Apple iPhone owners are still sticking with the brand at rates that shame every other smartphone producer, and a small dip in loyalty doesn’t mean much without better data.

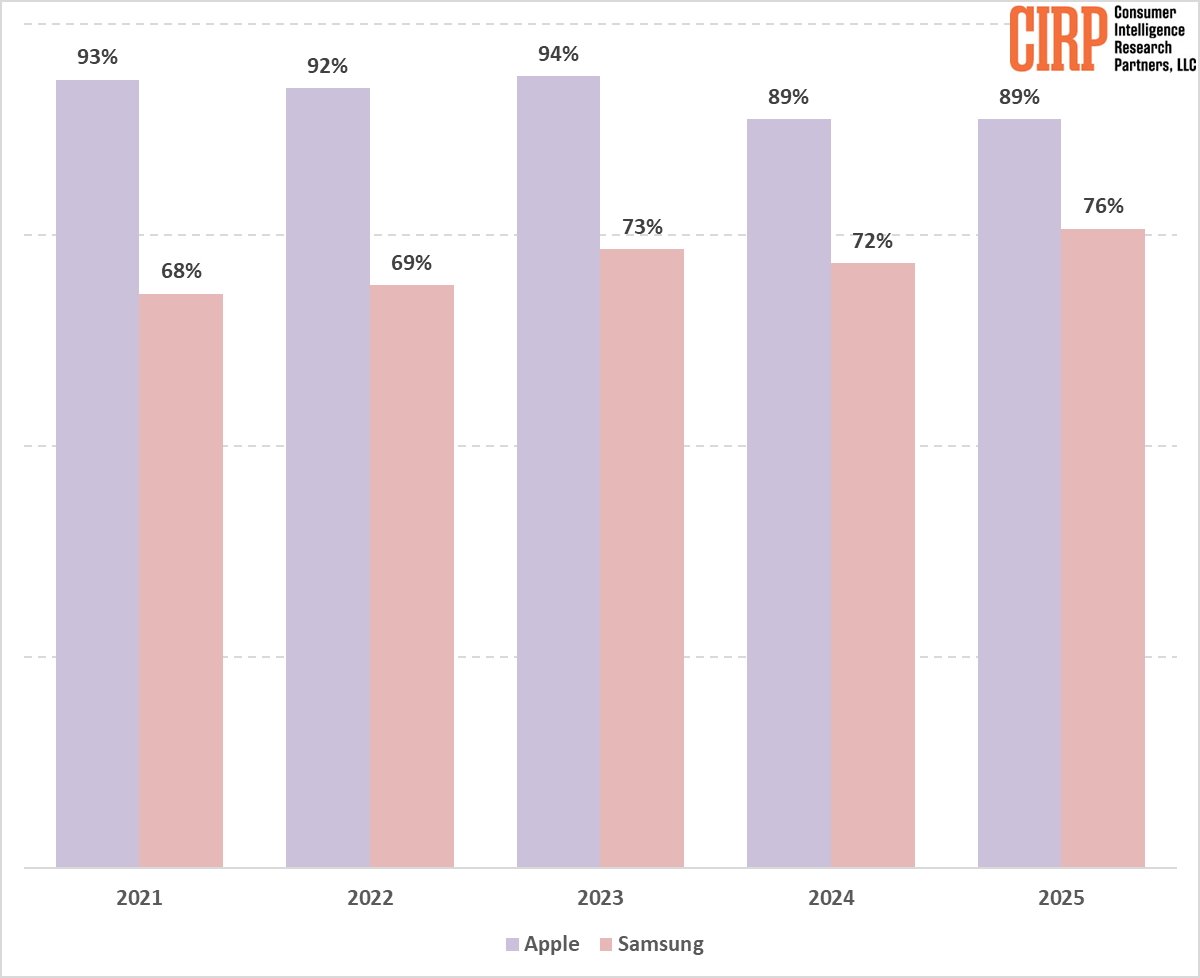

Apple iPhone owners aren’t quite as loyal as they used to be. New data shows that 89% bought another iPhone when upgrading. That figure, known as the loyalty rate, measures how often customers stick with the same brand.

Though 89% still stick with the company when upgrading, that’s down from a 94% high in 2021, according to new data from Consumer Intelligence Research Partners (CIRP).

That might sound alarming, but it’s hard to call it a meaningful shift without more information. CIRP didn’t release its sample size or margin of error, and five points over three years doesn’t necessarily indicate a pattern.

In an industry where customer retention hovers well below 70% on the average, including Apple and Samsung, Apple still leads the pack, despite a so-called decline.

Samsung, meanwhile, is gaining ground, or at least holding onto more users. Its customer retention rate has reportedly climbed to about 77%, though that figure, too, lacks transparent sourcing in the latest CIRP summary.

Samsung has benefited from the 2021 exit of LG from the US smartphone market and a shrinking field of Android competitors. With fewer major options to jump to, Samsung has become the default destination for many Android users — not necessarily the most beloved.

A ceiling, or just noise?

Apple’s loyalty rate remains the highest in the industry, and the idea that a drop from 94 to 89% signals real trouble is questionable. CIRP’s data reflects trends from the twelve months ending in March 2024, based on unspecified survey methodology.

It’s likely that the biggest contributor to the “decline” is statistical noise. But it also coincides with rising prices and fewer incentives to upgrade.

Smartphone loyalty: percent of users who bought the same brand again in the year ending each March. Image credit: CIRP

The iPhone 16 Pro starts at $999, and many owners are holding onto devices longer. That may not reflect diminished brand loyalty so much as evolving economic priorities.

Some analysts have also pointed to Apple’s adoption of RCS messaging in iOS 18 as a potential softening of ecosystem lock-in. The standard enables features like high-resolution media, read receipts, and typing indicators between iPhone and Android users.

Samsung benefits from fewer Android competitors

Samsung’s loyalty boost may reflect reduced competition more than renewed customer passion. With LG gone and brands like Google and Motorola capturing only small slices of the market, Samsung often wins by default.

Its midrange Galaxy A series has performed well among cost-conscious buyers, with competitive hardware and aggressive Trade-in deals. But whether those users are truly loyal or simply sticking with what’s familiar remains unclear.

Without more detail from CIRP, it’s hard to know how much of Samsung’s loyalty gain is organic and how much is circumstantial.

What’s next for Apple?

With the iPhone 17 lineup expected later in 2025, Apple faces a slower upgrade cycle, tighter household budgets, and regulatory changes, especially in Europe. The Digital Markets Act has already forced the company to open up its App Store policies, and further interoperability mandates may follow.

But despite all the speculation, there is no real sign that Apple’s customer base is slipping. An 89% loyalty rate still puts it far ahead of every competitor.

If there’s a shift happening, it’s incredibly minor at best.