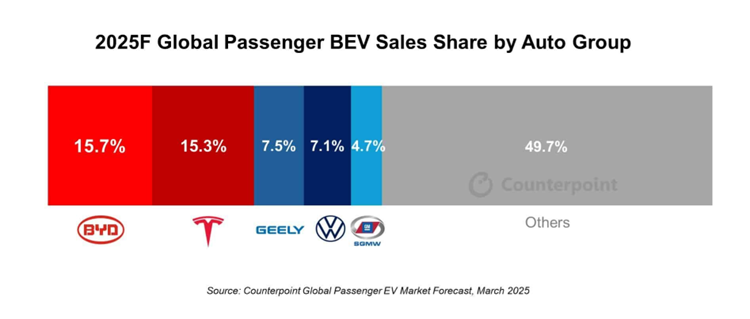

This aggressive capacity buildout means BYD can produce millions of units per year. In 2024, the company delivered around 4.25 million cars, nearly as many as Ford. In 2025, BYD expects to reach up to 6 million vehicle deliveries. In 2023, BYD became the world’s top-selling EV maker by units. Economies of scale are now a major advantage for BYD. By producing at a high volume, the company can lower per-unit costs, offer its cars at more affordable prices and maintain healthy margins, around 22%.

While most global automakers depend on third-party suppliers for key components, BYD produces much of its technology in-house. This strategy, known as vertical integration, gives BYD more control over the EV value chain. As of 2024, BYD manufactures around 75% of its vehicle components internally, including batteries, electric motors, semiconductors, and power electronics. In 2020, BYD launched its own Blade Battery and shifted from traditional nickel-cobalt-manganese (NCM) chemistry to lithium iron phosphate (LFP) technology. This decision turned out to be a smart move: while the rest of the industry struggled with rising lithium carbonate prices, critical for NCM batteries, BYD had already pivoted to a more cost-effective and stable battery solution. Blade batteries are not only cheaper—but also safer—and are now being sold to other automakers as well.

This control over the supply chain allows the company to reduce costs, avoid supply chain bottlenecks, and accelerate innovation. This unique setup supports a dual-track strategy: ensuring a secure battery supply for its own vehicle production, while also growing its external battery business by offering its technology to other manufacturers.

Unable to enter the US market due to high tariffs, BYD has strategically redirected its international expansion efforts. In Q1 2025, BYD’s overseas sales jumped by 111%, driven by strong demand in Europe, South America, and Southeast Asia. Exports now represent 21% of its total sales, and this share is expected to keep growing. Fortunately, because BYD has no direct presence in the US, it remains largely unaffected by American tariffs on Chinese EVs.

Instead of relying solely on exports from China, BYD is investing in local manufacturing, with new plants in Thailand, Hungary, and Brazil, to lower logistics costs, gain regulatory advantages and improve market access. Additionally, BYD adapts its vehicles for regional needs and often works with governments or local partners, particularly in public transport. Its electric buses are already in operation in countries like Colombia, Egypt, and the UK.

Source: Counterpoint

Outlook

BYD’s unique combination of scale, cost competitiveness, and technological innovation positions it for significant global growth, though it faces a growing set of challenges as it broadens its international footprint.

BYD continues to lead in EV innovation. It recently unveiled a supercharging platform capable of adding 470 km of range in just 5 minutes. The “God’s Eye” driver-assistance system is being integrated into even its most affordable models, democratising access to smart driving features. At the core of its vehicle technology is the BYD Blade Battery, which offers superior safety, durability, and thermal stability, reinforcing the competitive edge in battery innovation.

BYD aims to sell 5.5 million vehicles in 2025, including 800,000 units overseas, nearly double last year’s international sales. To support this aggressive goal, the company is scaling up global manufacturing with several key projects underway. In Hungary, a €4 billion factory in Szeged is under construction and expected to produce up to 200,000 vehicles annually starting in late 2025. In Türkiye, a new plant in Izmir is planned, with operations set to begin in 2026. In Brazil, BYD is launching a facility in Camaçari in 2025, focused on models like the Dolphin Mini and Song Pro.

As part of its move upmarket, BYD is leveraging high-end models like the Yangwang U8 and Denza Z to elevate its brand image and position itself as a serious competitor to premium players such as leading European automakers.

As BYD accelerates its global expansion, geopolitical tensions remain a significant headwind. In October 2024, the European Union imposed an additional 17% tariff on Chinese battery electric vehicle (BEV) imports, on top of the existing 10% flat rate, citing China’s unfair state subsidies. Although BYD is firmly established as China’s leading automotive brand, it has yet to achieve comparable traction in Europe and the US, where tariffs and import restrictions on Chinese-made vehicles continue to hinder its expansion.

To fully support its new ultra-fast supercharging technology, BYD will need to build approximately 4,000 charging stations across China, representing a major infrastructure and capital investment challenge.

Western governments are growing increasingly cautious about the potential data privacy risks posed by Chinese-made EVs. Several British defence contractors have reportedly warned employees against pairing their phones with Chinese-made electric vehicles, citing concerns that the Chinese government could potentially access sensitive data from connected devices. Last but not least, the global EV market is becoming increasingly crowded. Competitors such as Xiaomi, NIO, XPeng (NYSE:), Tesla, Volkswagen, and Hyundai are all scaling rapidly and innovating in software, design, and performance.

Conclusion

Through vertical integration, competitive pricing, and strategic international growth, BYD has positioned itself not only as a fast follower but as a front-runner. If the first wave of the EV revolution was led by Silicon Valley, it seems the next may come from China.