Advisor Resource Council purchased a new stake in shares of Enterprise Products Partners L.P. (NYSE:EPD – Free Report) during the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor purchased 20,307 shares of the oil and gas producer’s stock, valued at approximately $535,000.

Advisor Resource Council purchased a new stake in shares of Enterprise Products Partners L.P. (NYSE:EPD – Free Report) during the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor purchased 20,307 shares of the oil and gas producer’s stock, valued at approximately $535,000.

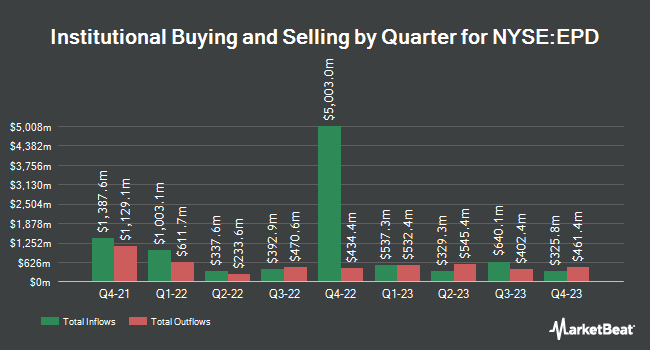

Several other hedge funds have also added to or reduced their stakes in the company. Fairfield Bush & CO. bought a new stake in shares of Enterprise Products Partners during the 1st quarter valued at $31,000. Mirae Asset Global Investments Co. Ltd. grew its stake in shares of Enterprise Products Partners by 2.6% during the first quarter. Mirae Asset Global Investments Co. Ltd. now owns 6,571,535 shares of the oil and gas producer’s stock worth $169,611,000 after purchasing an additional 169,059 shares during the period. BlackRock Inc. increased its holdings in Enterprise Products Partners by 4.7% in the first quarter. BlackRock Inc. now owns 25,050,292 shares of the oil and gas producer’s stock valued at $646,548,000 after purchasing an additional 1,114,690 shares during the last quarter. Cibc World Market Inc. lifted its stake in Enterprise Products Partners by 3.2% in the first quarter. Cibc World Market Inc. now owns 89,367 shares of the oil and gas producer’s stock valued at $2,307,000 after buying an additional 2,804 shares during the period. Finally, Sei Investments Co. boosted its holdings in Enterprise Products Partners by 76.5% during the first quarter. Sei Investments Co. now owns 888,439 shares of the oil and gas producer’s stock worth $22,931,000 after buying an additional 385,008 shares during the last quarter. Institutional investors own 26.54% of the company’s stock.

Wall Street Analysts Forecast Growth

Several research firms recently weighed in on EPD. Stifel Nicolaus lifted their price objective on shares of Enterprise Products Partners from $35.00 to $36.00 and gave the stock a “buy” rating in a research note on Friday, February 2nd. StockNews.com raised shares of Enterprise Products Partners from a “buy” rating to a “strong-buy” rating in a research report on Saturday, March 9th. Truist Financial upped their price objective on shares of Enterprise Products Partners from $31.00 to $33.00 and gave the company a “buy” rating in a research report on Wednesday, February 21st. Royal Bank of Canada reiterated an “outperform” rating and set a $35.00 target price on shares of Enterprise Products Partners in a report on Tuesday, February 13th. Finally, Wells Fargo & Company raised their price target on Enterprise Products Partners from $31.00 to $32.00 and gave the stock an “overweight” rating in a research report on Tuesday, February 6th. Two analysts have rated the stock with a hold rating, eight have given a buy rating and two have given a strong buy rating to the stock. According to data from MarketBeat, the stock currently has a consensus rating of “Buy” and an average target price of $32.36.

Get Our Latest Stock Analysis on EPD

Enterprise Products Partners Stock Up 0.2 %

NYSE:EPD opened at $28.86 on Friday. The company has a market cap of $62.58 billion, a PE ratio of 11.45 and a beta of 1.02. The stock has a 50-day simple moving average of $27.43 and a 200 day simple moving average of $26.97. The company has a debt-to-equity ratio of 0.95, a quick ratio of 0.68 and a current ratio of 0.93. Enterprise Products Partners L.P. has a 52-week low of $24.77 and a 52-week high of $29.09.

Enterprise Products Partners (NYSE:EPD – Get Free Report) last posted its quarterly earnings data on Thursday, February 1st. The oil and gas producer reported $0.72 earnings per share (EPS) for the quarter, beating analysts’ consensus estimates of $0.68 by $0.04. Enterprise Products Partners had a net margin of 11.12% and a return on equity of 19.65%. The company had revenue of $14.62 billion for the quarter, compared to the consensus estimate of $12.43 billion. During the same period last year, the company earned $0.65 earnings per share. The firm’s revenue was up 7.1% compared to the same quarter last year. On average, sell-side analysts expect that Enterprise Products Partners L.P. will post 2.64 EPS for the current fiscal year.

Enterprise Products Partners Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Wednesday, February 14th. Investors of record on Wednesday, January 31st were given a dividend of $0.515 per share. The ex-dividend date was Tuesday, January 30th. This is a boost from Enterprise Products Partners’s previous quarterly dividend of $0.50. This represents a $2.06 annualized dividend and a yield of 7.14%. Enterprise Products Partners’s dividend payout ratio is 81.75%.

About Enterprise Products Partners

Enterprise Products Partners L.P. provides midstream energy services to producers and consumers of natural gas, natural gas liquids (NGLs), crude oil, petrochemicals, and refined products. The company operates through four segments: NGL Pipelines & Services, Crude Oil Pipelines & Services, Natural Gas Pipelines & Services, and Petrochemical & Refined Products Services.

Read More

Want to see what other hedge funds are holding EPD? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Enterprise Products Partners L.P. (NYSE:EPD – Free Report).

Receive News & Ratings for Enterprise Products Partners Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Enterprise Products Partners and related companies with MarketBeat.com’s FREE daily email newsletter.