Apple Inc. (NASDAQ:AAPL) is the second-largest company in the world at the time of writing, and many investors are concerned the company may be past its high-growth stage. However, I believe the investment could still have a useful place in portfolios that are looking for good returns at a lower risk.

My own opinion on the stock over the long term is that it will certainly not contract in value in the next 10 years, but that its value accretion will be more moderate. Additionally, if management does not effectively shift the company’s financial strategy to meet long-term growth opportunities and mitigate present growth risks, which are vastly different now compared to historically due to its size, Apple’s stock could start to depreciate in value.

Apple might have to manage a strategy shift

There are valid concerns at the moment about how Apple’s growth might slow down in the coming years due to how saturated its markets are. In addition, I believe that with the absence of Steve Jobs as CEO, the company could undeniably face issues in vision and technology development in the future. Even though I admire Tim Cook’s management and believe Apple hosts some of the best talent in the world, it is leading that talent with an effective long-term vision which is paramount, and it is very difficult to match the late founder in this regard. I will discuss in the following sections how I believe Apple’s negation of developing a real moat in artificial intelligence infrastructure is a mistake and that it may need to shift its focus away from consumer goods as its primary value-add to a higher focus on investment operations, similar to how Microsoft (NASDAQ:MSFT) operates, with a strategy of portfolio management of technology companies that operate under the umbrella of Apple. I believe that a failure to do this could mean the firm eventually plateaus in growth and, over the next few decades, sees its share price depreciate as a result.

While Apple’s transition into services and its large moat in the app store is admirable, it is facing significant pushback from regulatory bodies for monopoly practices. I believe this is a bad reputation for Apple to be getting, and it also highlights a critical issue. The company is preventing innovative upstarts from flourishing through negative app store ecosystem payment rules, which are eating away at the potential earnings these newer players will depend on for their survival. Instead of investing in these companies, as I have alluded to would be wise in my analysis here, Apple is trying to capitalize off of them without necessarily astutely supporting their long-term growth.

In essence, I think this is a bad strategy and is not conducive to long-term flourishment for Apple unless it changes its strategy somewhat. The tech giant has changed its commission structure for small developers, but I still think it could be more generous if it began a more thorough investment strategy, which could bolster long-term growth and open up its services and ecosystem for use in a more egalitarian way.

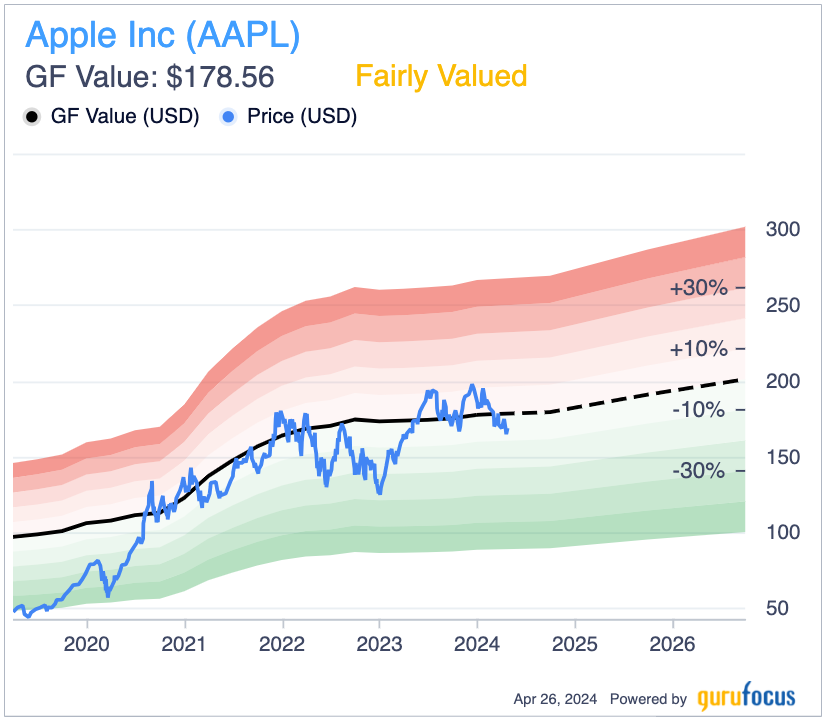

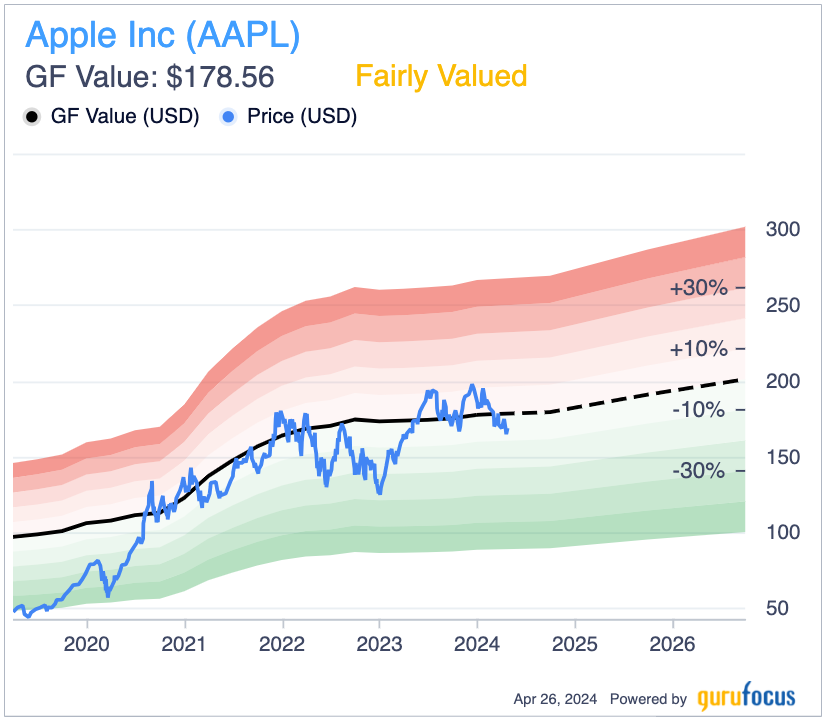

Assessing Apple’s valuation

Because Apple is the second-largest company in the world by market cap, there is very little room for inefficiencies in the valuation. As the GF Value chart indicates, the stock is fairly valued at the time of writing. Recently, the company’s valuation multiples have increased somewhat. However, this is warranted due to the fact its earnings growth rates without non-recurring items have been increasing over the past decade.

The main concern I have with the valuation is that, at the moment, it is still notably high, even if fair. I believe that if the company’s growth reduces significantly over the long term because it fails to effectively pivot in a manner similar to my operations forecast above, the market could deem Apple’s valuation a problem and begin a significant sell-off. After a potential significant correction, if the company is not managed with stock price growth in mind over the next decade, it could enter a new period of earnings contraction and share price depreciation. This is something we definitely do not want to see as shareholders, which is why Apple will have to focus carefully on its capital allocation strategies to maintain long-term growth in line with the broader economy as a baseline from here on out.

Deeper analysis of market risks

A significant slowdown in Apple’s growth could occur if it ineffectively harnesses its acquisitions in AI to produce a moat in machine and deep learning capabilities, products and services. I believe that AI is going to absolutely transform the technology industry and will have far-reaching effects on every industry in the world. I believe it is a massive mistake for Apple to sideline AI or even outsource the most advanced tasks. Before his death in 2011, Jobs was involved in bringing Siri to the market through an acquisition led by Apple’s leadership in 2010, which was arguably one of the first AI implementations in consumer technology. However, today, with the recent AI surge, which I posit was driven largely by OpenAI, Apple showed that it was not at the forefront of this innovation, but instead is having to adapt accordingly. Based on my analysis and research, the company wants to harness AI tools to create the best consumer goods rather than have a moat in any real sense in AI technology, tools or infrastructure. Its focus has been on deploying AI in its hardware and software ecosystems, with less noticeably visible offerings for consumers. To me, this is a mistake and will significantly negatively impact shareholder value over the long term as AI becomes the largest value-add in the modern technology industry in history.

In many respects, despite Apple’s size, it is already behind on the AI front. Even considering its 25 acquisitions of AI companies from 2016 to 2020 and 32 AI startups being acquired in 2023, the question here is not acquiring the talent; it is what Apple does with the talent that is paramount. This reiterates my point that Jobs was known to be ruthless in the pursuit of technological excellence and vision. Without him, I believe the company’s focus on consumer goods as its primary value-add could begin to wane over the long term. Its strategic shift to technology investments rather than fully integrated acquisitions could broaden its growth opportunities and allow for a deeper ecosystem of growth to strengthen it over the long term.

Key takeaway

Apple may still be a big player in the game, but I believe it is quite telling that Microsoft has recently overtaken it. I think what Microsoft has over Apple, which is incredibly astute, is a business strategy that is similar to portfolio management but focused on technology. I believe this was instilled in Microsoft by Bill Gates (Trades, Portfolio), and while I think Apple’s consumer products have been the best in the world up until now, I think due to its size and the loss of Jobs, Apple’s executive management has to navigate a shift in strategy to meet long-term financial growth targets that shareholders will want.

In many respects, Apple is at a critical crossroads and must navigate its future carefully. As such, I will hold the stock, but not at too high a weight in my portfolio until I see the shifts needed to maintain growth over the long term.

This article first appeared on GuruFocus.