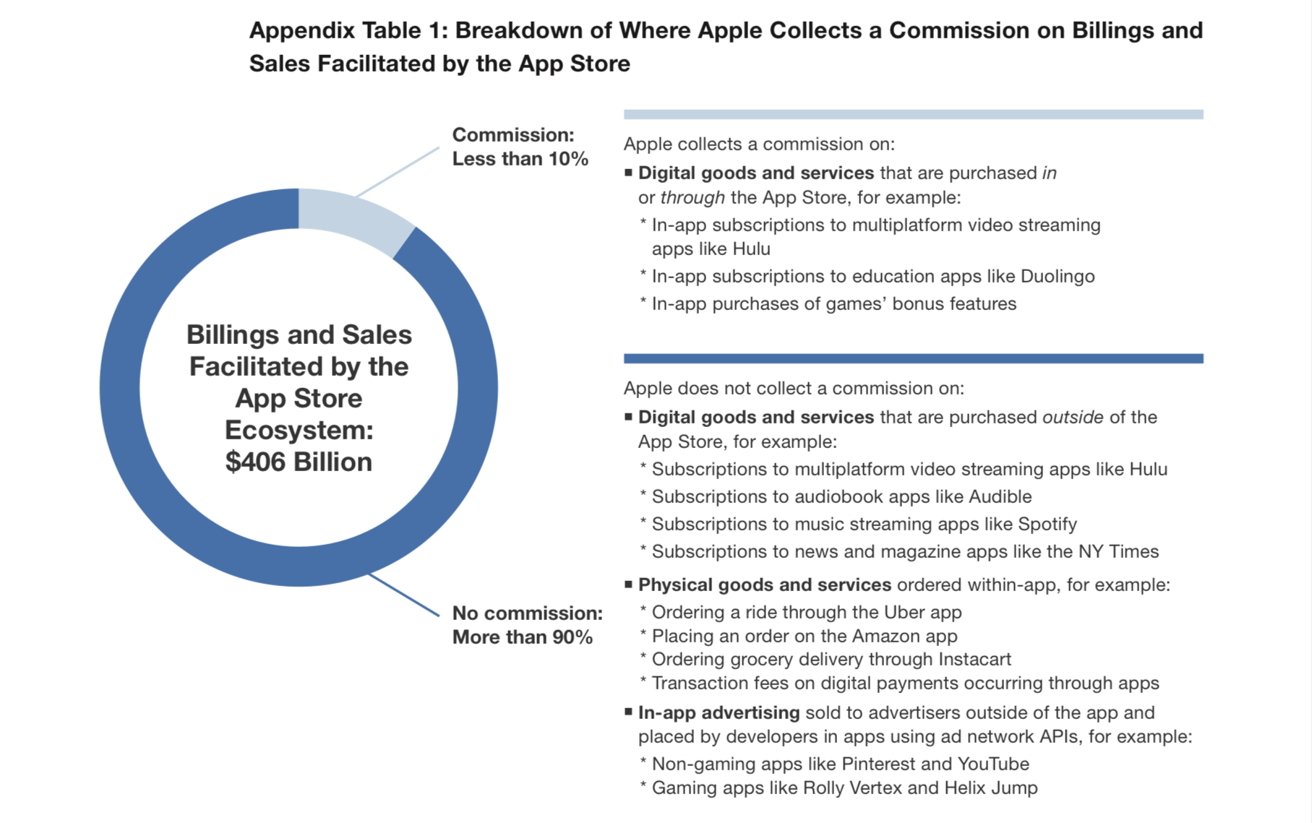

Perhaps to fight off the ire of legislators worldwide about App Store fees, Apple says that it has grown the global economy and collected commissions on under 10% of platform transactions in 2024.

More than 90% of the $406 billion in commerce linked to the App Store in the United States in 2024 didn’t result in any commission for Apple. That’s one of the headline findings in a new economic report ahead of WWDC 2025, which shows how the App Store has become a hub for far more than digital downloads.

The timing is deliberate. Apple is releasing the report it sponsored just before WWDC 2025, likely aiming to reframe public and regulatory perceptions of how much it earns from the App Store.

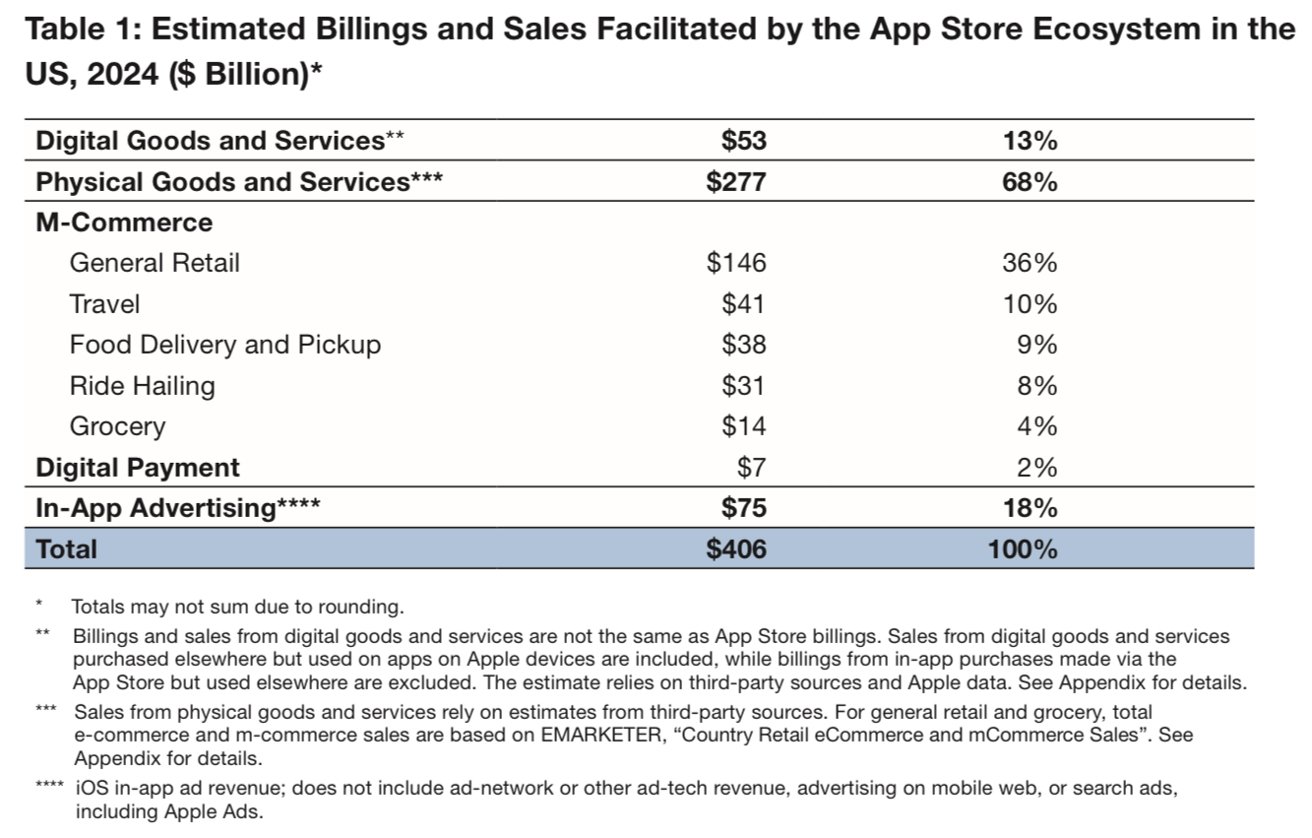

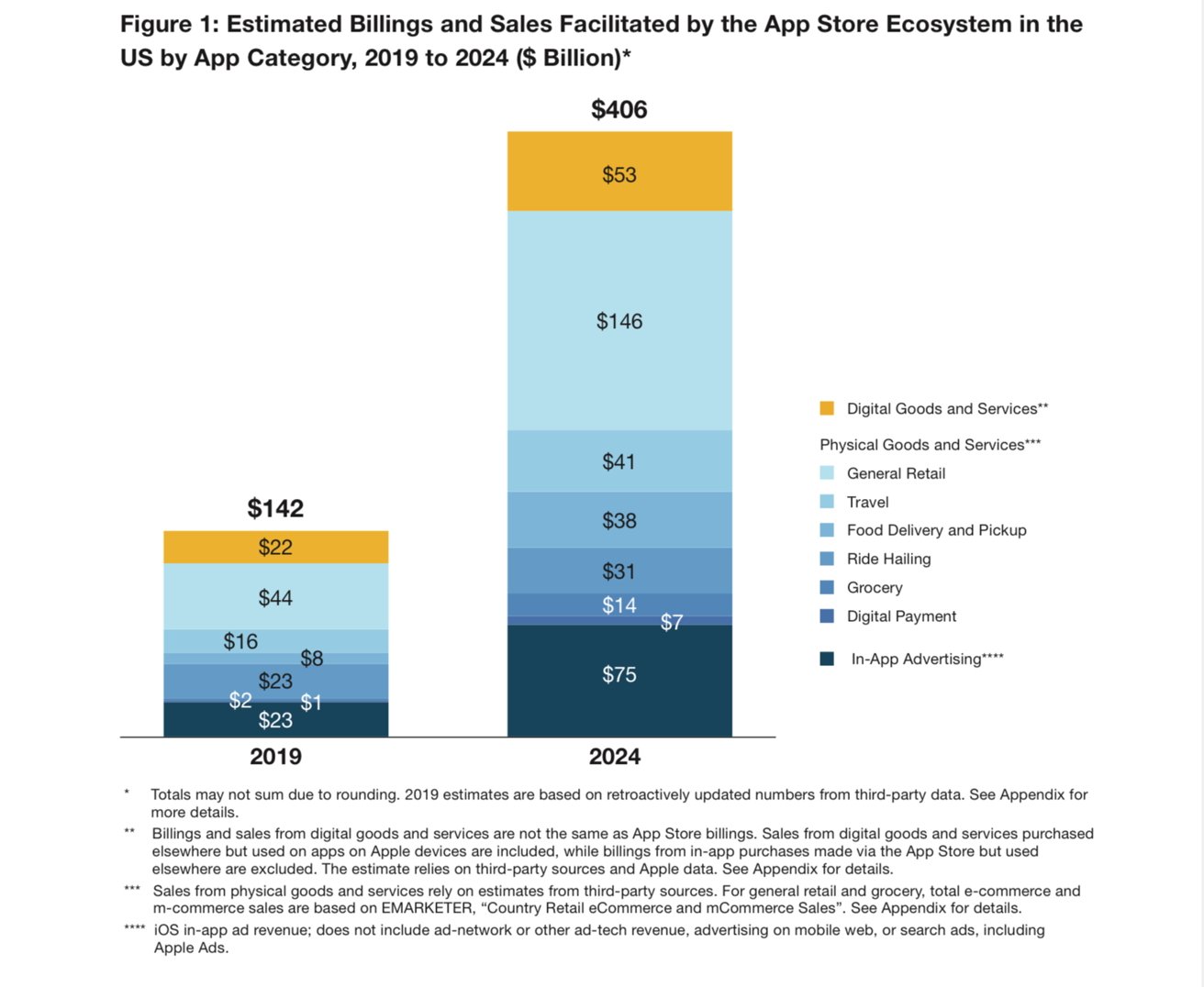

The App Store economy has nearly tripled since 2019, growing from $142 billion to $406 billion. Much of that growth came from physical goods, advertising, and services sold through iOS apps, which Apple doesn’t charge developers for.

Physical goods and ads now drive the App Store economy

Of the $406 billion in app-facilitated transactions, Apple says that $277 billion came from physical goods and services purchased through apps like Amazon, DoorDash, Instacart, and Uber. In-app advertising added another $75 billion.

Digital goods and services, such as subscriptions, games, and streaming content, made up the remaining $53 billion. General retail was the biggest category, bringing in $146 billion. Grocery delivery, ride hailing, food pickup, and travel apps also brought in tens of billions each.

While Apple still makes money from in-app purchases and subscriptions, mobile commerce now plays a much larger role. Users are increasingly turning to their phones to shop, manage logistics, and handle daily tasks.

In-app advertising has also taken off. Spending more than doubled since 2019, with developers using ads to monetize free apps and reach wider audiences. Social, entertainment, and productivity apps all leaned into this strategy, especially as users grew tired of paywalls and subscription fatigue.

Commission debate gets a reality check

Apple’s decision to emphasize the share of transactions it doesn’t monetize reflects a shift in tone from previous studies, which have historically been done about annually at this time of year. As regulators challenge its business model, in this study, Apple is reframing the App Store as a platform that enables commerce rather than extracts from it.

These numbers complicate the ongoing debate about Apple’s App Store fees. While Apple does charge a 30% commission on digital purchases, most transactions on the platform fall outside that category.

Apple offers reduced 15% commission rates through two separate programs. Smaller developers who earn under $1 million a year can join Apple’s Small Business Program which provides that discount.

The company introduced these reduced-rate programs in response to regulatory pressure and developer push-back beginning in 2020. They now form a core part of the company’s argument that it supports small developers.

Subscriptions that last more than one year also qualify for the 15% rate. These policies apply to many digital transactions. However, they don’t cover things like grocery orders, ride fares, or in-app advertising, which now account for most iOS-related commerce.

Critics have long argued that Apple’s policies give it too much control over the app economy. But the new data from Apple paints a more complicated picture.

The company provides the tools and infrastructure that power a growing range of mobile transactions, while collecting fees on only a small portion of them. That distinction could shape how regulators view Apple’s role.

Its commission model is still under pressure. However, the idea that Apple takes a cut of everything happening on iOS doesn’t reflect the scale or makeup of the platform’s economy.

US developers lead the way, both at home and abroad

Apps built by US-based developers were downloaded more than 12.4 billion times in 2024. That’s a 36% increase over 2019. Earnings also more than doubled over the same period, with strong performance in categories like photo editing, productivity, and education.

Nine out of the ten most downloaded apps on the US App Store came from American developers. Many of these apps also succeeded internationally. US-made apps ranked in the top five in 170 out of 175 App Store storefronts around the world.

Smaller developers also saw real gains. Earnings for those who were active in 2021 rose by 76% through 2024. Tools like SwiftUI and TestFlight helped level the playing field, while Apple’s Small Business Program provided better revenue splits.

The App Store looks more like infrastructure than a storefront

Apple’s business model is under review in several major markets. The European Union, Japan, and the United States are all considering rules that would require Apple to open iOS to third-party payment systems and alternative app stores.

While it started as a place to buy apps, the App Store now supports a much broader set of economic activity. Apple gives developers access to APIs, payment systems, security tools, analytics, and global distribution.

In 2024, the platform handled over 66 billion app updates per week worldwide. At the same time, Apple continues to face scrutiny over its platform rules.

Regulators are still evaluating how much control the company should have over payments and app distribution. But the report suggests that Apple’s share of total app-related revenue is smaller than many assume.

The App Store has become one of the digital economy’s most important platforms. Even as the debate over commissions continues, it’s clear that the ecosystem’s influence goes far beyond what Apple earns from a single in-app purchase.

The economic report could serve as a defensive tool. By focusing on the wider impact of the App Store, Apple appears to be trying to reshape the narrative around platform control and developer fairness.