Only six American companies have a valuation of at least $1 trillion:

-

Microsoft, valued at $2.9 trillion.

-

Apple, valued at $2.6 trillion.

-

Nvidia, valued at $2.1 trillion.

-

Alphabet, valued at $2 trillion.

-

Amazon (NASDAQ: AMZN), valued at $1.9 trillion.

-

Meta Platforms, valued at $1.1 trillion.

And as this list shows, just four companies have crossed the $2 trillion threshold. But Amazon is now knocking on the door of that exclusive club. In fact, it gained admission in April for a brief period before its stock price pulled back.

Amazon was founded in 1994 as an e-commerce company, but it has since evolved to build a gargantuan presence in other tech segments including cloud computing, streaming, digital advertising, and now artificial intelligence (AI).

Amazon just released its financial results for the first quarter of 2024 (ended March 31), and they were strong across the board. However, AI might be the technology that lifts this company’s valuation to $2 trillion (and beyond) on a sustained basis.

Amazon is weaving AI into its most important businesses

E-commerce is Amazon’s largest source of revenue, and the Amazon Web Services (AWS) cloud platform is responsible for the overwhelming majority of the company’s operating income (profit). Therefore, Amazon needs both segments firing on all cylinders, and it’s currently using AI to drive their success.

In his Q1 conference call with investors, CEO Andy Jassy said that more than 100,000 sellers have used at least one of Amazon’s generative AI tools to improve product listings and reach more customers. One of its newest tools allows sellers to automatically create detailed and engaging product pages by simply feeding Amazon’s AI engine a link to their website. Other AI tools help sellers craft content for their advertisements to increase clicks and improve conversions.

On the cloud side, Amazon continued to make progress on its mission to dominate the three core layers of AI. Infrastructure is the bottom layer, and Jassy said demand remained high for AWS’s new Trainium 2 chips, which were designed in-house, because of their favorable price and performance relative to competing hardware. They complement AWS’s broad selection of data center instances powered by Nvidia’s industry-leading graphics chips (GPUs).

The middle layer is home to Amazon Bedrock, which is a service for businesses that don’t want to build and train their own AI large language models (LLMs). In Bedrock, they can access a portfolio of ready-made LLMs to accelerate the development of customer-facing AI applications. Those LLMs include some of the industry’s most powerful, like Anthropic’s Claude 3 and Meta Platforms’ Llama 3.

Finally, complete AI applications sit at the top layer. AWS developed a powerful AI virtual assistant called Q, which became widely available to customers in the first quarter. It’s fully customizable and can be trained to enhance productivity within almost any business using internal data. It’s capable of writing, testing, and debugging computer code, which Amazon says can save months of manual work. Plus, it can rapidly analyze mountains of data to spot trends and potential opportunities across an organization.

Amazon delivered strong revenue growth, and soaring profits

Last year, Amazon split its U.S. fulfillment network into eight separate regions. This allows fulfillment centers to hold increased levels of inventory for products that are popular in their own geographic area, and it also means those goods travel shorter distances to reach customers. The end result is faster delivery times; in March, Amazon said 60% of orders from its Prime members arrived on the same day or the next day across 60 of the largest U.S. metro areas.

Amazon’s theory is that speeding up delivery times will give customers the confidence to buy from its website more frequently, and Jassy points to the growing everyday essentials segment as evidence the strategy is working. Plus, growth in Amazon’s online sales revenue overall appears to be accelerating. It increased by 7% to $54.7 billion during Q1, which was much faster than the 3% growth rate it delivered in the year-ago period.

AWS cloud revenue came in at $25 billion, representing year-over-year growth of 17%, which was also an acceleration, both sequentially and compared to the year-ago period. AWS is currently the world’s top cloud provider by revenue, and investors have longed for faster growth after a sluggish 2023 when businesses trimmed their spending due to high interest rates. That period of cost optimization appears to be over, according to Jassy, and he says momentum is picking up — thanks especially to AI demand.

Finally, Amazon’s digital advertising revenue jumped 24% to $11.8 billion, making it the fastest-growing segment in the entire organization. Amazon.com receives 2.2 billion visits every month, making it the ideal place for merchants to advertise their products. Amazon also introduced ads to the Prime Video streaming service this year, and while it’s still early days, this could be a lucrative opportunity as more of the $147.9 billion television ad market shifts to streaming.

Across all segments, Amazon’s total revenue came in at $143.3 billion during Q1, which was a 13% year-over-year jump. The bigger story was on the bottom line; the company’s net income (profit) soared 228% to $10.4 billion as management carefully controlled costs across all divisions.

Amazon is a stone’s throw away from the $2 trillion club

With a market cap of $1.9 trillion, Amazon stock only has to gain another 5.3% to join the $2 trillion club. Membership might be a mere formality at this point considering the company’s growth, but there’s a big reason Amazon could remain there for the long haul.

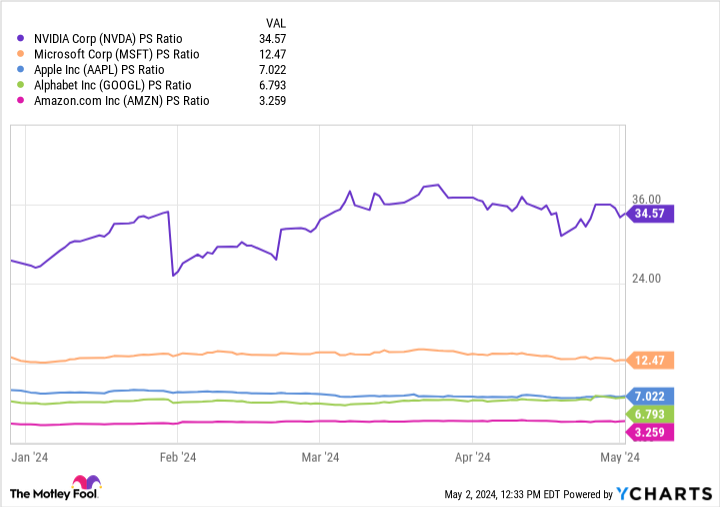

Amazon generates more revenue than every company in the $2 trillion club. More than $574 billion flowed through its doors in 2023, compared to $394 billion for Apple, which led Nvidia, Microsoft, and Alphabet. However, Amazon stock is cheaper than all of them on the basis of its price to sales (P/S) ratio (which divides a company’s market capitalization by its revenue):

Amazon is historically the least profitable company among its big-tech peers, primarily because its e-commerce business runs on razor thin margins. However, the company’s net income has surged by triple-digit percentages in the last three quarters, which, in my opinion, should entice investors to pay a higher valuation multiple for Amazon’s revenue over time. Its P/S ratio has slowly climbed over the past year, which is proof this is already happening.

Therefore, not only will Amazon stock likely rise in the future based on the strong growth across its business, but there might also be a case of multiple expansion in its P/S ratio — especially considering how far it’s lagging behind Alphabet, which is next-to-last in the above chart.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $544,015!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

1 Unstoppable Stock Set to Join Nvidia, Microsoft, Apple, and Alphabet in the $2 Trillion Club was originally published by The Motley Fool