Key Points

- Over the past decade, many electronics firms have talked about diversifying their supply chains. An analysis of Apple—America’s biggest consumer electronics firm—illustrates that most of their manufacturing supply chain remains in China, though there have been limited increases in Southeast Asia and India.

- China’s role for Apple has grown substantially. Ten years ago, Apple relied on China primarily for final assembly, while today Apple not only assembles devices in China, it also sources many components from the country.

- However, Chinese-owned firms generally only play a role in lower-value segments of the supply chain. Many of the higher-value components—even those made in China—are produced in factories owned by Japanese, Taiwanese, or US firms.

Introduction

“Designed in California, assembled in China,” reads the text etched on the back of most iPhones. For over a decade, the iPhone has exemplified China’s central role in producing the world’s electronics and solidified the country’s status as the world’s leading manufacturer. Today, electronics constitute around a quarter of China’s exports; China counted for nearly a third of the entire world’s electronics exports. Apple— the world’s most valuable manufacturer of consumer electronics—stands at the center of this manufacturing base, having played a major role in helping build China’s capabilities.1

Analysts who track Apple’s supply chain have demonstrated how Apple not only assembles many of its devices in China but also has over time sourced more components from China. Economist Yuqing Xing has calculated that iPhones manufactured in 2009 sourced nearly all their components from outside China with only the final assembly (costing $6.50 per iPhone) happening in China.2 In contrast, by 2018, many components were sourced from China, totaling $104 per iPhone. Journalist Patrick McGee has reported how Apple spent billions of dollars buying equipment to place in Chinese factories, enabling them to produce more components.3

Over the past few years, however, some analysts have questioned whether China’s centrality to electronics manufacturing might be eroding. First, many multinationals have expressed a desire to diversify their supply chains with a “China plus one” manufacturing footprint. Second, countries like India, Mexico, and Vietnam have sought to develop their own electronics manufacturing ecosystems, winning business from some of the firms diversifying away from China. Yet questions remain about just how significant this supply-chain shift actually is.

This report explores the significance of these trends in Apple’s supply chain. Apple releases only limited data about its supply chain. As a result, it is not possible to track the number or dollar value of components produced in different countries. However, Apple does report the number of factories in each country and which company owns them.4

We find that Apple has begun to shift its supply chain—but that change has been more limited than headlines might suggest. iPhone assembly began in the Indian state of Tamil Nadu; a second production hub will soon open in Karnataka.5 AirPods began to be assembled in Vietnam.6 Yet Apple still relies on a complex, multinational supply chain—in which factories based in China still play an critical role (Figure 1).

A second finding, however, is of the durable role of many US, Japanese, and Taiwanese firms that operate factories in China. In certain supply-chain segments, Apple has largely shifted to Chinese suppliers in China. For other supply-chain segments, Apple relies mostly on Western firms with factories in China. Chinese firms have generally struggled to break in to the production of some types of components.

We find that Chinese firms have made much more progress winning business with Apple in lower-tech, lower-profit-margin segments of the supply chain, while foreign firms (including those producing in China) generally remain well represented in higher-tech, higher-margin segments of the supply chain. In other words, the parts of the Apple supply chain that have become meaningfully more “Chinese” in ownership tend to be the more commoditized segments. These are generally also the segments for which Apple has taken some steps in recent years to open factories in other locations, such as Southeast Asia and India.

Understanding Value Chains

Electronic devices such as computers or smartphones, built from hundreds of components from dozens of factories, can’t be described as being made by a single company or in a single country. Where these devices are assembled often says little about the rest of the manufacturing production process. The concept of a value chain is used to map the contributions of different suppliers that provide component production, assembly, software, design, marketing, logistics, and sales capabilities.

Much of the profit in electronics accrues to the production of the most complex components (especially the semiconductors) or the design and sales of these devices. In a phone that costs $1,000, for example, the bill of materials—that is, the cost of all the components and assembly manufacturing capabilities—is around $500. The rest of the value is captured by companies providing design, software, and services.

Within the bill of materials for an electronic device, there are hundreds of components, some of which are extraordinarily complicated (e.g., semiconductors and displays) and others that are relatively simple (e.g., screws). A full value-chain analysis would seek to understand the production cost and the price paid for each individual component, which would clarify which companies produced which component and illustrate how much profit they made.

However, companies generally don’t release detailed information about their value chains, because efficiently engineering supplier relationships is a source of competitive advantage. Analysts and policymakers must understand value chains, though, because they dictate how products are made, how trade flows, and how companies profit. As countries try to improve their economic position, they try to attract higher-value production steps, enabling more profitable production, higher-paid jobs, and an expanded tax base.

Understanding value chains is especially important now, as the international trade system faces dramatic changes in the face of Chinese industrial subsidies and US tariffs. The past four decades have seen deep economic integration of the US and China, with key US multinationals using China as their primary production and assembly hub. Yet tariffs, restrictions, and political tension have induced companies to diversify their supply chains. Countries like India and Vietnam have actively tried to attract investment from Western multinationals to build their own position in electronics value chains. The dramatic increase in US tariff rates will reset the playing field—and could open the door for other countries to win new portions of the value chain.

Tracking Apple’s Value Chain Shifts

To understand whether and how electronics value chains are shifting, we examine the value chain of the world’s most valuable consumer electronics firm: Apple. Apple is a bellwether for electronics value chains more generally. In the 2000s and 2010s, it bet heavily on locating a substantial share of its suppliers’ manufacturing operations in China. Over the past few years, though, it has taken some steps to reorient and diversify its value chain, though these remain limited in scale.

To understand the scope of these changes, this report analyzes Apple’s annual publication of its top 200 suppliers, across all the devices Apple produces: phones, computers, watches, and so forth. According to Apple, these suppliers represent 98 percent of the company’s spending on materials, manufacturing, and assembly. These lists provide supplier names and the locations of factories where manufacturing for Apple occurs.

We collated data from 2013 to 2023 (except for 2019) and categorized suppliers based on what we believe they produce for Apple. Categories included semiconductors, sensors and displays, and precision manufacturing. We then analyzed the data to understand shifts in supplier locations.

How Has Apple’s Value Chain Shifted? A Component-Level Analysis

This section examines shifts in Apple’s value chain over the past decade, at the component level. We group component production by key categories: batteries, semiconductors, electronics manufacturing, connectors and cables, materials, sensors and displays, molded and mechanical components, precision manufacturing, printed circuit boards (PCBs), and packaging and printing. Below, we map trends in each of these component categories by location of manufacture, grouping the world into seven groups of countries: China, India, Japan, South Korea, Taiwan, the US and Europe, and “other,” which mostly refers to countries in Southeast Asia.

To reiterate, this segment of the analysis focuses on the location of manufacturing, not the headquarters of the firm conducting the component manufacturing. So a manufacturing plant in China owned by a Japanese firm is categorized in this analysis as “China.” The below figures and analyses capture only the number of manufacturing locations in each region. A more complete analysis would seek to understand each region’s share of Apple’s total manufacturing output, but Apple does not release detailed data.

Electronics Manufacturing

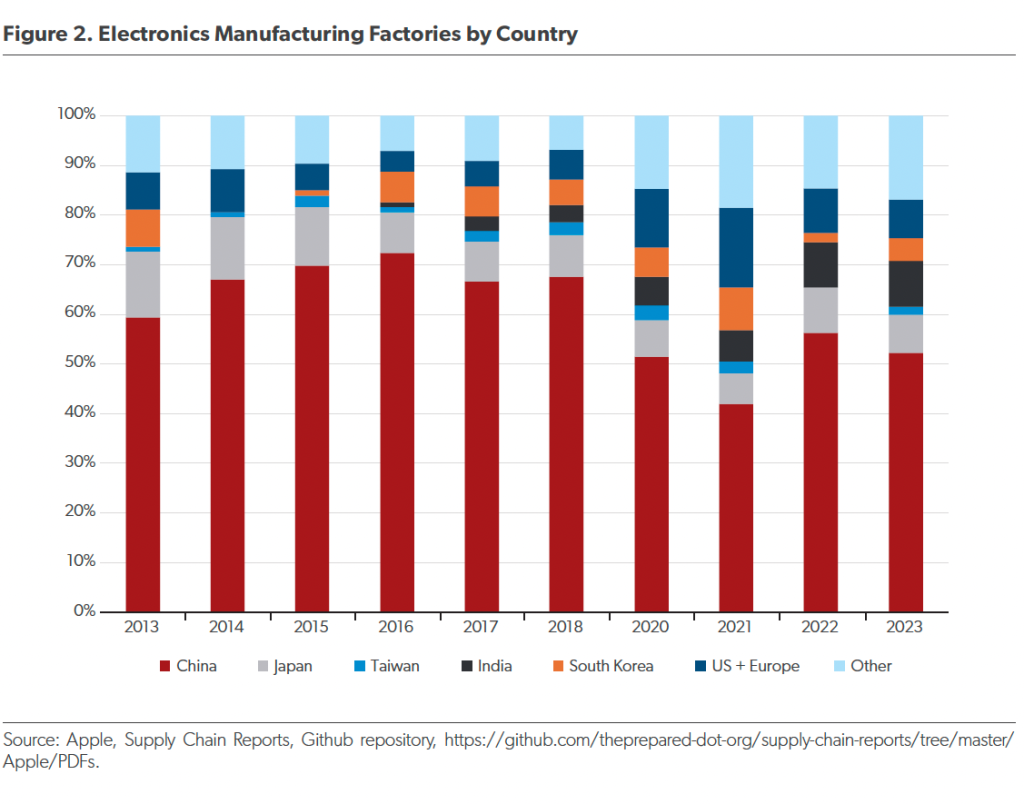

The assembly of all other components into a device— the final step in the production process—is referred to as electronics manufacturing or assembly. Beginning in 2018, Apple began to shift its electronics manufacturing footprint, presumably driven by the 2018 US tariffs on China. Before 2018, around 60–70 percent of electronics manufacturing locations were in China, including nearly all final assembly of key devices like iPhones (Figure 2).7

Today, by contrast, around 50 percent of Apple facilities are in China, with increased factory share in India and Southeast Asia. Of the 17 companies conducting electronics manufacturing in Apple’s supply chain, only two are Chinese. Of the 34 electronics manufacturing facilities reported in China, only three are operated by Chinese firms.

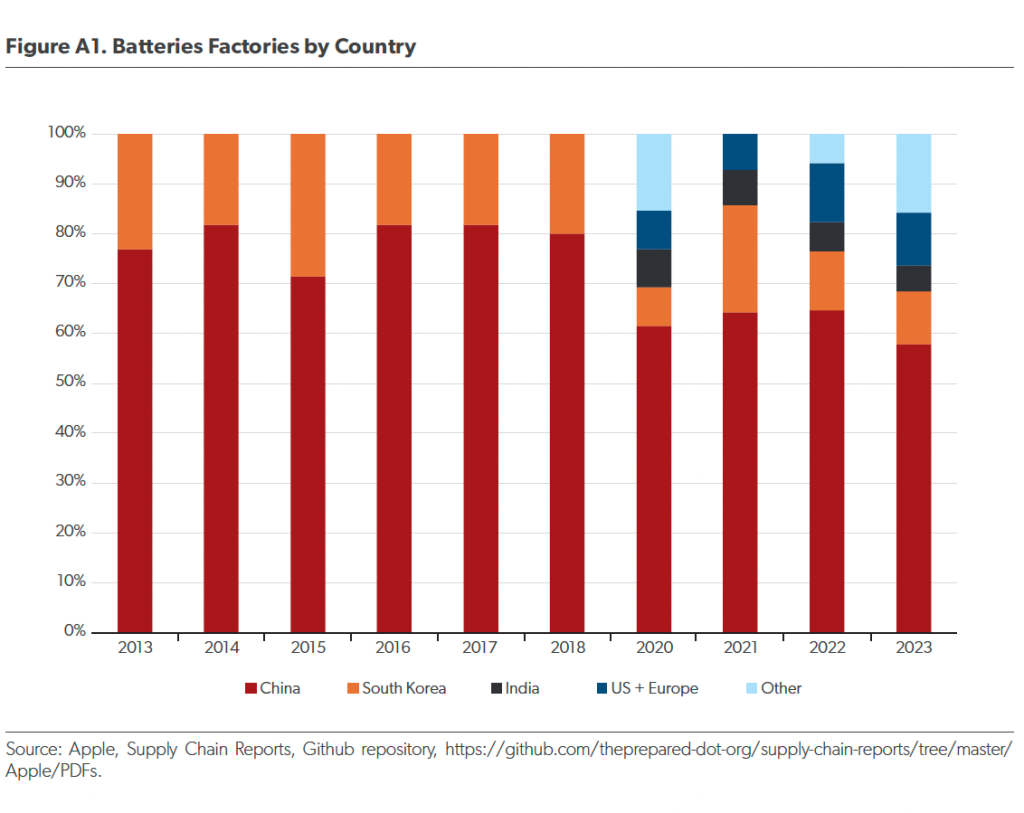

Batteries

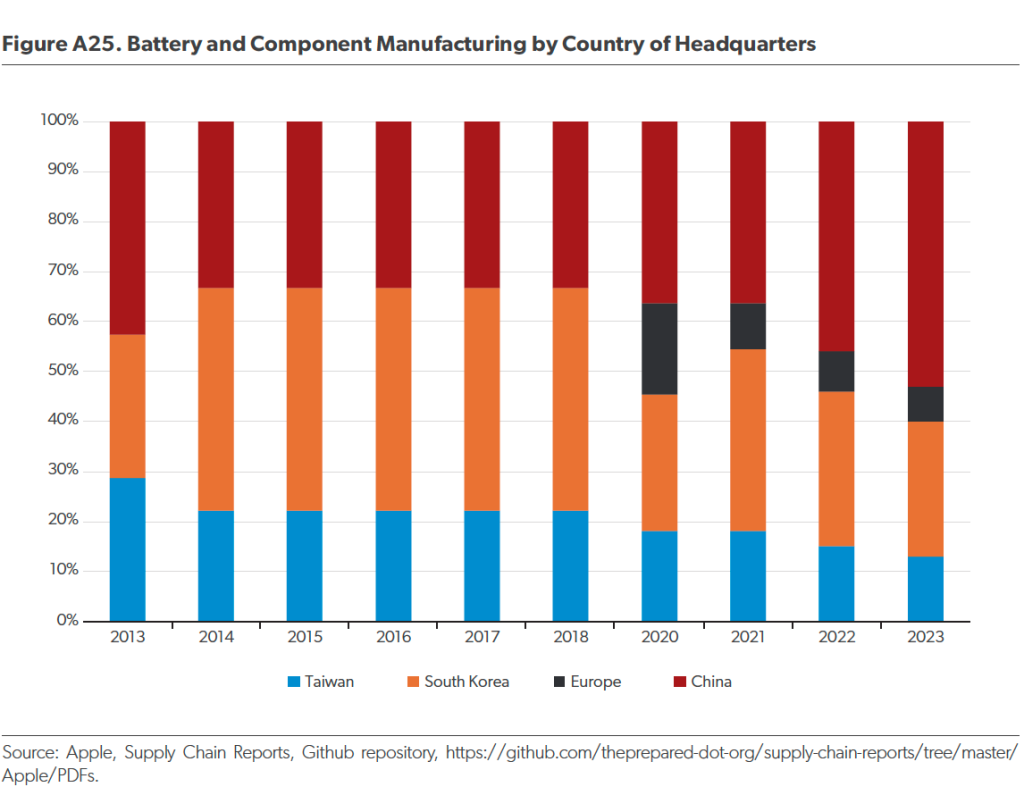

China has played a central role in developing and manufacturing the lithium-ion batteries that are widespread in electronic devices, including in Apple phones, computers, and other products. Discussions about diversifying battery supply chains have been publicly prominent in the case of electric vehicle batteries, but our analysis of Apple’s value chain suggests that Apple has also been diversifying its own battery sourcing.

Batteries are one of the more expensive components of a phone or electronic device. Low-quality batteries can cause high-profile problems, including overheating or low battery life. As a result, battery quality is highly important for companies like Apple.

Until 2018, Apple sourced batteries and battery components solely from China and South Korea (Figure A1). Today, however, it procures battery components from five different regions, including India and Southeast Asia. While over half of Apple’s battery component sourcing locations remain in China, above 40 percent of locations are now outside China, representing a significant shift in Apple’s production footprint. Notably, the concentration of China-based manufacturing facilities is less than the share of Chinese firms. As of 2023, there were firms headquartered in Taiwan, South Korea, and Germany in Apple’s battery supply chain, more non-Chinese firms (five) than Chinese (four).

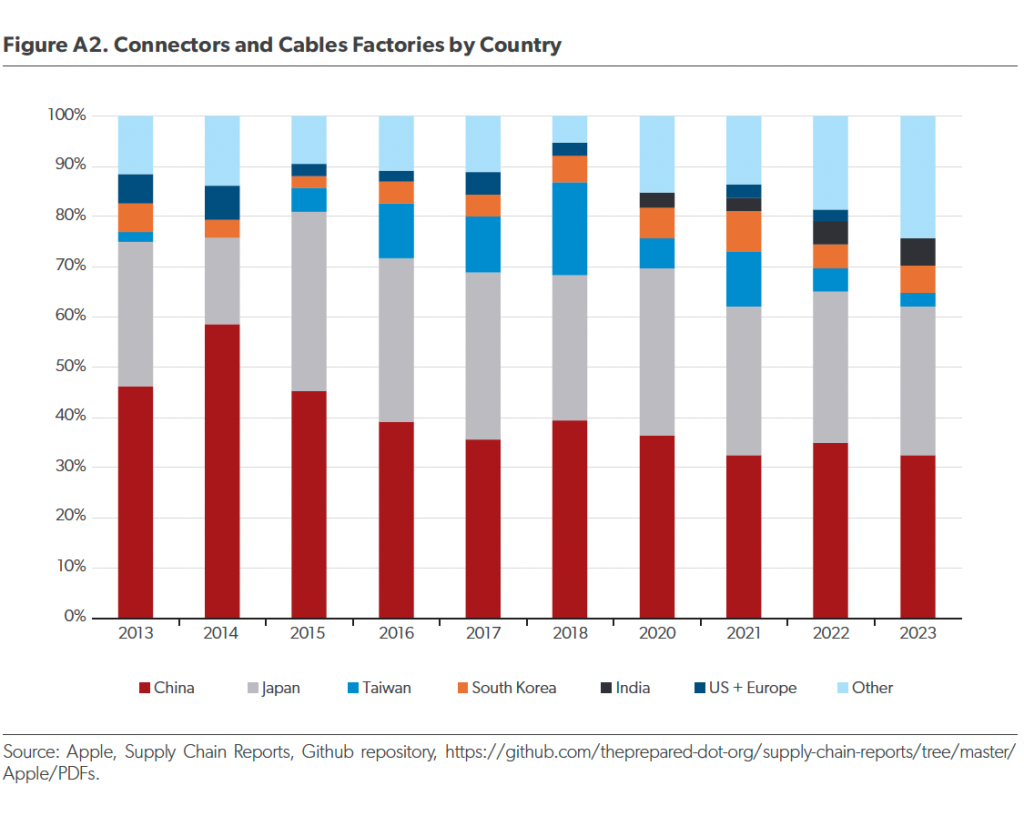

Connectors and Cables

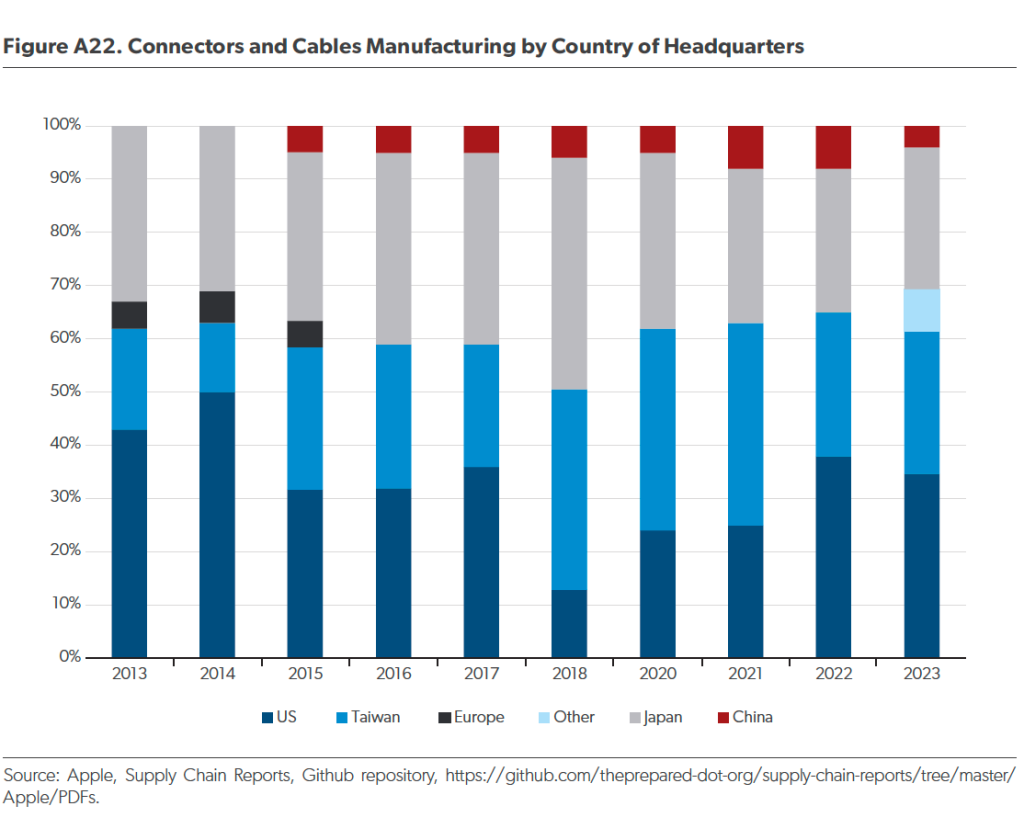

The connectors and cables category involves some low-end products and some that require more high-end, specialty chemicals. The enduring position of Japan-based manufacturing in this category illustrates the higher-end manufacturing involved in certain components (Figure A2). Other segments, however, have seen a substantial shift from China to India and the “other” category, mostly Southeast Asian countries.

Of the nine companies producing products in this category, only one is Chinese. Other firms in this category with China-based manufacturing are American, Taiwanese, or Japanese. Companies like Amphenol (US), Japan Aviation Electronics Industry (Japan), Furukawa Electric (Japan), and Hirose Electric (Japan) have been part of Apple’s supply chain since 2013. Their persistence suggests that even though the manufacturing locations can shift, these companies have capabilities that cannot be easily substituted by competitors.

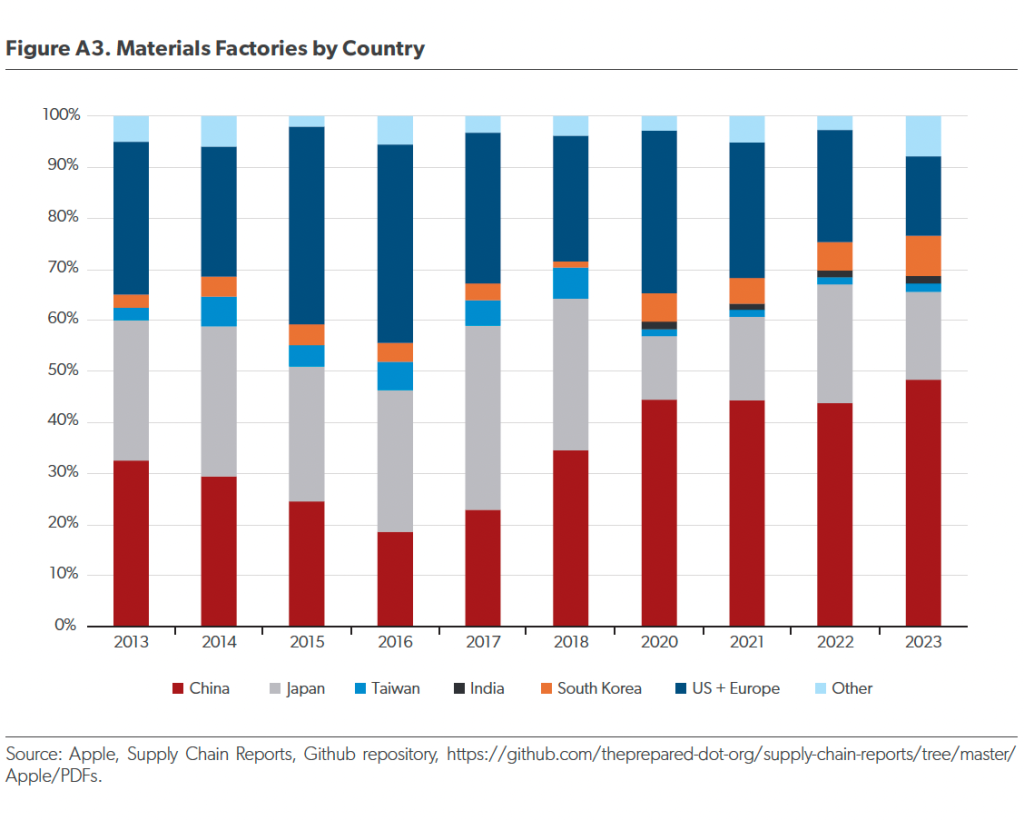

Materials

The number of materials suppliers in Apple’s supply chain has increased from 13 to 23, while the share of manufacturing facilities in China has increased from about 30 percent to about 50 percent, corresponding with a decline in the US and Europe share from about 30 percent to about 15 percent (Figure A3). Western suppliers of specialty materials, like 3M (US) and Sumitomo (Japan), have been persistent over time, suggesting that they have durable competitive positions. The number of 3M factories supplying Apple increased from five in 2013 to 13 in 2023 across China, Japan, Singapore, South Korea, and the US.

However, Chinese firms have largely replaced Western suppliers of commodity metals like Alcoa (US) and Nisshin Steel (Japan). Alcoa, an aluminum company, does not appear on Apple’s 2023 supplier list, but Chinese firms Fujian Nanping Aluminum and Kam Kiu Aluminum do.

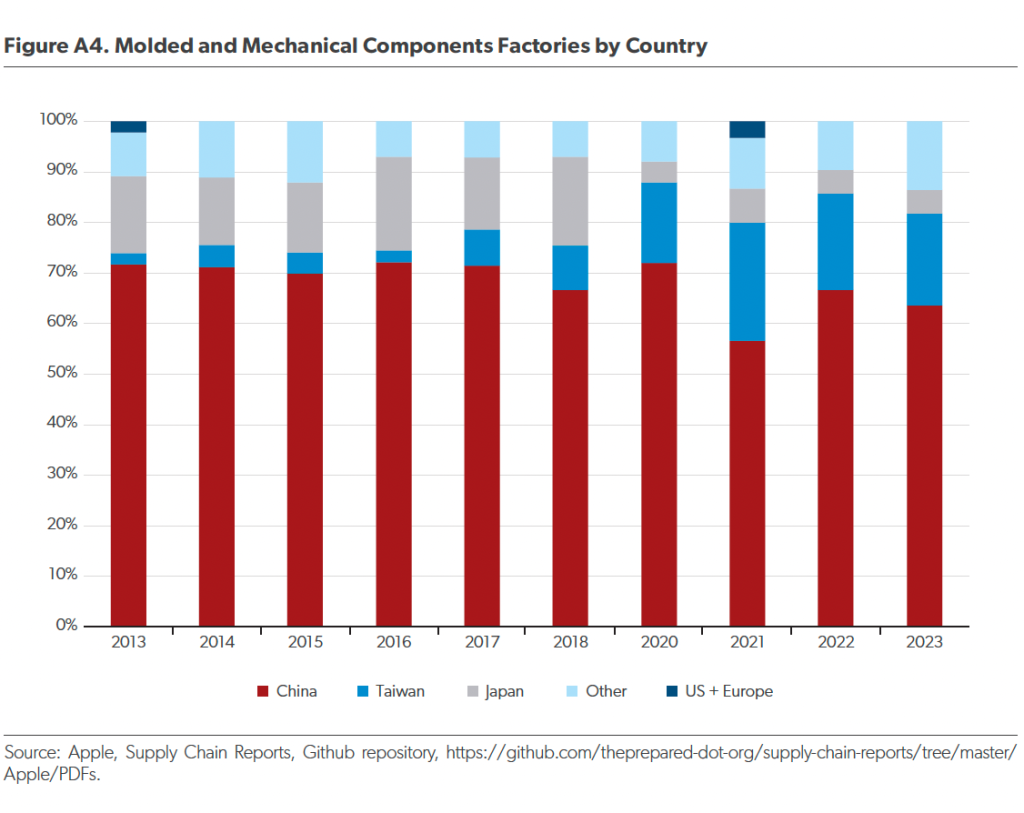

Molded and Mechanical Components

In Apple’s supply chain, molded and mechanical components—such as metal frames, SIM trays, speaker grills, camera housings, button assemblies, internal brackets, and thermal shields—are crucial for the structural integrity and functionality of its devices. These parts are produced using techniques like computer numerical control machining, injection molding, and die-casting by specialized suppliers maintaining strict standards for accuracy, durability, and finish.

The firms in this category have been relatively durable over time, with largely the same set of companies persisting in Apple’s supply chain over the past few years. Though there are many China-based manufacturing facilities, since 2021 there has been only one Chinese firm providing these materials, with the others from Japan, Singapore, Taiwan, and the US (Figure A4).

Sensors and Display Components

Sensors and display components are key to Apple’s user experience and include devices such as ambient light sensors, accelerometers, gyroscopes, proximity sensors, biometric modules facilitating face and touch recognition, and OLEDs and LCD screens.

Display technology involves substantial economies of scale and vast capital investment. In the 2010s, Korean firms like Samsung consolidated their position as leading display manufacturers, but the past few years have seen Chinese firms like BOE gain market share (Figure A5). BOE has been in Apple’s supply chain since at least 2018. Chinese display providers have benefited from substantial government capital subsidies, which have underwritten their international expansion, discouraging investment from non-Chinese firms.

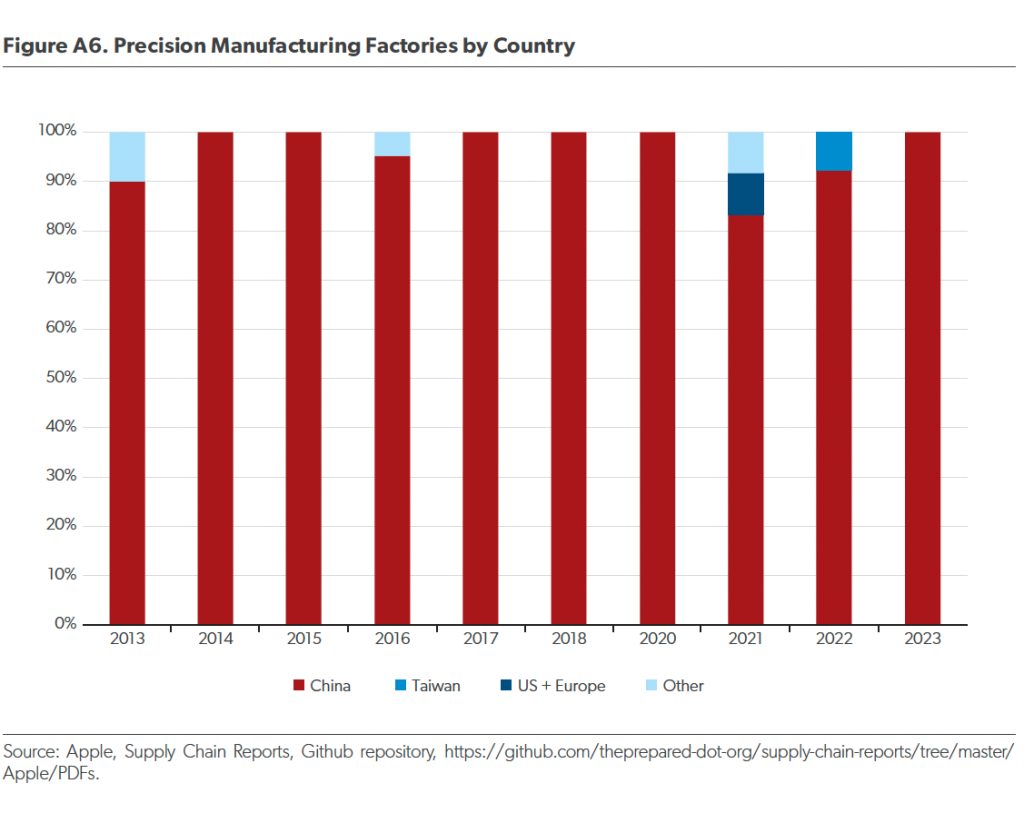

Precision Manufacturing

Precision manufacturing refers primarily to the machining and metalworking parts of the production process, including machining, manufacturing screws, and working with alloy metals in the printed circuit board stack. The key aspect in precision manufacturing is maintaining micron-level accuracy without compromising the components’ stability and the aesthetic appeal. The use of materials such as titanium and other alloys that require advanced machining capabilities offer superior strength-to-weight ratios, which helps Apple retain its premium brand status in the market.

This segment has seen the most dramatic shift toward Chinese ownership and Chinese factory location. Nearly all precision manufacturing today occurs in China (Figure A6) by China-headquartered firms. Only one of the firms conducting precision manufacturing for Apple in 2013—all but one of which was not Chinese—remains in Apple’s supply chain. As of the most recent data, all but one of the precision manufacturing firms are headquartered in China.

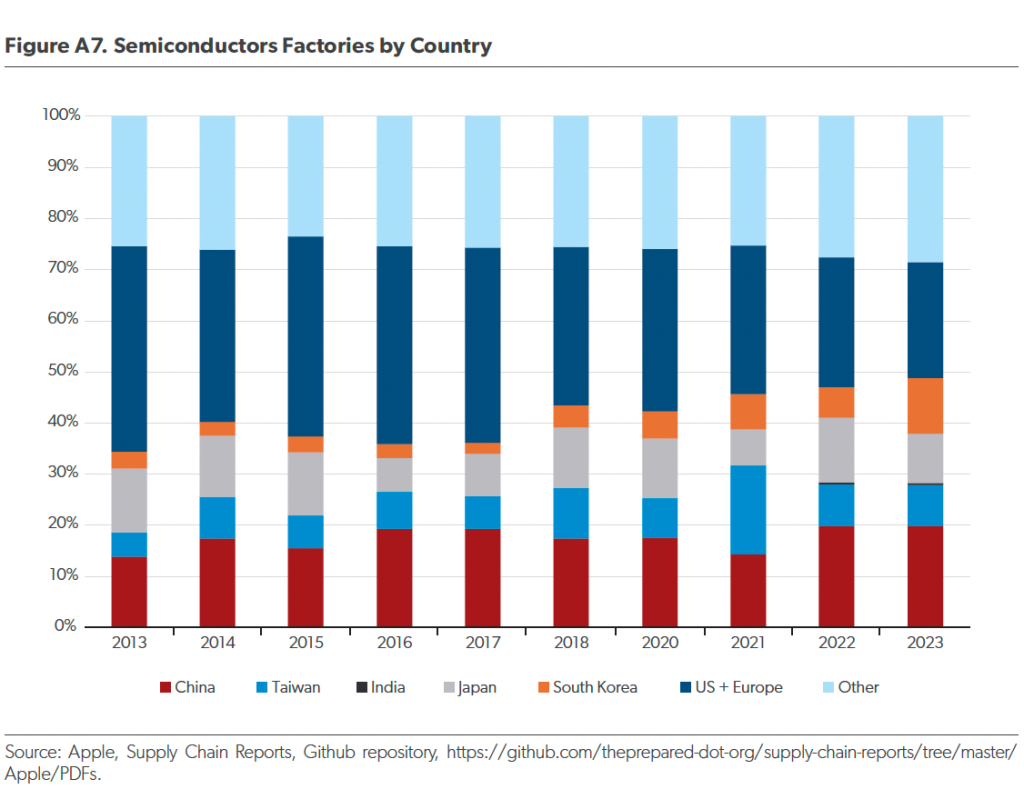

Semiconductors

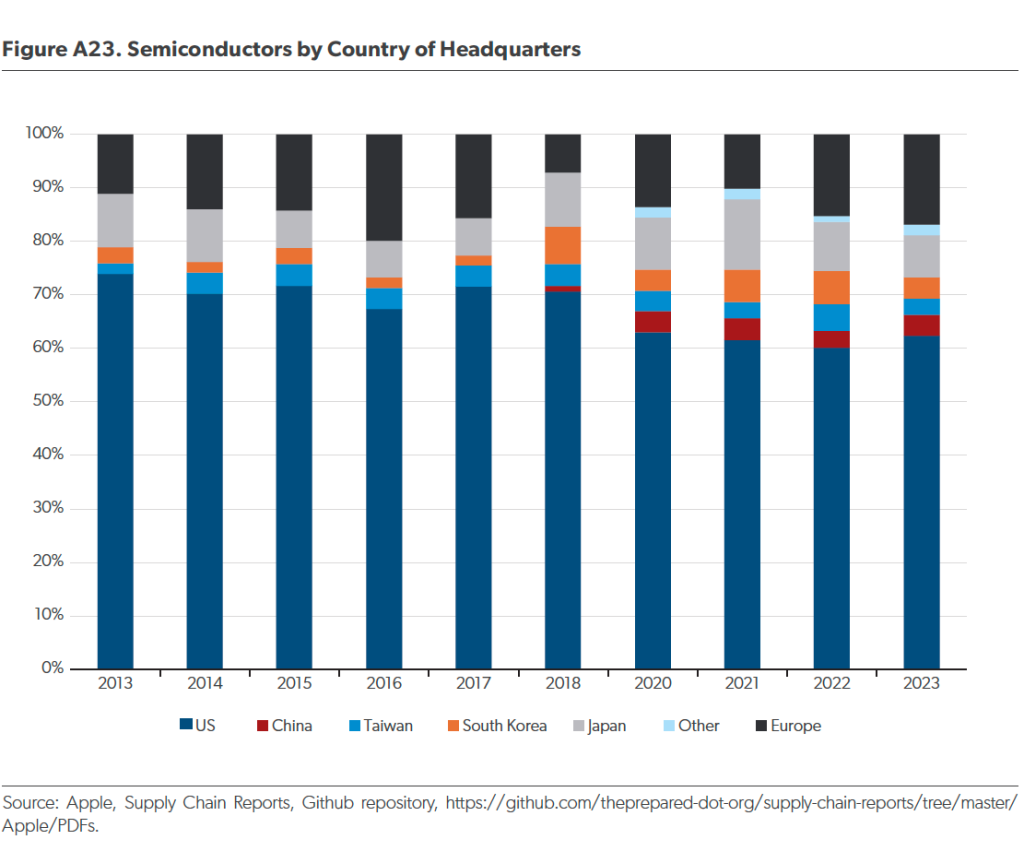

Chips are among the highest-value components in the Apple supply chain. Semiconductors like processor and memory chips are also among the most expensive components in a phone. In 2013, the first year of our data, none of the companies producing chips for Apple were headquartered in China. That number has changed only slightly over time: In 2023, of over 30 firms producing chips for Apple, still only four were Chinese, though many of the non-Chinese firms appear to use China-based manufacturing or assembly facilities (Figure A7).

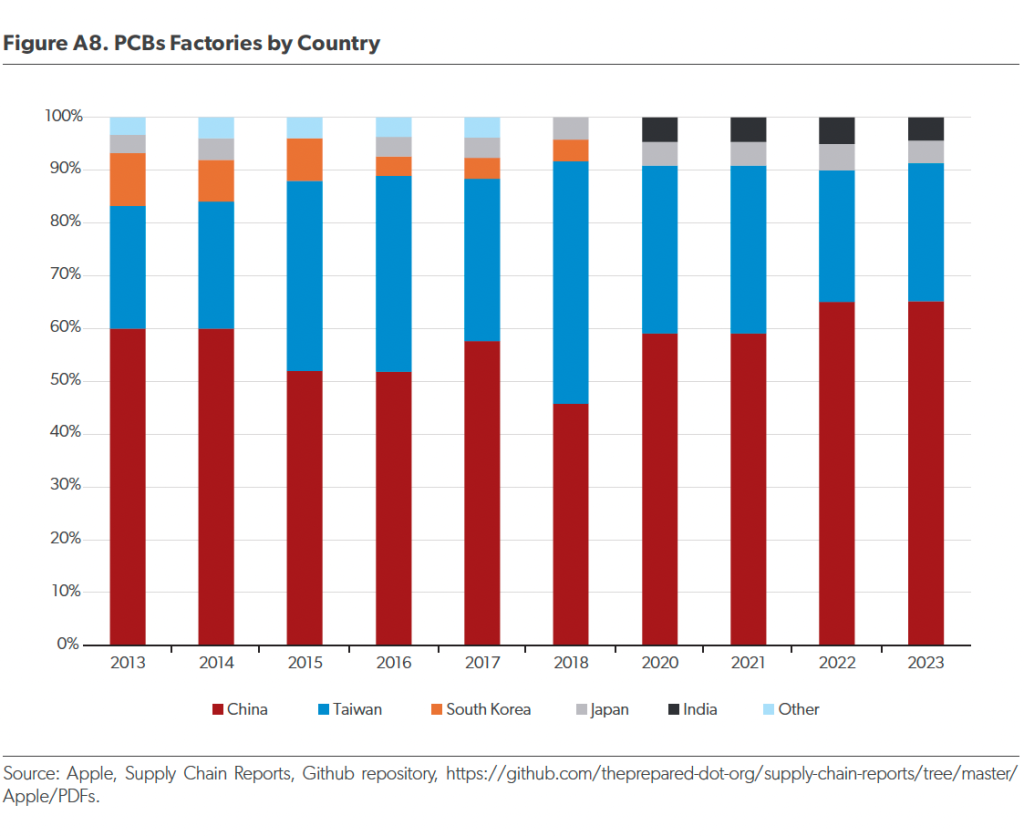

PCBs

PCBs are the boards on which chips and other electronic components are connected before being assembled into a phone, computer, or other device. PCB manufacturing is in some ways a chemical industry, given the role of different chemical processes in manufacturing them. Because of this, environmental regulations play a critical role in determining which locations are most cost competitive. This explains partly why China is the world’s leader in PCB production.

The majority of the PCB factories that supply Apple are in China, but with only a few exceptions, the factories are owned by Taiwanese companies (Figure A8). In recent years, of the 23 PCB manufacturing facilities reported in Apple’s data, only one is owned by a Chinese firm.

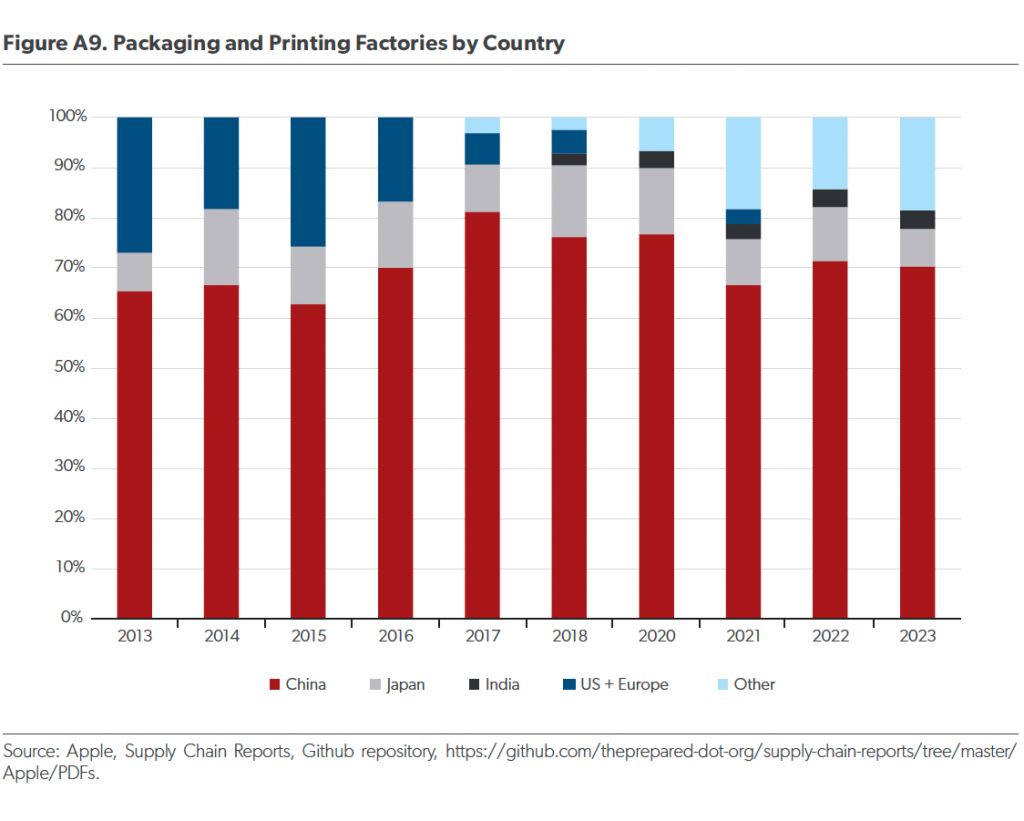

Packaging and Printing

Packaging and printing drive Apple’s brand image and sustainability. The iconic Apple boxes with perfect tolerances, elegant graphics, and tactile pull tabs offer a premium experience. This requires high-quality printing techniques alongside environmentally friendly innovations like fiber trays, eliminating plastic while maintaining visual appeal. Packaging contributes to efficient logistics and shipping.

The majority of China’s packaging and printing facilities have always been in China, though Southeast Asia and India have displaced the US and Europe as secondary locations (Figure A9).

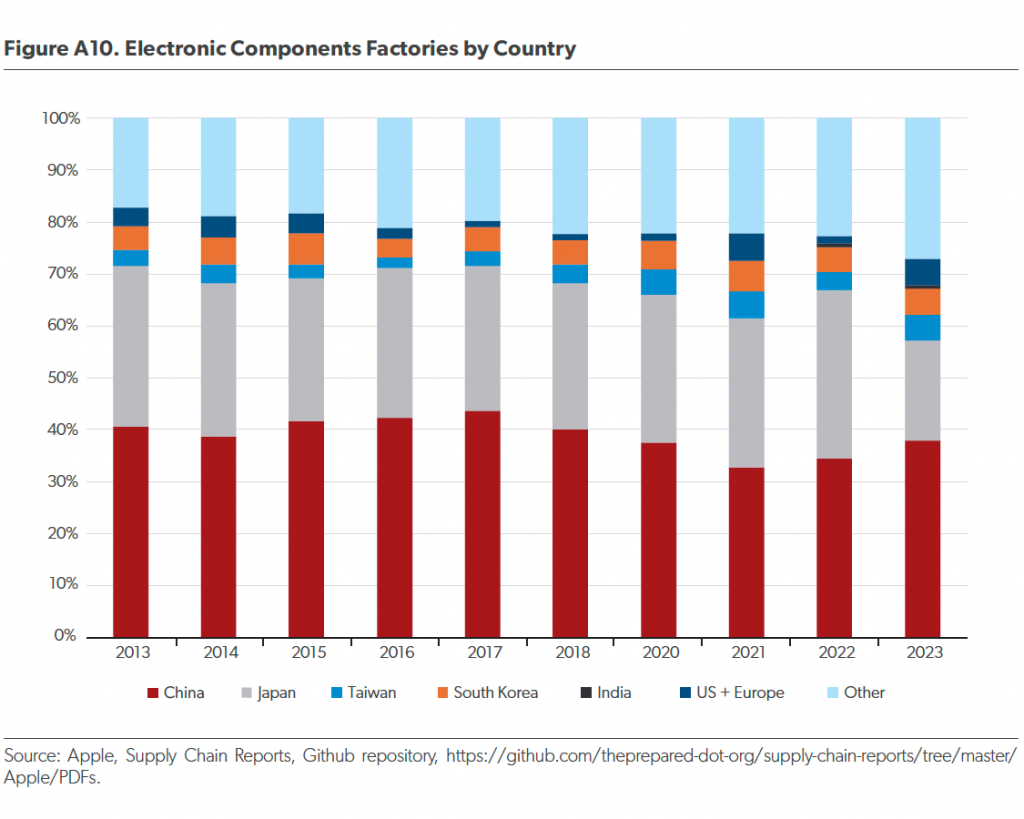

Electronic Components

Electronic components manufacturing refers to the production of the individual building blocks of electronics devices, such as resistors, capacitors, and transducers. Often requiring specialized materials and equipment for high-volume production at low tolerances, these components are critical to ensure reliability and overall performance. Factory locations for these components are split among China, Japan, Southeast Asia, South Korea, and Taiwan (Figure A10).

How Has Apple’s Value Chain Shifted? A Country-Level Analysis

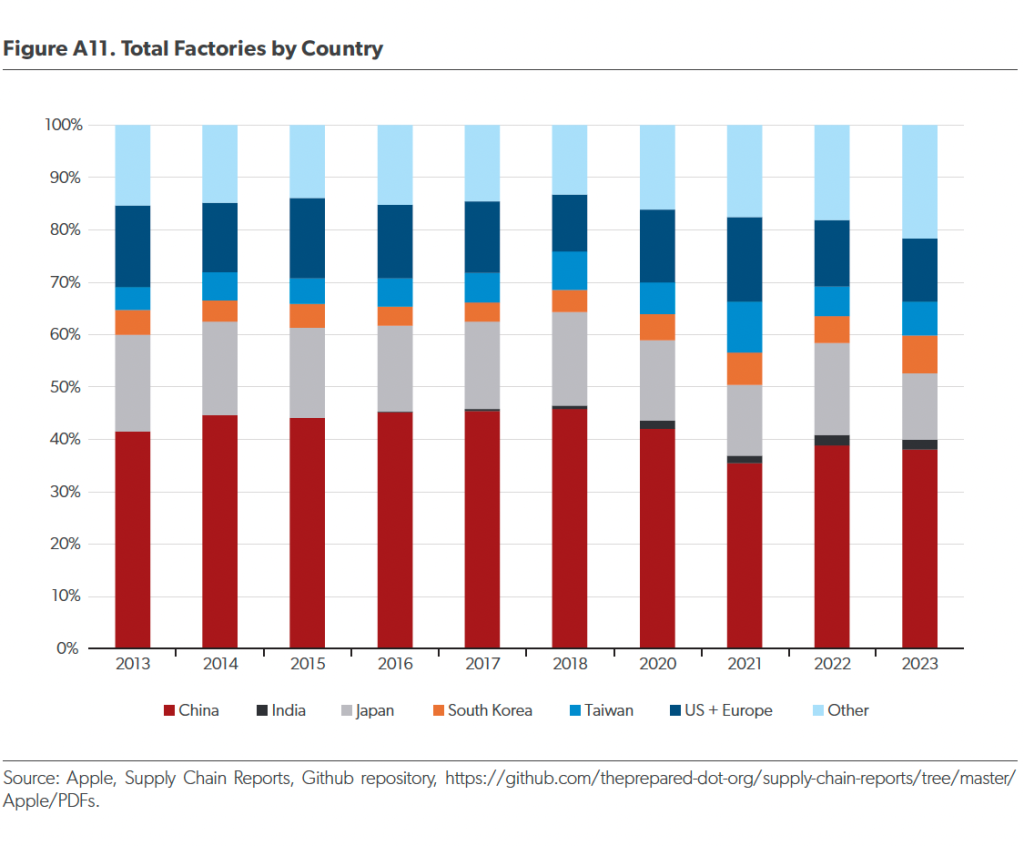

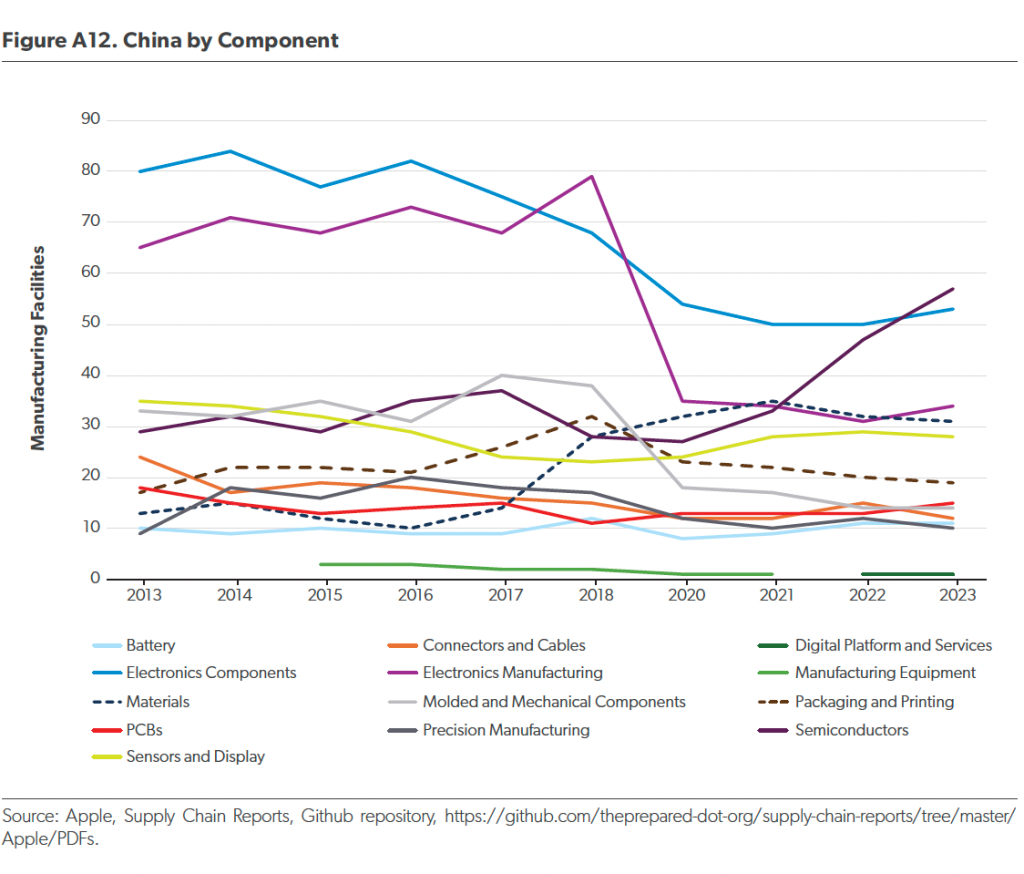

In addition to looking at Apple’s factory locations by component, we can also examine the number of factories per country. China has hosted the largest number of manufacturing facilities since data began in 2013; it remains the largest player (Figure A11). The number of electronics manufacturing (i.e., assembly) facilities in China saw a notable decline after 2018, when the US imposed tariffs on China and Apple suppliers opened new assembly facilities in other countries, notably Southeast Asia. This was counteracted, however, by a growing role for China-based facilities in other component categories (Figure A12). The total share of factories in China has fluctuated around 40 percent for the duration of our data.

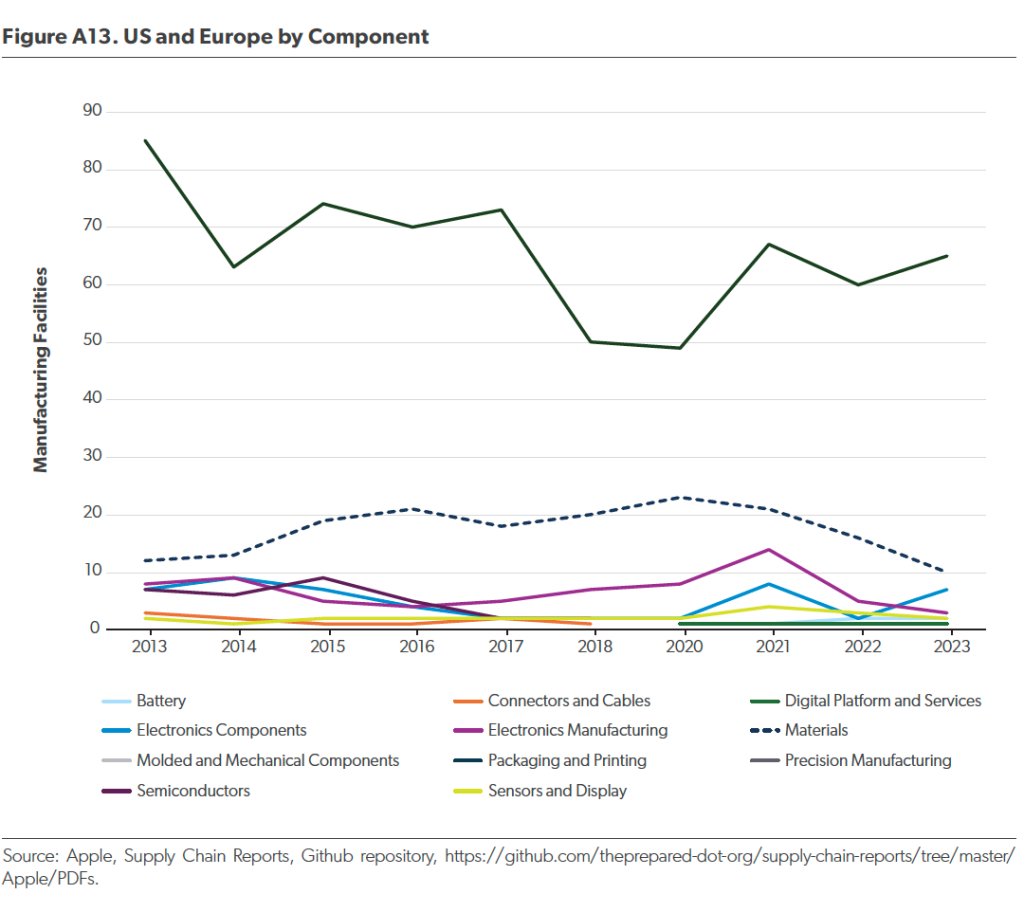

By contrast, the US and Europe have seen the number of Apple supply-chain factories in their borders decline somewhat, driven especially by the reduction in the number of chip manufacturing facilities producing chips for Apple (Figure A13). This has been supplanted by a growing role for China, South Korea, and Taiwan.

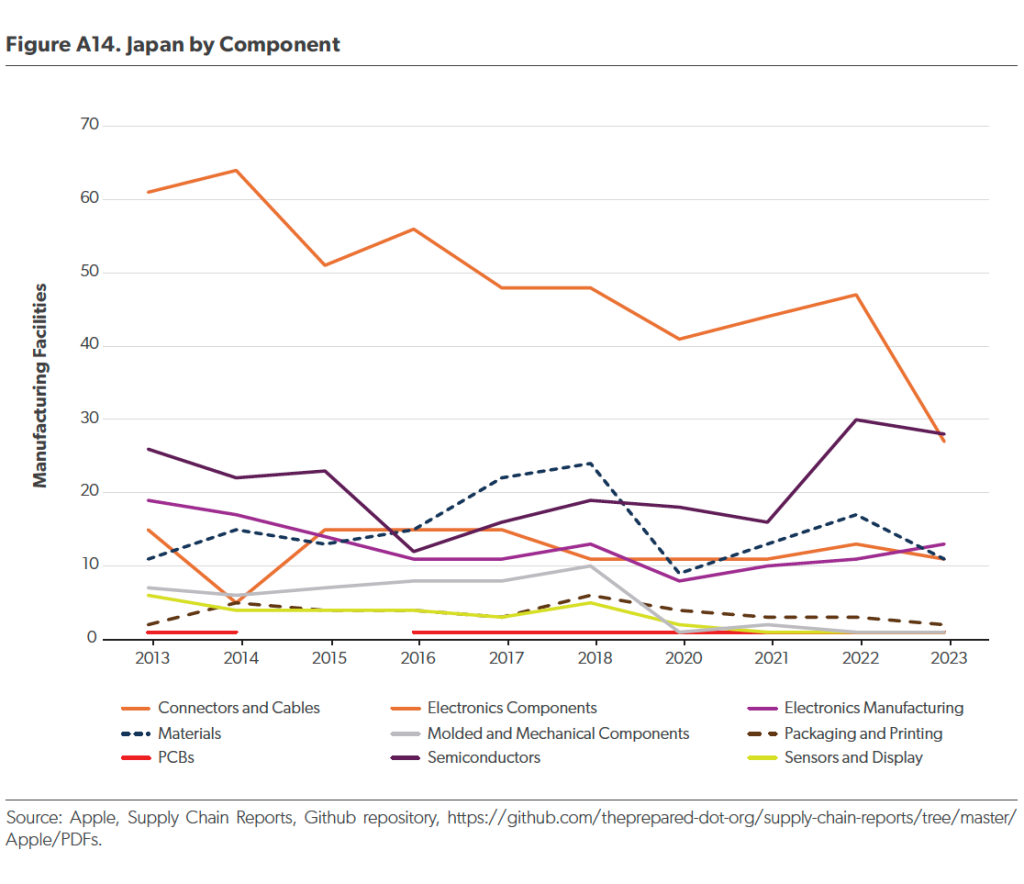

Japan, meanwhile, has seen the number of factories producing for Apple decline as well (Figure A14). However, this may not be closely correlated with the amount of Japan-based production, because the Japanese firms that contracted the number of Japan-based factories also reduced the number of China-based facilities. In other words, this may reflect simply a consolidation of these firms’ manufacturing footprint into a smaller number of factories, not a shift in the geography of production.

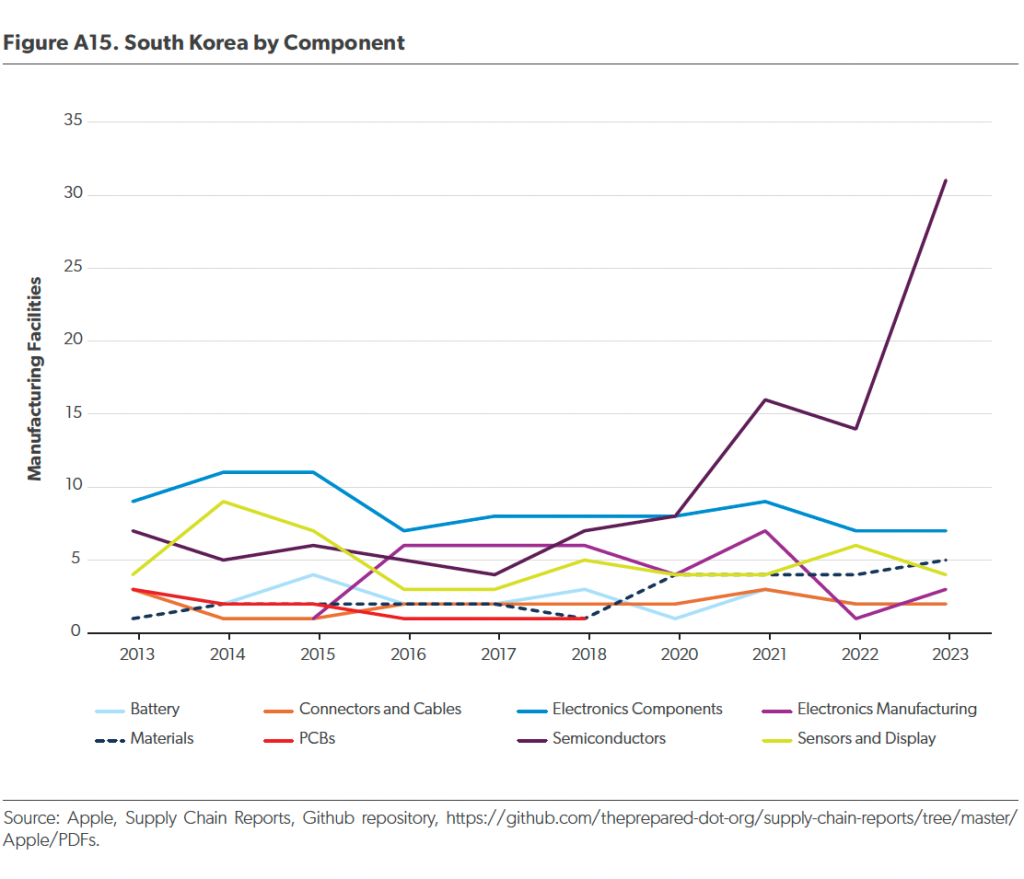

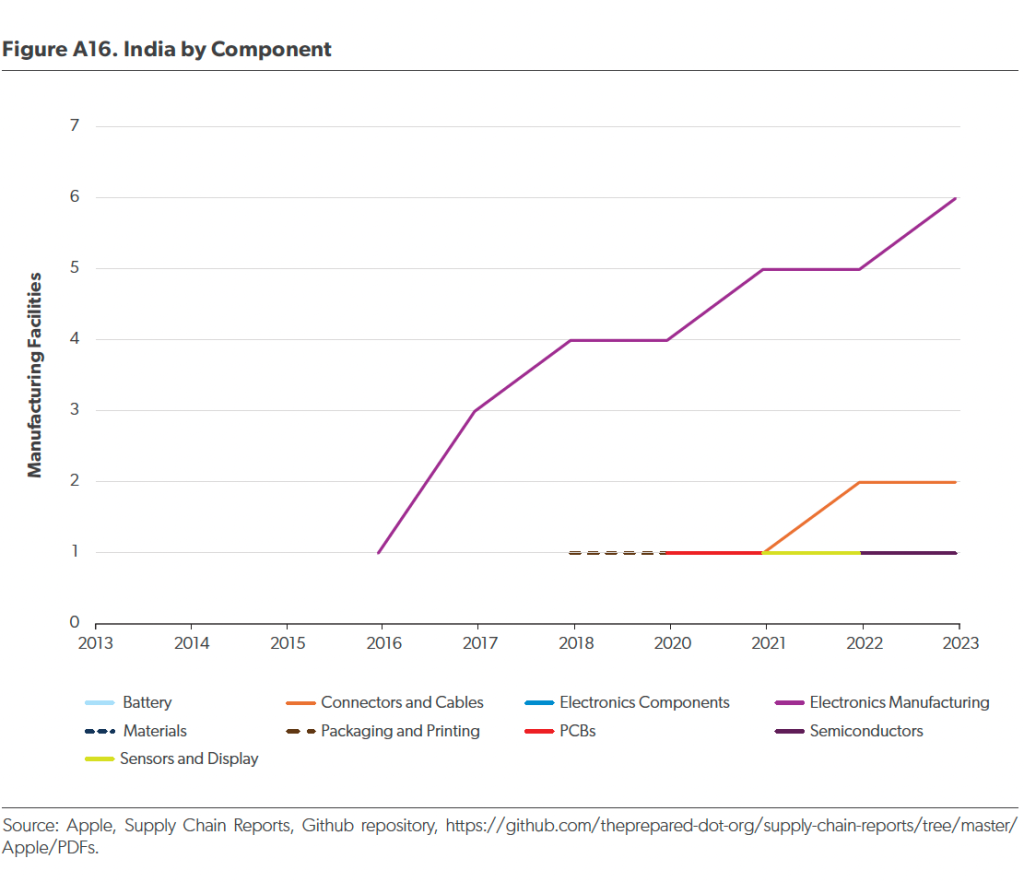

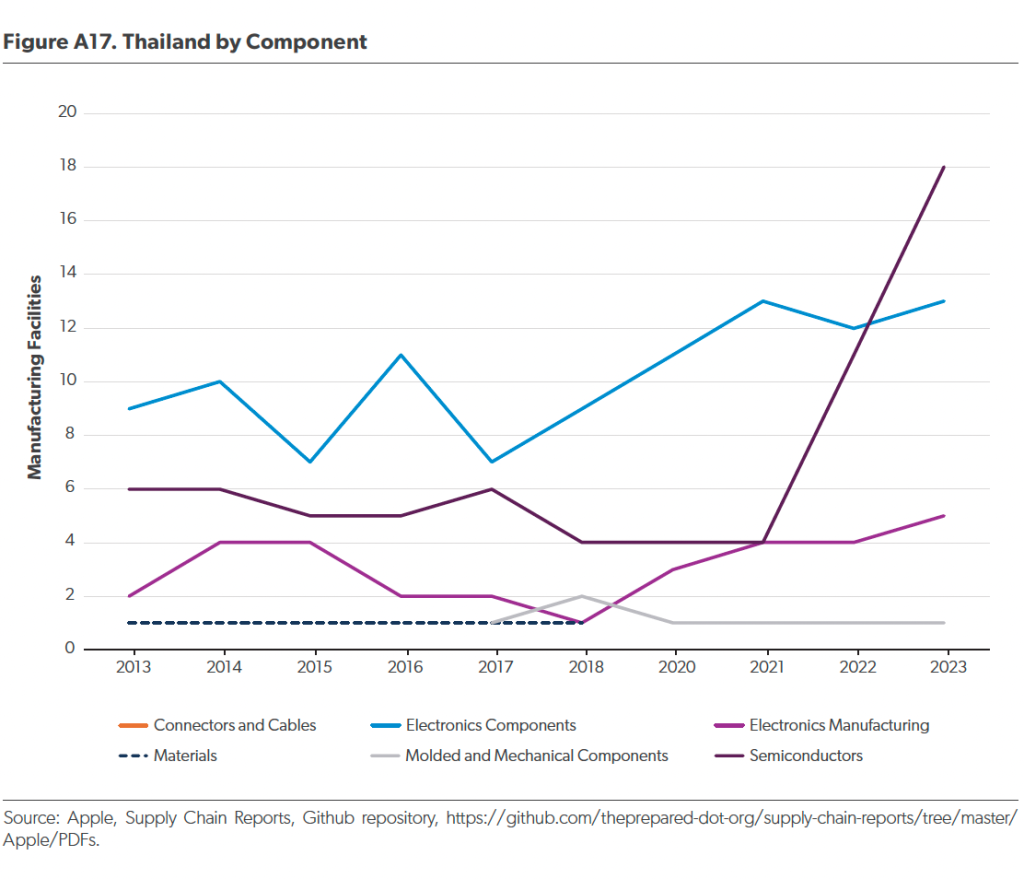

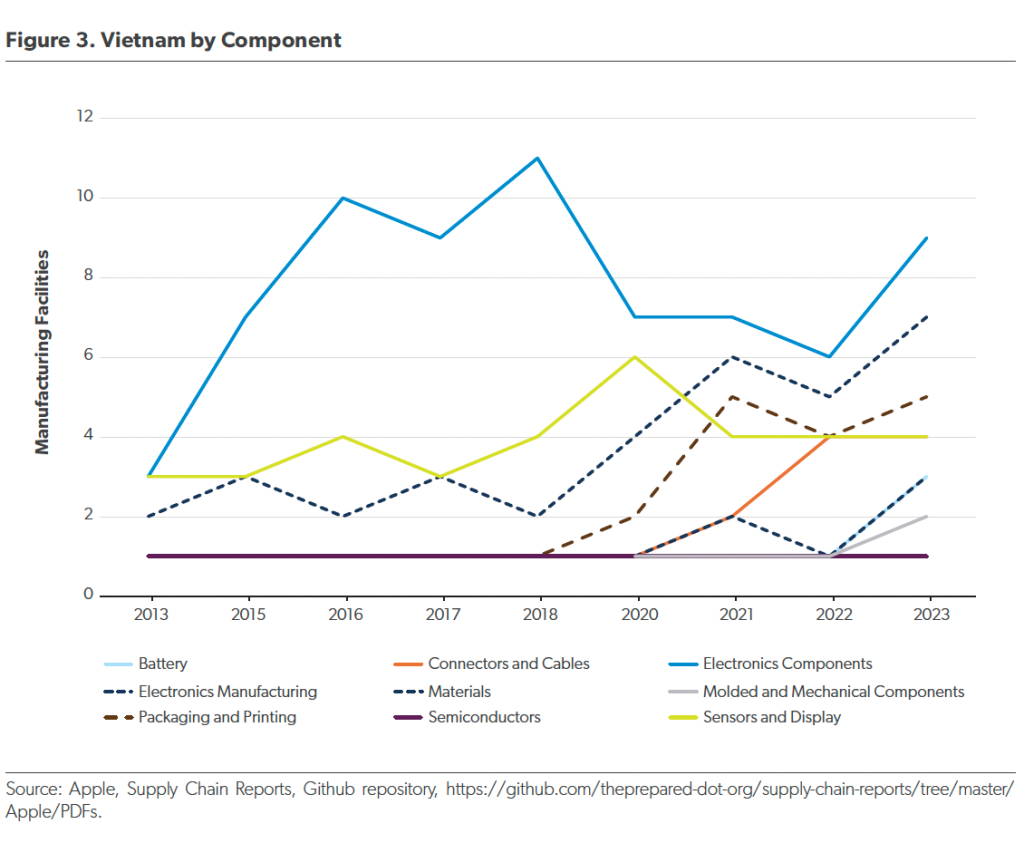

South Korea has become a much more significant player, but this shift appears driven by a single category: semiconductors (Figure A15). The other big change is the rise of factories in India and Southeast Asia. India scarcely played a role in Apple’s 2013 supply chain, and while it is still a small player, it has seen growth across multiple categories (Figure A16). Thailand and especially Vietnam have also seen broad-based growth (Figures 3 and A17).

How Has Apple’s Value Chain Shifted? A Headquarter-Level Analysis

The above analyses look at factory location by country. We can also examine the data through firm headquarters location by country. Such an analysis likely provides more insight into who makes money from Apple’s supply chain, because headquarters locations are where high-value steps such as design and research and development are more likely to occur. A semiconductor designed by a US firm but packaged in Malaysia produces much more value for the US than Malaysia, so the data about semiconductor packaging locations must be interpreted with this in mind. For less technology- or design-intensive manufacturing steps, such as precision machining, value capture may be more closely correlated with factory location than headquarter location.

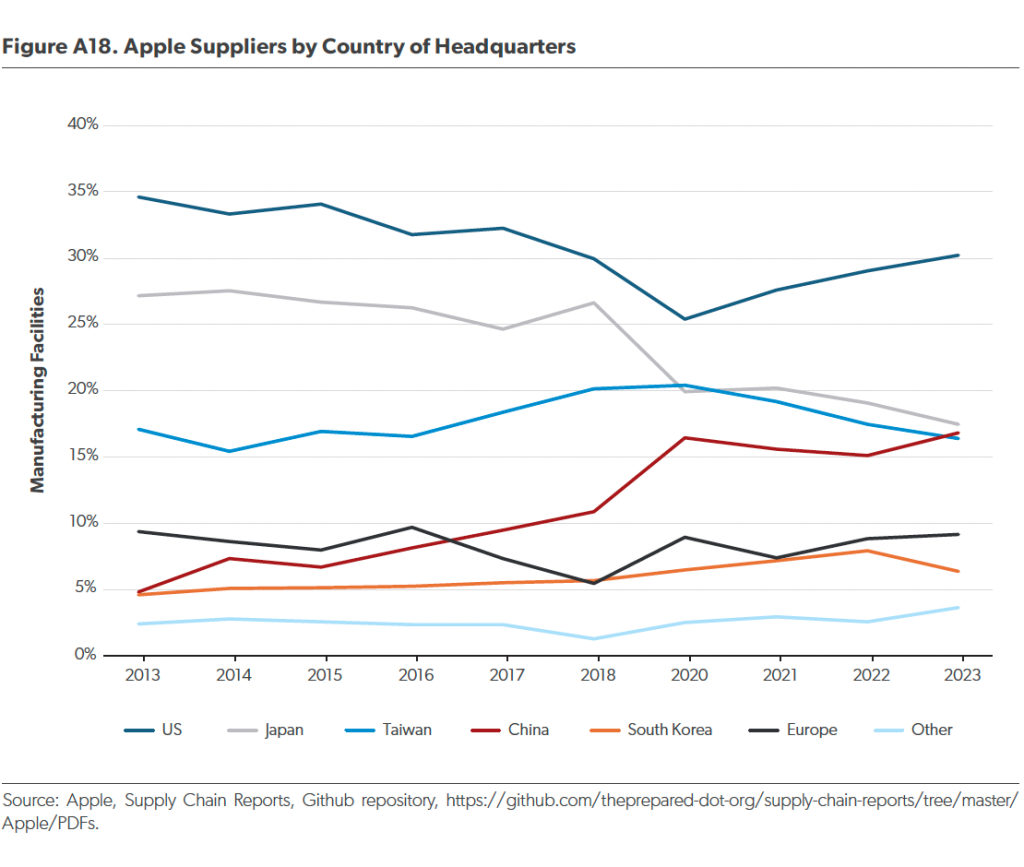

Across the component steps, Apple’s supply chain shows a clear shift toward reliance on China-headquartered firms at the expense of firms headquartered in the US, Europe, and especially Japan (Figure A18). However, there is substantial variation by product category.

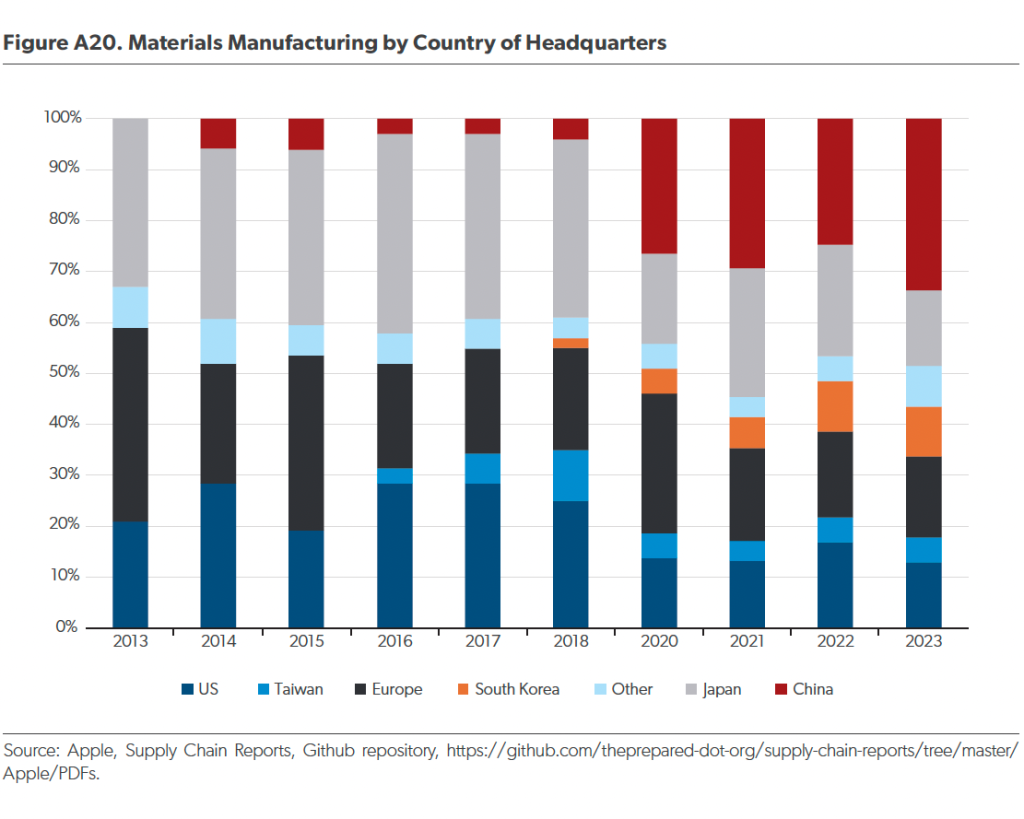

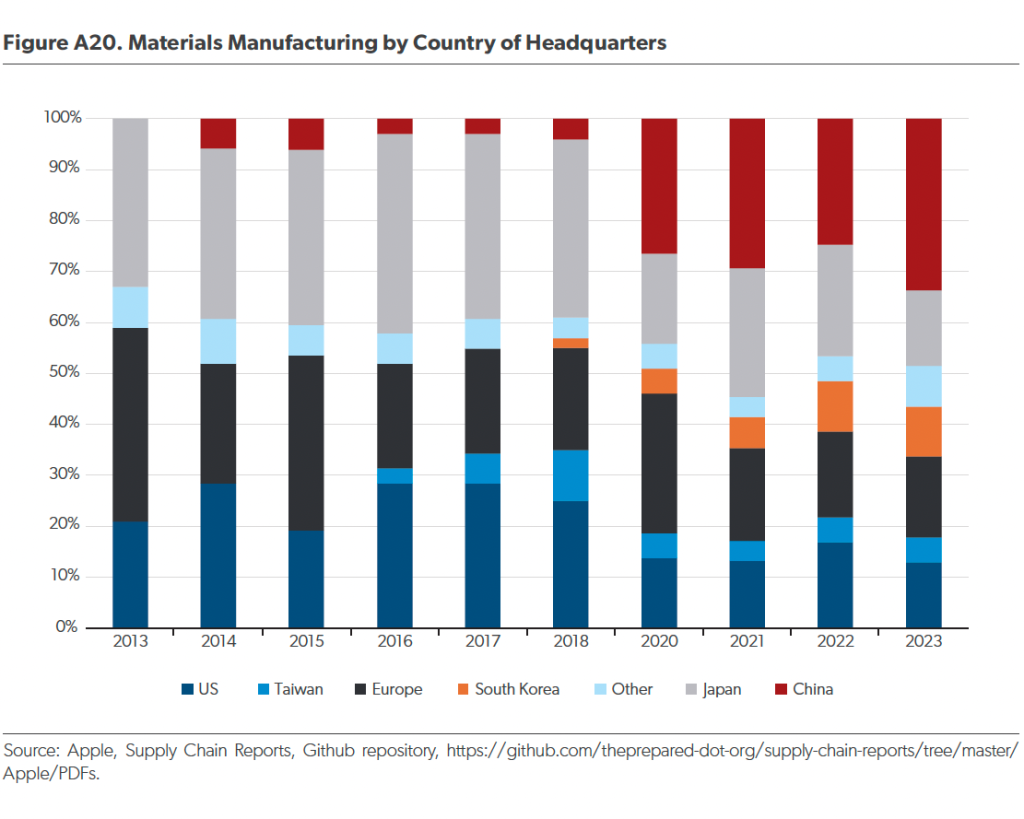

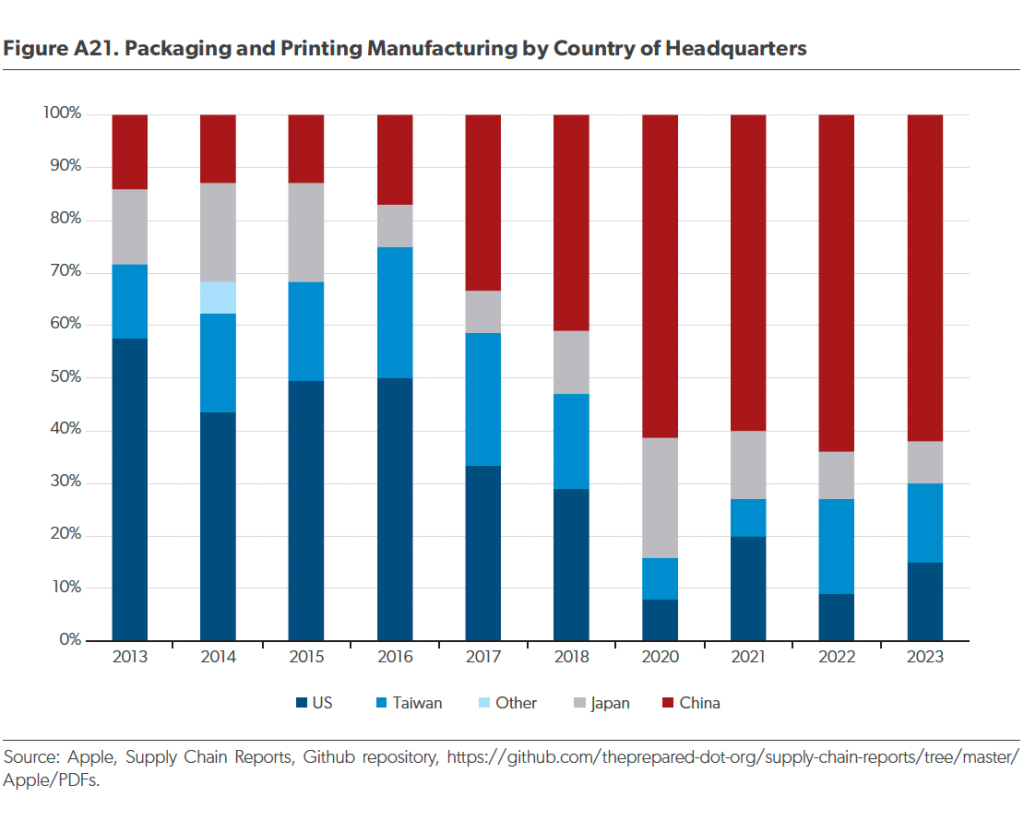

In precision manufacturing, China’s share of firms by headquarters has increased from 14 percent to 86 percent (Figure A19). In electronic components, it has increased from 4 percent to 23 percent. In materials, Chinese-headquartered firms have grown from zero in 2013 to 34 percent of all materials firms in 2023, displacing German, Japanese, and US firms (Figure A20). (However, as discussed above in our analysis of materials, the limited data available suggest that Chinese firms have displaced commodity Western producers, while specialty Western producers retained their position.) In packaging and printing, China’s share of firms by headquarters has grown from 14 percent to 62 percent (Figure A21).

Other segments have seen less change. In connectors and cables—a segment for which roughly a third of factories are in China—only 4 percent of firms were Chinese (Figure A22). Japanese, Taiwanese, and US firms had retained their strong positions since Apple first released data in 2013. In PCBs—a segment for which slightly over half of factories are in China— 88 percent of Apple suppliers are headquartered in Taiwan; only one was Chinese (Figure 4).

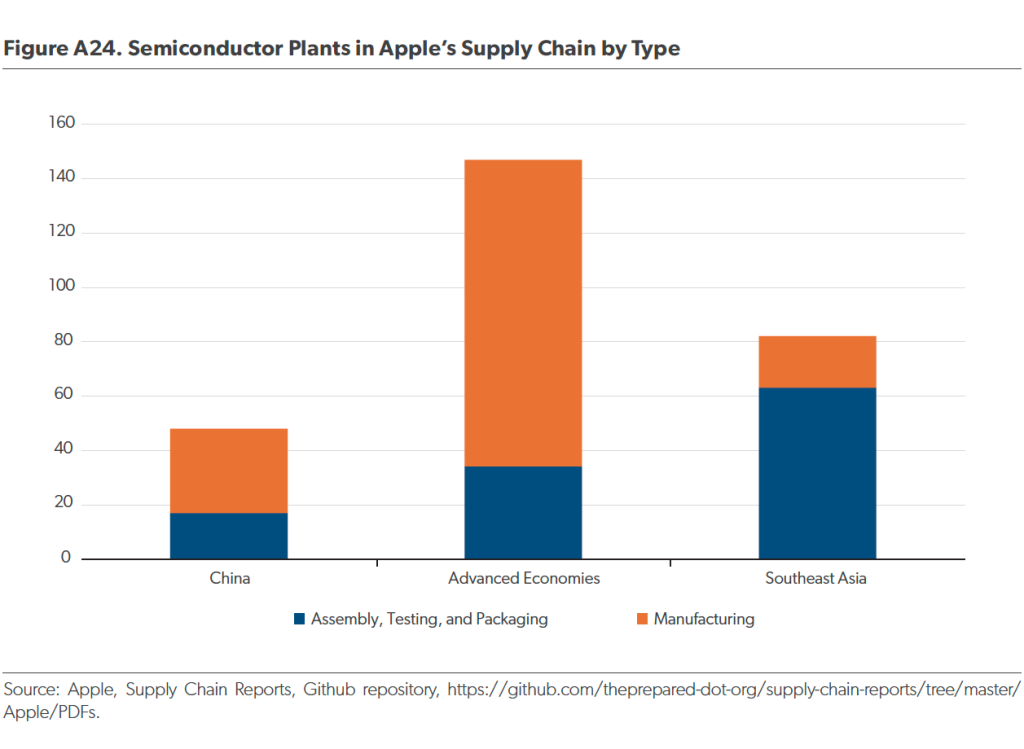

The most expensive parts of an electronic device are generally the chips, display, and batteries. In semiconductors, only 4 percent of Apple suppliers are headquartered in China, and 63 percent are headquartered in the US (Figure A23). The vast majority of semiconductor manufacturing locations in Apple’s supply chain are in advanced economies; China has some chip manufacturing but also a substantial share of the low-end assembly plants (Figure A24).

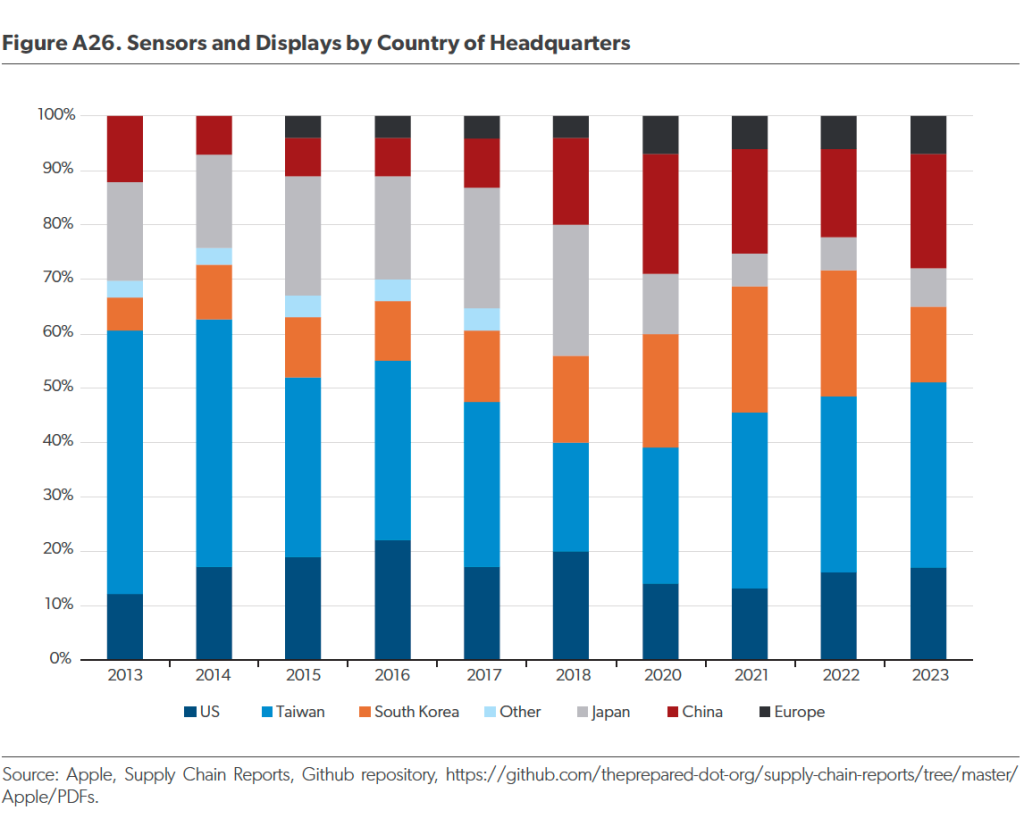

In batteries—for which there are only nine suppliers in the 2023 data—Apple appears to have deliberately cultivated non-Chinese suppliers (Figure A25). Of Apple’s battery and battery component suppliers, 53 percent are headquartered in China, much less than one might expect given China’s general dominance in batteries. However, in the absence of other data, the safest assumption is that volumes purchased are highest from China-headquartered firms. Other suppliers are headquartered in Germany, South Korea, and Taiwan. For sensors and displays, South Korea, Taiwan, and the US retain substantial shares, though Chinese-headquartered firms have become important players (Figure A26).

This analysis of the headquarters of Apple’s supply-chain partners provides only a partial and tentative glimpse at the share of economic value from Apple’s supply chain that accrues to different countries. The differences between Apple suppliers’ factory location and their headquarters—and the concentration of firms headquartered outside China in high-end segments of the value chain—suggest that far more of the value from Apple’s supply chain accrues to non-Chinese firms than an analysis of factory locations suggests.

Conclusions

The analysis above illustrates that China remains by far the center of Apple’s manufacturing operations. Southeast Asia and India have become more important over the past few years, though the magnitude of this trend is less pronounced than headlines about “decoupling” suggest.

The escalation of US-China tariffs over the past several months will undoubtedly accelerate this trend. Media reports suggest that Apple plans to ramp up iPhone assembly in India, with the aim of increasing its flexibility to avoid current or future tariffs. Yet tariffs on phones won’t necessarily induce Apple to dramatically shift sourcing of the rest of its components. Beijing will likely pressure Apple to continue buying as many components as possible from Chinese factories.

Thus far, Southeast Asia and India have broken into only certain segments of the value chain, especially electronics manufacturing (assembly), connectors and cables, and electronic components. Other supply-chain segments, such as printed circuit boards, printing and packaging, molded and mechanical components, and especially precision manufacturing remain predominantly in China.8

However, the analysis also suggests that many segments of Apple’s supply chain remain dominated by non-Chinese firms, though they often undertake their manufacturing in China. The enduring role of Taiwanese, US, and Japanese firms as owners and operators of factories in China suggests that these firms retain certain types of expertise and capability, which is why they haven’t been supplanted by Chinese-owned competitors. If Chinese firms were capable of offering similar capabilities, they would likely have won business from Apple, particularly given Chinese firms’ general willingness to accept thinner profit margins than Western firms are.

This analysis suggests that policymakers in India and countries in Southeast Asia seeking to attract investment and upgrade their manufacturing capabilities have substantial scope to continue attracting suppliers of companies like Apple, in not only basic assembly but also some of the other component categories described above. The fact that many of these China-based factories are owned by foreign firms facilitates potential supply-chain shifts. Moreover, as Western electronics firms face higher tariffs, they are looking for more diversified production locations.

For policymakers in the United States, this analysis underscores the futility of analyzing a device solely by where it was assembled—and, as a result, the irrationality of imposing tariffs using this logic. If a tariff results in electronics manufacturing shifting final assembly from China to a different country—without any other changes in its supply chain—the impact would be small. The assembly process for devices like phones often only costs around $10—a tiny fraction of the sales price. Understanding the economic implications of the manufacturing base of a firm like Apple requires digging deeply into its supply chain, not simply looking at where its devices are assembled.

About the Authors

Chris Miller is a nonresident senior fellow at the American Enterprise Institute, where he focuses on Russian foreign policy, politics, and economics; Russia and Ukraine; Russian-European relations; and Eurasia. He also focuses on semiconductors and the geopolitics of technology.

Vishnu Venugopalan is a fellow at Harvard University and an Indian Administrative Service officer. His research focuses on the intersection of industrialization, technology, social change, and geopolitics. He is also passionate about the economic history of developing countries. Views expressed are personal.

Acknowledgements

Caroline Nowak is a research associate to Chris Miller at the American Enterprise Institute, focusing on Russian studies and critical technology.

Puneet Agrawal is pursuing an MPA from Harvard University, focusing on telecom technology, semiconductors, AI, and global digital infrastructure.

Appendix A