Chinese EV manufacturer XPENG hosted the global launch of its X9 2025 flagship electric car in early April, gathering media from around the world at Kai Tako Cruise Terminal in Hong Kong.

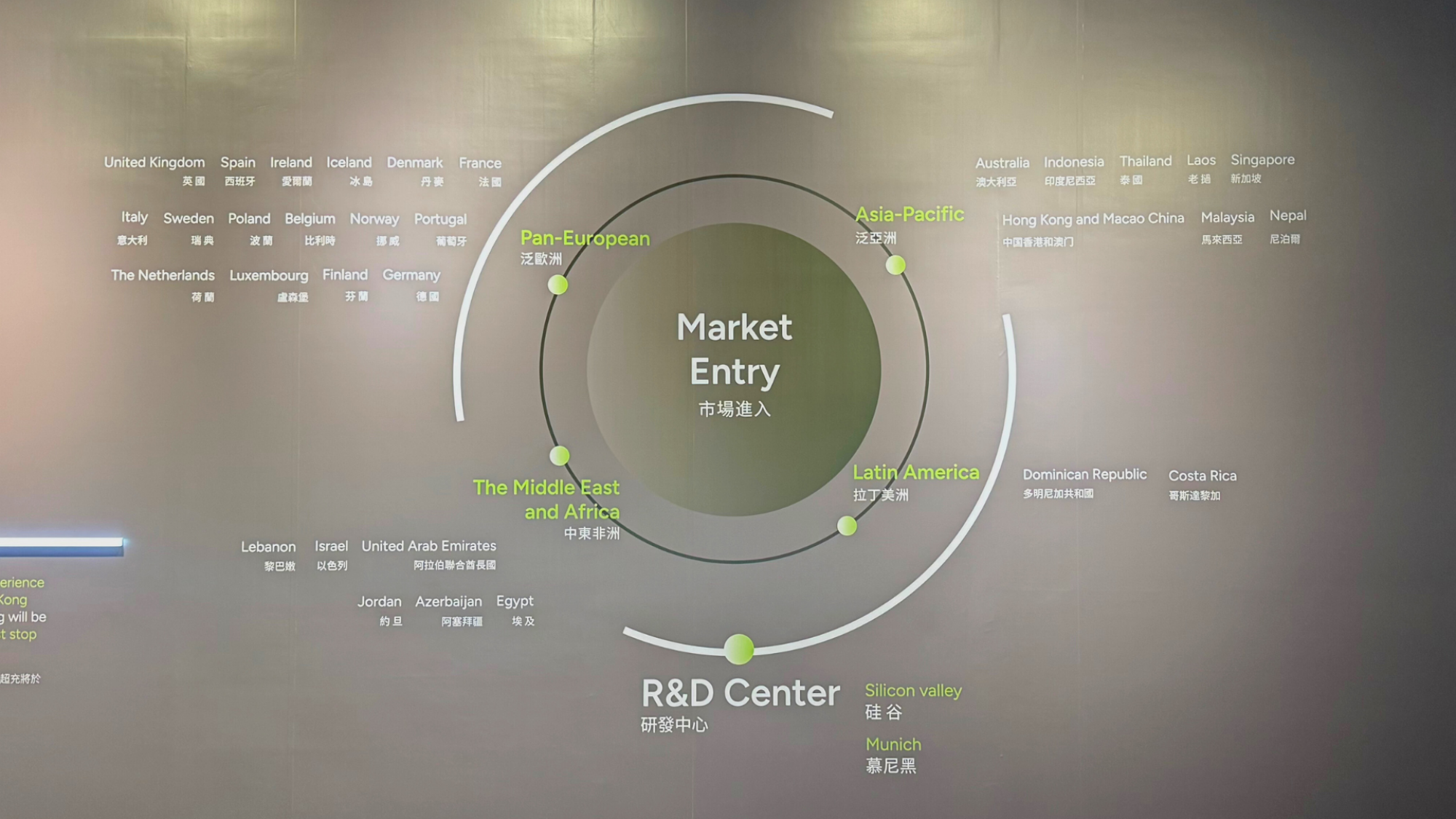

With XPENG’s lineup of EVs parked by the water, the walls at the venue’s entrance displayed a timeline of the company’s history, stretching from its founding in 2014 up until the present day. There was also a graphic displaying the markets XPENG is targeting, covering countries in Latin America, the Asia-Pacific, the Middle East, Africa, and pan-European regions.

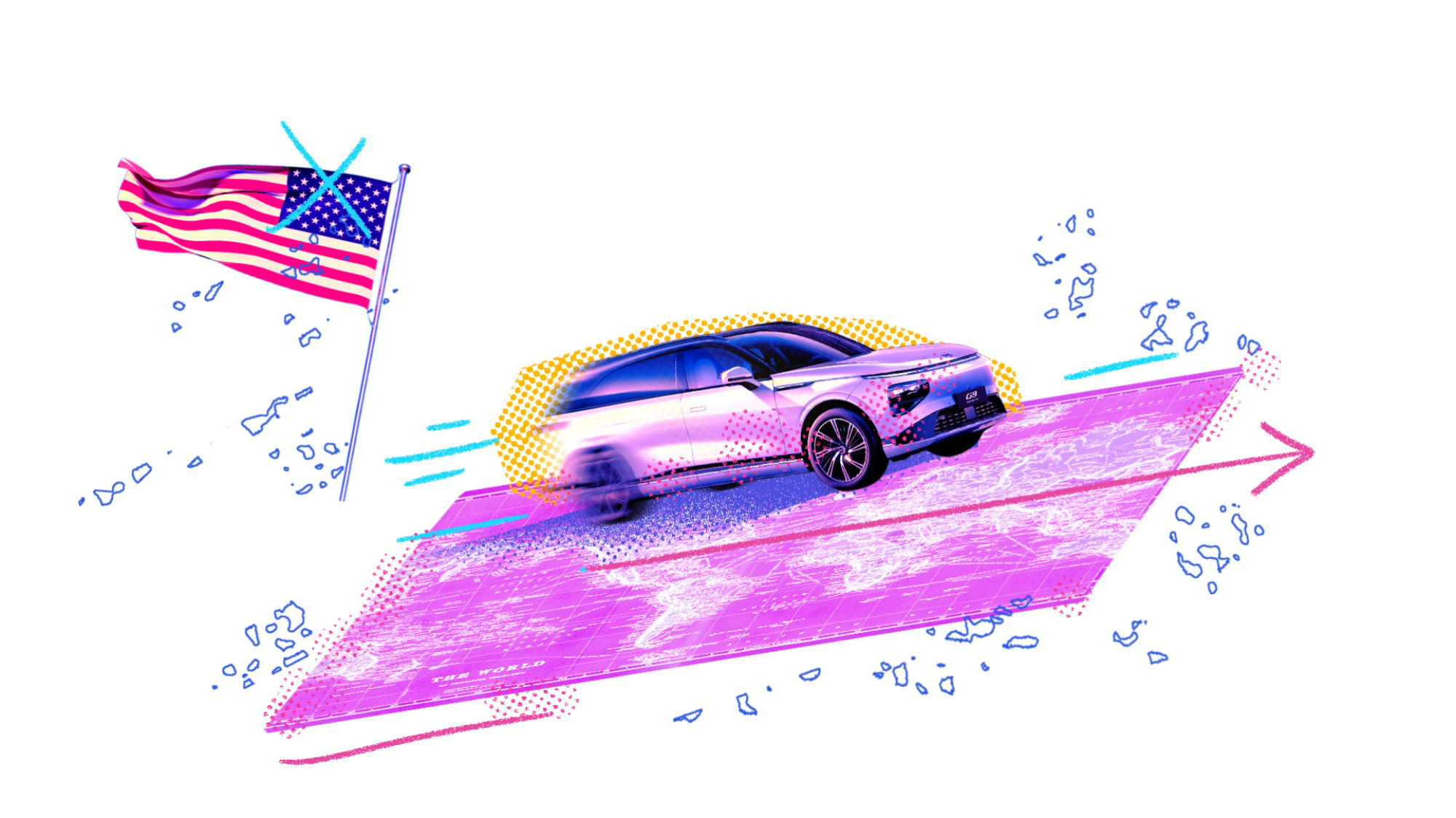

Conspicuously absent from XPENG’s international vision board? America.

XPENG sees U.S. tariffs as ‘opportunity’ for global expansion

Credit: Image Credit: Ian Moore / Mashable Composite; hudiemm / E+ / Getty / XPENG

Tesla is the reigning king of electric vehicles within the U.S., accounting for over 50 percent of the country’s new EV registrations in 2024 according to an analysis by EV Volumes. Elon Musk‘s company faces little real competition, with distant runner up Ford responsible for just six percent of registrations.

However, the EV landscape looks markedly different beyond U.S. borders. While Tesla still has a significant foothold, its sales last year were more than doubled by Chinese giant BYD, which dominated the global market with over 22 percent of all EV sales. Coming in third was Wuling, another Chinese company which most Americans will likely have never heard of.

XPENG hasn’t yet achieved such heights, ranked 10th last December at almost two percent of global EV market share. Though considering the competition, that’s still no mean feat. The company also has clear ambitions to continue climbing, with vice-chairman and president Dr. Brian Gu stating that he considers the U.S. tariffs on China both “a challenge and opportunity.”

“As a company, we cannot escape from economic volatilities that come with such tension,” said Gu. “We need to be prepared to make sure that our products continue to sell well. We also need to prepare that it may have an impact on the potentially global supply chain… However, I think it does raise an opportunity for a company that has aspirations globally.”

Credit: Image Credit: Ian Moore / Mashable Composite; Wong Yu Liang / Moment / Getty / XPENG

Gu noted that XPENG is closely monitoring the U.S.-China tariff feud to ensure its supply chain isn’t impacted. “With the tariff situation, it also means that we have to be even better at making sure we are self-sufficient,” he said.

However, as the company hasn’t expanded to the American market, its sales haven’t been affected by the turmoil. XPENG’s global expansion plans don’t appear to have been adversely affected either.

“We will continue to expand our footprint, because we see that our product is now welcomed by a lot of the international markets that we enter,” said Gu. “The customer feedback has been great. We think we have a strong confidence and appeal to tackle into more markets, to offer our product to more customers…

“I would say a crisis always leads to opportunity, and we feel like we can actually take advantage of that to really [put] more focus on our mission, more focus onto making ourselves better, but at the same time to be more diversified and more strong, [and] introducing our product [and] technology to global customers.”

Tariffs, tariffs, everywhere, but not an EV to drive

Credit: Image Credit: Ian Moore / Mashable Composite; anucha sirivisansuwan / Moment / Getty / XPENG

While global Tesla sales have plummeted in recent months, demand for electric vehicles in general isn’t waning. As of March, global sales of electric vehicles have reportedly increased by 30 percent compared to the same time last year, with the U.S. market in particular growing by 28 percent. However, U.S. tariffs mean that anyone hoping to buy an EV in the land of the free has significantly fewer options than their counterparts across the globe.

Tariffs play a significant part in this. President Donald Trump initially increased U.S. tariffs on Chinese-made electric vehicles during his first term in 2018. Such vehicles had already been subject to a standard 2.5 percent tariff, however Trump added an extra 25 percent tariff on Chinese goods to bump the rate up to 27.5 percent. His successor Joe Biden subsequently increased tariffs on Chinese electric vehicles to 100 percent in 2024.

U.S. tariffs on Chinese EVs then skyrocketed to a whopping 247.5 percent earlier this year, courtesy of Trump’s second term tariff blitz. Specifically, Trump added a further 145 percent tariff on all Chinese goods, plus a 2.75 percent tariff on electric vehicles in general. A recent 90-day pause has temporarily dropped the U.S.’ tariffs on China from 145 percent down to 30 percent. However, this still leaves Chinese EVs subject to a tariff rate of 132.5 percent.

This means that if launching the X9 in the U.S. were to make financial sense, XPENG would have to charge local drivers a significantly larger sum than its pre-order price tag of ¥399,800 ($54,800 U.S.) in other parts of the world.

Credit: Image Credit: Ian Moore / Mashable Composite; XPENG

Yet despite this relative affordability, XPENG’s X9 is packed with extravagant features you won’t see in Tesla EVs twice the price. These include massage chair functions, a storage box for keeping food either cool or warm, and a 21.4-inch ceiling-mounted screen to keep rear passengers entertained.

Mashable Light Speed

“We also see [the U.S. tariff situation] as an opportunity for us to differentiate from the rest of [the] EV players, because we feel like we’re bringing something different,” said Gu. “We’re not just another affordable China brand in a foreign market.

“We want to be viewed as bringing the best in technology, the highest quality, and the coolest brand to these local customers. And that’s something I think will position us well when there’s actually these difficulties and tensions around the world.”

Fuelling an EV industry with subsidies

Credit: Image Credit: Ian Moore / Mashable Composite; Zbigniew Pietrakowski / 500px / ekinyalgin / iStock / Getty / XPENG

An aggressive shift toward electric cars in the U.S. would have a notable beneficial impact on the environment. China has already seen carbon emissions from vehicles drop significantly due to its adoption of EVs. However, when it comes to U.S. policies, business and economic concerns prevail.

When raising tariffs last year, part of Biden’s reasoning was that Chinese EV manufacturers have been assisted by their government’s subsidy programs. The now former U.S. president claimed that such support helped Chinese companies to “cheat” by selling cars at “unfairly low prices” which drove competitors out of business.

“Our competitor is not a domestic one [local to the markets XPENG is expanding to],” said Gu via a translator, indicating disinterest in nationalistic EV rivalries. “It is more about who is able to provide the most forward looking, most competitive technology, as well as with quality.”

The Chinese government has heavily invested in local EV manufacturing since 2009, reportedly offering over ¥200 billion ($27.5 billion U.S.) in subsidies and tax breaks in the following 13 years. It also actively encouraged EV adoption by entering contracts for its public transport fleet, and enacting policies which cut obstacles to car ownership for those who chose to go electric. Local companies aren’t the only ones that benefited though. U.S.-based Tesla was reportedly the second largest beneficiary of Chinese subsidies, receiving over $450 million U.S.

Credit: Image Credit: Ian Moore / Mashable Composite; Epoxydude / YayaErnst / fStop / Angel Di Bilio / iStock / Getty / XPENG

The U.S. government has its own subsidiary programs for local EV manufacturing as well. However, its efforts to invest in the industry don’t appear to have fostered a similarly strong or diverse local EV scene. Electric and hybrid vehicles only accounted for around 21 percent of new light-duty vehicle sales in the U.S. during Q2 of 2024, while last July almost half of all new vehicle sales in China were EVs.

Instead, the U.S. government’s investment appears to have had one primary beneficiary: Tesla. The EV company has reportedly received at least $38 billion from the U.S. government in the form of subsidies, tax credits, loans, and contracts, spread over more than 20 years.

In fact, Tesla only became profitable after it began selling regulatory credits to other auto manufacturers — a revenue stream made possible by U.S. government incentives. Under this policy, auto manufacturers are required to build a certain percentage of zero-emission vehicles. Companies who don’t meet their target can make it up by buying credits from other manufacturers who have a surplus.

As Tesla only sells electric vehicles, it has a significant number of credits to sell. Tesla’s regulatory credit sales account for around a third of its $35 billion in profits since 2014, and were responsible for the company turning its first year of profitability in 2020.

XPENG aims to win over the world

Credit: Image Credit: Ian Moore / Mashable Composite; Richard Drury / DigitalVision / Getty / XPENG

China’s investment in the EVs has fuelled hundreds of local companies, as well as fierce competition between them. As such, not all of them are realistically expected to survive. Speaking via a translator, XPENG’s CEO He Xiaopeng stated that those which have performed well centered software and AI. He believes companies will therefore focus on research and development moving forward.

“We used to have hundreds, thousands, of [mobile phone manufacturers], and right now only six Chinese mobile phone companies [remain],” He said via a translator. “For automakers, we used to have 100 to 200, and with EVs we have 400 to 500. I think that in the end, only 10 will survive.”

XPENG first ventured into the international market in 2020, launching its G3 SUV in Norway. It has expanded to around 30 countries in the years since, with He telling reporters that they plan to double this number to 60 by the end of 2025. The EV company has already debuted in Indonesian and Polish markets this year, and has announced it will arrive in Switzerland, the Czech Republic, and Slovakia in Q2. This is already significant, though many more launches can be expected if XPENG intends to keep up with its ambitious growth plans.

“In the countries where Tesla sells well we also sell well, because these are the countries that have been educated [in EVs], they would recognize these technology driven vehicles,” said Gu, also speaking via a translator.

“[In the] next 10 years we hope that more than half of XPENG’s sales come from outside China, so revenue is not a single stream,” said He through a translator.

Credit: Image Credit: Ian Moore / Mashable Composite; Flavio Coelho / mikroman6 / Moment / Getty / XPENG

Such confident expansion plans seem to have been informed by XPENG’s apparent success overseas. The company recently reported it had delivered 94,008 of its smart EVs in Q1 2025 — a 331 percent increase since the same time last year. It further saw a 23.4 percent increase in revenue in Q4 2024 when compared to the same time in 2023.

“We are continuing to expand despite the current geopolitical situation, because we see that having a more diversified portfolio will ultimately benefit our company,” said Gu.

Such expansion may eventually include bringing local manufacturing jobs to its new markets. Gu believes that if XPENG is to become a leading EV manufacturer internationally, it’s inevitable that it will transition to having operations that are more locally based.

“Local brand, local operations, local services, maybe local charging capabilities and also local production capabilities,” said Gu. “You cannot rely on the export-only strategy to tackle such an important market [as Europe]. But the timing and how to do it is something that we’re working on intently.”

The U.S. may soon be left behind

Credit: Image Credit: Ian Moore / Mashable Composite; Wong Yu Liang / mikroman6 / Moment / Getty / XPENG

With U.S. trade relationships having become increasingly volatile, public sentiment in other countries has become more open to exploring alternate options for partnerships. And as Gu noted, it seems the perfect opportunity for Chinese companies such as XPENG to show what they have to offer.

In the Emerald Pavilion at Hong Kong’s Hopewell Hotel, reporters from around the world questioned He and Gu about XPENG’s plans in various countries. When might it expand to South Korea? What are their views on the Italian market? Will XPENG be addressing its voice recognition software’s issues with the Australian accent?

Amidst this global conversation, the U.S. barely merits a mention.

Credit: Amanda Yeo / Mashable

Disclosure: Mashable traveled to Hong Kong as a guest of XPENG.